PPPs as an enabler of project financing for geothermal in Africa

With Public-Private Partnerships (PPPs) achieving success for geothermal in Kenya, it has potential to attract project financing for the rest of Africa.

A paper by Jesse Nyokabi, Johnson Kilangi, Louise Mathu, Sharon Mwakugu, and Kumbuso Joshua Nyoni looks into the mechanism of Private-Public Partnerships (PPPs) and how these can be used to mobilize project financing for geothermal projects in Africa. It expands upon the premise of a previous paper that shows how PPP has enabled geothermal development in Kenya, paving the way for the Eastern African nation to build 985 MWe of installed geothermal power capacity as of the end of 2023.

The paper was presented during the 2023 World Geothermal Congress in Beijing, China. The full text of the paper can be accessed via this link.

The status of geothermal in Africa

Most of the geothermal power potential in Africa is focused on the countries in the Eastern Africa Rift System (EARS), where temperatures as high as 400 °C have bene reported at depths of 2300 meters. Kenya and Ethiopia are leading the way in terms of installed capacity, but geothermal resources have already been confirmed by drilling in Djoubiti, the Democratic Republic of Congo, and Zambia.

Active drilling of geothermal wells is ongoing in Djibouti, Ethiopia, and Kenya, while slim drilling has been done in Tanzania, Uganda, and Zambia. Other countries in East Africa are still in the surface exploration phase of development.

The potential for retrofitting oil and gas wells for geothermal is also considered in oil and gas-producing countries like Algeria, Angola, Libya, and Nigeria. A play fairway analysis was done (Petrolen & WellPerform, 2020) on the conversion of oil and gas wells to geothermal energy, identifying several requirements for its successful deployment including the guarantee of adequate well integrity and a nearby heat demand.

PPPs in Africa

High upfront costs and risk remain one of the major obstacles to geothermal project development. Facilitating financing of geothermal projects through PPPs will provide the opportunity for new geothermal projects in Africa. PPPs allow governments to tap into the expertise, innovativeness, and flexibility of the private sector towards the timely conclusion of projects, financial efficiency, and quality assurance.

A government’s PPP framework typically evolves over time, and can vary significantly from one nation to another. In the early stages, governments may focus on enabling or promoting opportunities for PPPs. Once several PPPs have been implemented, the PPP framework may be strengthened by address their level of fiscal risk. For instance, South Africa focused on improving public financial managements for PPPs.

PPP laws and institutions have become increasingly common in Africa but are still in development in many cases. African governments are in different stages of implementing or creating PPP frameworks. The challenge, however, is ensuring strong rules and regulations, as well as effective implementation. A PPP program can only be effective if the legislative framework provides a clear, fair, predictable, and stable legal environment.

A case study of PPPs in Kenya

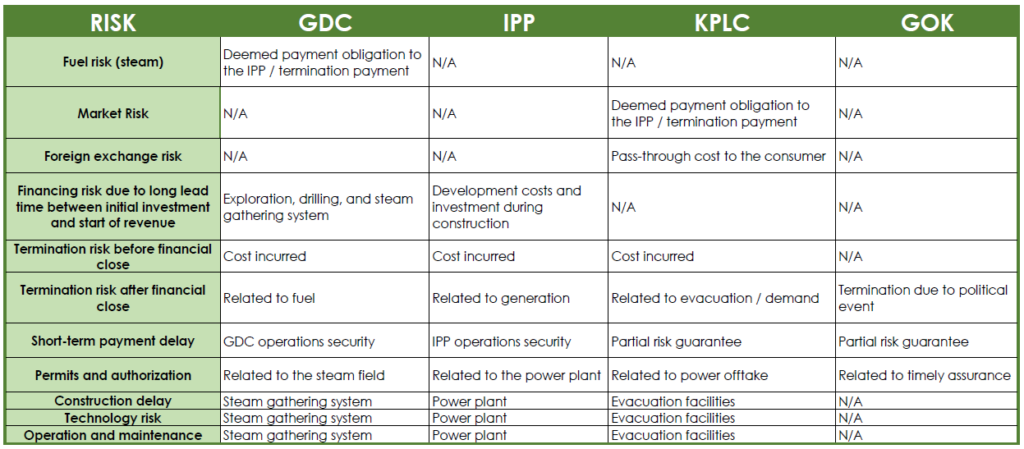

Perhaps the best example of a successful PPP implementation in Africa is in the Menengai geothermal power project in Kenya. The participants in this PPP are as follows – Geothermal Development Company (GDC) as the steam supplier, Kenya Power (KPLC) as the off-taker, Kenya Transmission Company (KETRACO) as the party in charge of evacuation facilities, and three Independent Power Producers (IPPs) to build power plants of 35 MW capacity each.

In this example, the PPP model allows for the distribution of project risks among the different stakeholders.

Two PPP models have been used in Kenya. The first model was adopted for the Olkaria III geothermal power project, where public funds were used for the development of the field following exploration and a private entity was licensed to drill appraisal and production wells, construct a power plant, and operate and maintain it. The project started with equity financing by Ormat and debt financing that was facilitated by the renegotiation of the PPA with off-taker KPLC and a government security package provided in part by the Multilateral Investment Guarantee Agency (MIGA). Various development finance institutions provided the required financing.

It is worth noting that the construction of the Olkaria III geothermal power plant began well before Kenya had the first PPP Act of 2013.

The second model involved the adoption of a Project Implementation and Steam Supply Agreement (PISSA) under the Menengai Phase I project. The project is being undertaken through a team seals business model where state-owned GDC is responsible for financing the early phases of steam resource development, including drilling, and development of the steam gathering system. The IPPs then finance the construction and operation of the power plants and buy steam supplied by GDC.

A third PPP model is being implemented for the Corbetti and Tulu Moyo projects in Ethiopia, where an IPP enters into an agreement with the state of state agency for the joint development of a geothermal field. Under this agreement, the licensee will drill exploration and production wells, and construct and operate the power plant under a Build-Own-Operate-Transfer (BOOT) mechanism.

Hurdles for project financing

Even with the risk sharing mechanism of PPPs, securing project financing remains a challenge for geothermal projects in Africa. An undeveloped financial market is one of these challenges. Most of the players in the African financial market insist on collateral-based lending, making it impossible for many projects sponsors to justify the heavy borrowing needed for geothermal projects. Commercial banks are also hesitant to lend for long tenures, making it practically impossible to access financing facilities with tenures of more than 10 years in most African countries.

The skills and experiences needed to structure and manage PPPs for large and complex geothermal projects may also not be available locally, making it necessary to contract often very expensive foreign consultants. Public bodies often lack the teams that can combine technical experience with the skills for structuring, procurement, and financing for PPPs. Thus, private sector investors are also hesitant to engage in PPPs for geothermal projects.

Lastly, there has been some negative publicity in Africa that has put off investors. Factors such as inadequate transparency in the procurement process, inconsistent decision making in the government, and changes in tax laws that provide no protection to private investors have turned these investors away, choosing instead to invest in other countries.