3 big trends headlining a tumultuous year in food

GreenBiz

DECEMBER 11, 2020

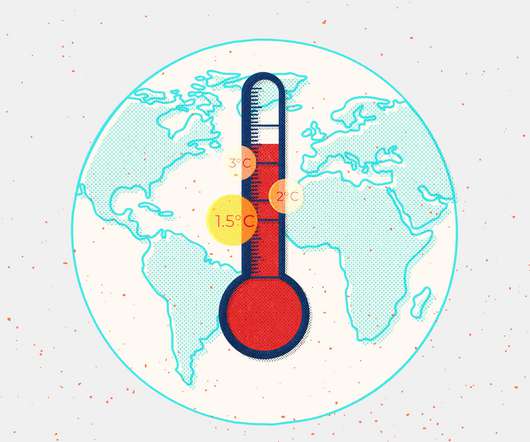

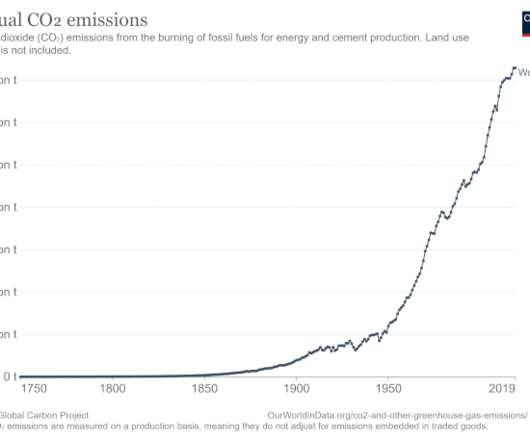

1, venture capitalists invested a whopping $1.5 dairy brand that committed to going carbon-negative by 2025 ? The twist: No one disputes that these efforts will be good for soil health. But do regenerative methods sequester as much carbon as advocates claim? An insane year for alternative proteins.

Let's personalize your content