A CFO’s take on climate and risk management

GreenBiz

JULY 13, 2020

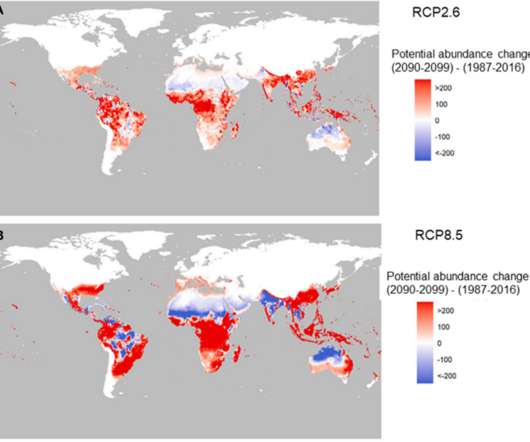

A CFO’s take on climate and risk management. When COVID-19 arrived, we saw the impact that global crises have overnight, teaching the corporate sphere valuable lessons about risk mitigation. Strategic risk factors. Vincent Manier. Mon, 07/13/2020 - 01:00. percent to 7.5 percent by 2050.

Let's personalize your content