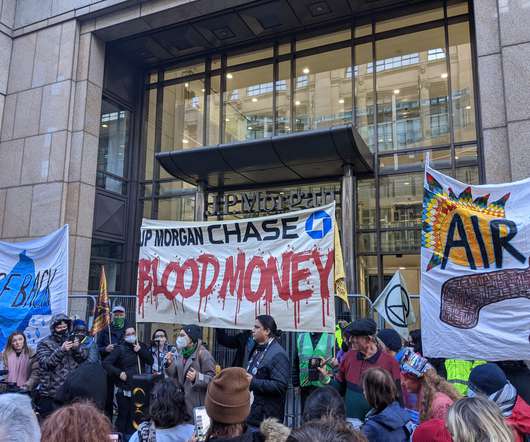

GB News Owner’s Hedge Fund Has $2.2 Billion Fossil Fuel Investments

DeSmogBlog

OCTOBER 30, 2023

Paul Marshall is the chairman and chief investment officer of Marshall Wace, a London-based hedge fund that he co-founded in 1997. Marshall Wace is now one of the world’s largest hedge funds – an investment vehicle that bets on rising and falling share prices – with around $63 billion (£51.9 billion) in fossil fuel firms.

Let's personalize your content