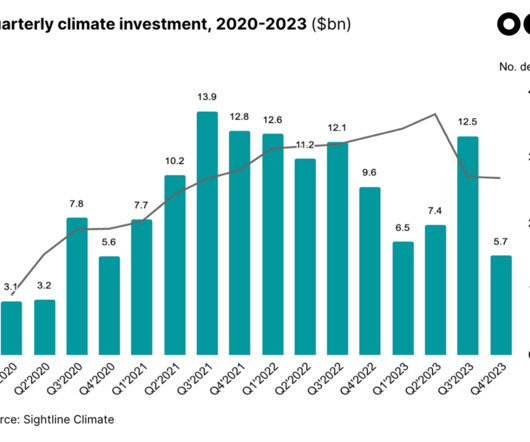

? $32bn and 30% drop as market hits pause in 2023

Climate Tech VC

JANUARY 5, 2024

🚗 Vertical: Transportation and Energy investment declined, but remained on top. Food & Land Use fell dramatically, down -55%, and was replaced by Industry in the big three. Redwood Materials raised $1bn to build its US battery materials and recycling facility. Removing Industry, the average was 34% down.

Let's personalize your content