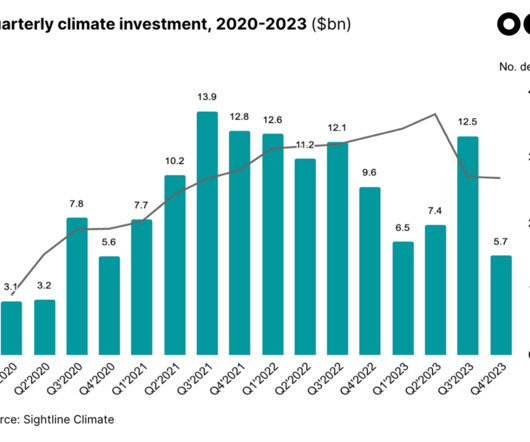

? $32bn and 30% drop as market hits pause in 2023

Climate Tech VC

JANUARY 5, 2024

We've been meticulously tracking climate tech investment, deal by deal, since the term ‘climate tech’ emerged. In 2023, a challenging macro environment marked by higher interest rates and a cautious private investment market raised the hurdles for deployment.

Let's personalize your content