US DOE publishes report on Commercial Liftoff of Next-Generation Geothermal

The US Department of Energy has published a comprehensive report on how next-generation geothermal projects can attain commercial liftoff by 2030.

The US Department of Energy (DOE) has released the “Pathways to Commercial Liftoff: Next-Generation Geothermal Power” report, highlighting the potential of next-generation geothermal power to transform the U.S. energy landscape. This marks the ninth installment of the Liftoff series that launched in March 2023.

The full report can be accessed via this link.

Within the context of the report, next-generation geothermal refers to either Enhanced Geothermal Systems (EGS) or Closed Loop Geothermal Systems.

The report shows how next-generation geothermal technology can increase the United States’ geothermal energy production to 90 GW or more by 2050 – a twentyfold increase. This growth in geothermal energy supports the Biden-Harris Administration’s goals of facilitating a carbon-free electricity grid by 2035 while creating thousands of jobs to boost the clean energy economy.

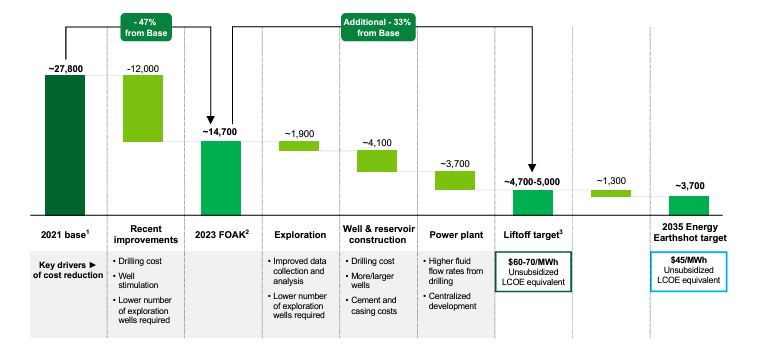

The Liftoff report also supports the goals of the DOE’s Enhanced Geothermal Shot which aims to reduce the cost of Enhanced Geothermal Systems (EGS) by 90% to $45 per MWh by 2035.

“The US can lead the clean energy future with continued innovation on next-generation technologies, from harnessing the power of the sun to the heat beneath our feet, and cracking the code to deploy them at scale,” said U.S. Secretary of Energy Jennifer Granholm.

“The newest report in DOE’s commercial liftoff series showcases the enormous potential for geothermal energy and that with strong public-private partnerships we can lower costs for this hot technology to expand access for cleaner, more reliable power to communities across the nation.”

Next-generation geothermal can be cost-competitive

In the past two years, advancement in field projects have already reduced the estimated project development costs for EGS by almost 50%. This has been demonstrated at the Utah FORGE project, where drilling speeds have been improved by over 500% in the last 3 years and well development costs have decreased from $13 million to $5 million per well.

With further advances expected in drilling, reservoir engineering, and resource exploration, the national average cost of EGS can be reduced to $60-$70/MWh by 2030, implying profit margins of $10-$30/MWh based on current PPA prices.

Pathway to full-scale deployment

The report proposes that full-scale deployment of next-generation geothermal power can proceed in two phases.

Phase 1 (Reaching Liftoff) aims to successfully deploy next-generation geothermal power projects in five to ten different geologic settings in greenfield conditions. The objective of this phase is to provide the validation suite necessary to demonstrate reduced technical and resource risk, thus proving market opportunity and unlocking debt financing for project development.

An estimated $20 to $25 billion of investment will be needed to deploy 2-5 GW of next-generational geothermal across 4 to 6 states. By 2030, Phase 1 aims to establish cost reductions to the national average LCOE of next-generation geothermal, well-designed PPAs, large-scale demonstrations of the technology, and early and sustained community engagement.

Phase 2 (Achieving Scale) aims to expand the developments made in Phase 1, targeting an installed capacity of 88 to 125 GW. By validating the economic viability of next-generation geothermal during Phase 1, a larger capital pool and lower-risk financing is expected to enable $225 to $250 billion of investment for Phase 2.

Ultimately, a fully mature and de-risked geothermal industry can develop projects using a traditional project finance model, where a combination of debt and equity are available early on during a project’s development cycle.

Major challenges and proposed solutions

The report identifies five major challenges to achieving commercial-scale next-generation geothermal development:

- High upfront costs and risks constraining capital and limiting geographic reach

- Perceived and actual operability risk for deployments

- Long and unpredictable development lifecycles driven by permitting and interconnection

- Existing business models undervaluing the potential of next-generation geothermal

- Community opposition (in some instances)

The suite of proposed solutions include the mobilization of government capital for nascent technologies, procurement mandates from public utility commissions, advancement in resource characterization and drilling, cost-sharing programs, and the introduction of categorical exclusions for permitting of geothermal projects.

Source: US Department of Energy