Why Fact Checking of Audacious Claims About Nuclear Power Projects is Important

Energy Central

MAY 12, 2024

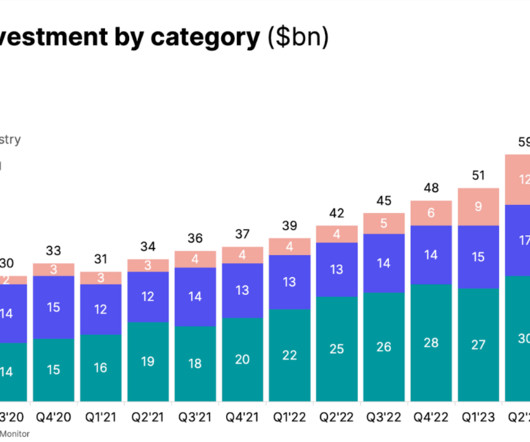

Note to readers - This past month has seen a flurry of sometimes fluffy press releases about startups, IPOs, and other kinds of investments in nuclear energy as well as P.T. Barnum type publicity stunts related to startups. None of this is a surprise in any industry that is on the cusp of potentially rapid growth.

Let's personalize your content