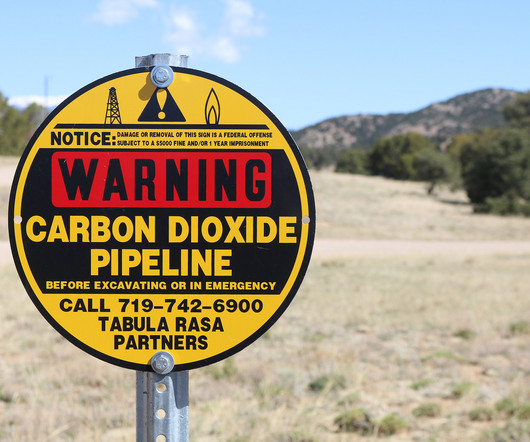

Princeton Maps Reveal US Plans for Massive CO2 Pipeline Buildout

DeSmogBlog

MAY 31, 2023

The price tag for just this stretch of pipeline is estimated to be $7 billion dollars (page 25 of Princeton report Annex). This “trunk line” pipeline would gather all the New England’s CO2 waste and pick up more from cement plants and other facilities along the way via smaller spur lines.

Let's personalize your content