How Europe can lead the way in transitioning oil and gas to geothermal

In this guest article, Henning von Zanthier makes an argument for how EU member states can influence the oil and gas industry to transition to geothermal.

The transition of oil and gas to deep geothermal is one that requires radical transformation of paradigms, business models, and policies. However, it is also one that is inevitable with effects of climate change becoming more dangerous and unpredictable, prompting a more drastic response to reduce CO2 emissions as the world nears the imminent tipping point.

Given the challenges of energy transition, Europe is optimally positioned to lead this movement by implementing political and economic policies that will incentivize oil and gas companies to leave fossil fuels behind and make the transition to deep geothermal. This is the proposal made by the author of this guest article, Henning von Zanthier.

Henning von Zanthier is the founding Partner of VON ZANTHIER & DACHOWSKI with offices in Berlin, Germany and Poznan, Poland. Following his legal studies in Germany, France and United States he was admitted in 1991 to the Berlin Bar. He founded his law firm in Berlin in 1992. In 1995 he established the first German linked law firm in Poznan.

His law firm focuses on business law, German and Polish geothermal law and has clients from Asia and Europe who invest in Germany or Poland. He is helping different oil and gas companies to shift to geothermal, among others, he is the lawyer helping the Danish geothermal company Innargi establishing the 100 MW geothermal project in Poznan, Poland. Henning is member of LAWASIA since 2006 and the Chairman of the Asian-European Subcommittee since 2016.

“Wandel durch Handel” 1: How geothermal in Europe can reconcile the oil and gas industry with inhabitable climate conditions and regain European energy autarchy

The world currently emits 37.12 billion metric tons of CO2 each year from fossil fuels.

According to a study published by McKinsey, those emissions need to be reduced to 16 billion metric tons of CO2 annually till 2030 to reach the target of less than 1.5 degrees Celsius of global warming.2 Another study published by McKinsey says that if the current trajectory continues, global temperatures would increase by 3-4 degrees Celsius by 2100, rendering 90% of the global population’s current habitat areas uninhabitable. 3

Rapid climate change and the objective of limiting global warming to 1.5 °C, along with concomitant national and global responses, have significantly increased the risks of the traditional business model in the oil and gas industry (hereafter referred to as O+G). More and more countries want to leave fossil fuels behind. In the EU, for example, the consumption of fossil fuels fell by 17% from 2022 to 2023 and this drop in demand also means falling prices, resulting in over-capacities and stranded assets.

The energy sector accounts for at least 70% of global CO2 emissions. If the burning of oil, gas, and coal were to stop tomorrow, the climate disaster would be averted – but such an abrupt change would paralyze the economy.

Luckily, there is a solution moving forward to avert both economic and climate crises:

Unlike coal, which can only be mainly phased out, an alternative for O+G is deep geothermal energy, which also employs similar geological skill and technology like drilling rigs in production. With record profits in recent years, O+G could readily provide the urgently needed financing for geothermal energy.

However, oil and gas companies remain hesitant to undergo a radical transformation, possibly underestimating the growing force of climate policies, which will be reinforced by the emerging signs of radical climate disruption.

The EU and its member states should establish a political and economic framework encouraging O+G to leave its fossil production behind and turn to geothermal, a move other countries and continents could then follow. If O+G would change completely to geothermal, it would not only eliminate additional fossil fuels and thus CO2 production, but global O+G could drill additional ca 65.000 wells p.a. for geothermal energy and thus facilitating e.g. close to 150 GW/e (power) p.a.( or the heat equivalent instead) which is close to the 170 GW/e manufacturing capacity of wind turbines.

Three other important stakeholders could benefit from this change in addition: The national energy production industry would become CO2-free and more autonomous, local communities and cities would be able to offload the financial burden of geothermal investments onto O+G, and finally the climate crisis would be averted, if the changes comes along fast enough.

Outset

According to a study by the Intergovernmental Panel on Climate Change (IPCC), the UN Organization in Geneva, there are 6.5 years left to limit global warming to 1.5 degrees Celsius. Tipping points are expected to occur in the 2030s when the 1.5-degree threshold is reached, and at that point, climate damages become increasingly unpredictable.4 By then, strong national countermeasures against CO2 emissions are almost inevitable to avert further climate damages.

Risks of O+G

Therefore, O+G may be one of the first sectors targeted by climate policies on both the national and international fronts. As the 2020-2022 Covid pandemic has shown, national governments can react quickly and very strongly when dealing with natural disasters and humanitarian emergencies. A similar radical response to a significant risk was the suspension of automobile production in the USA during WW2 to shift manufacturing towards military equipment.

Alternatively, due to climate policies, the demand for oil and gas may dramatically decline in the 2030s. Therefore, the sooner the O+G transitions from fossil fuels to renewable sources of energy, the lower these risks will be.

Why should O+G switch to geothermal?

A viable option for O+G is to switch to geothermal energy. That is primarily due to the similarities between the two sectors. Approximately 70% of the work in geothermal exploration is akin to that in O+G, encompassing areas such as geology, drilling, drilling equipment, seismic studies, chemical aspects, and resource mapping and allocation. The main differences are heat exchange, possible power production and energy distribution. O+G could therefore still make use of their employees, expertise and know-how in the new industry, giving themselves a head start over their competitors in the market.

An example of a successful transition in this area is A.P. Moller-Maersk A/S, a Danish company who has completely abandoned O+G in 2017 and has decided to set up Innargi A/S, a company solely dedicated to developing and investing in geothermal energy projects on large scale, e.g. 240 MW in Copenhagen. Innargi can be considered in the geothermal energy sector what Tesla is in the car industry – the audacious game changer, which others will follow or face problems.

Another pioneer in the geothermal sector is German Vulcan Energie Ressourcen GmbH, a company that is working on the innovative solution of acquiring lithium from geothermal brine. In in 2021, big global O+G producers like Norwegian Equinor bought a big share of Lithium France. Equinor is expanding its operations to incorporate the extraction of minerals like lithium besides the production of geothermal hot water.

The business model for lithium production is similar to oil production, granting O+G the flexibility to choose their buyers for oil/ lithium. This stands in contrast to geothermal heat production, which often relies on single clients.

The Canadian company Eavor Technologies is developing petrothermal energy5 for heat and power, a new technology that is still being tested in e.g. Geretsried, Bavaria, Germany, by which is would prove that not only hydrothermal formations are able to render geothermal hot water, but that geothermal potentials can be expanded dramatically by the additional use of geologically solid formations, so that “it can certainly play a key role in the energy transition.” 6 Danish MP EU, Pernille Weiss estimated the European hydrothermal, petrothermal and shallow7 geothermal potential to up to 75% of the EU heat demand.8

Finally, the former Austrian Oil company ONEO offers to drill also for geothermal energy during its oil drilling period and after its oil drilling has been concluded from the same wells.9

As these examples demonstrate, the geothermal industry is already developing quickly but the change would be even more substantial if O+G were to put their resources into the geothermal sector.

Why is oil and gas drilling still attractive despite of these risks?

It is noteworthy that despite these risks, O+G has not yet committed itself to a full transition to renewable energy sources. One of the reasons for it may be the consistently high profits of the O+G sector. For the last 50 years, O+G has been making 2.8 billion USD profit a day with 4 % profits on average, which can however be matched also by large scale geothermal energy production. 10

In fact, the O+G sector is investing heavily in the development of new oil and gas fields. According to studies, up to 536 billion USD annually will be spent on new fossil fuels projects by 2030.11 One can expect these new fossil fuel investments to face strong countermeasures by national governments in the 2030s when the climate situation deteriorates dramatically.

Another reason may be that big companies inadvertently sleepwalk into pending disasters. A good example of that is Kodak, once a worldwide leading producer of photography equipment. In 2005, the company still had a turnover of 12 billion USD, but it failed to adapt to the digital revolution and the rise of smartphones, causing it to go bankrupt in 2012. Another example is the German car industry, which lagged behind in embracing more environmentally friendly vehicle models. E.g. Volkswagen Group paid over € 30 billion in fines and indemnifications before changing to electric cars.12 Big companies can apparently sometimes miss their chance to transition until it is too late.

Proper risk assessment gives natural risks priority over politics

It is however untrue to say that O+G has given no thought at all to energy transformation.

In the EU and its member states, O+G has successfully lobbied for hydrogen to be the “backbone” of energy transformation, since gas can supposedly support the production of hydrogen for quite some decades, even though in climate terms “green” hydrogen wastes up to 40% of “green” power and is not sufficiently available, rendering it a niche product for high temperature applications and heavy vehicles , but not the main pillar of energy transformation.13

O+G is already changing and aware of the risks of climate change. In fact, many big European big O+G firms have already started investing in geothermal projects. In the face of the rapid climate changes, those decisions are nonetheless not sufficient to avert the climate crisis. As mentioned before, an inhabitable climate now needs radical cuts in CO2 emissions, otherwise we may face severe climate consequences already in the 2030s.

Many industries prefer to ignore scientific predictions of natural disasters and rely on the present political framework for their risk assessments. The approach is flawed because it is nature and our comprehension of its future trajectory that will ultimately establish the framework for risk assessment, not the current politics.

A good example illustrating the unreliability of assessing future risks based on extant politics can be found in Poland. In 2016, the government introduced legislation which almost completely stopped the development of wind energy for years in favor of “Polish” coal. However, in response to rising coal energy prices and public dissatisfaction with air pollution, the Polish government withdrew the legislation that hindered the development of wind energy. The anticipated severe climate disruptions in the 2030s may compel other governments to swiftly implement stricter CO2 emissions regulations.

The EU and its member states like Germany could produce the suction effect towards geothermal

The EU and its member states like Germany could play a crucial role in encouraging O+G to move to geothermal. The EU is the 4th worst CO2 polluter in the world, but is responsible only for 7.5 % of the world´s CO2 emissions. At first, it may seem that the EU is thus not in a position to alone bring about radical change in reducing CO2 emissions globally.

However, the EU and its member states could establish a market design for O+G to stop new investments in oil and gas and instead to finance geothermal energy. That way, the EU could not only contribute to lowering its own emissions but also global energy emissions (oil and gas generate up to 40 % of total global emissions).

Germany has published a Cornerstone Paper in November 2022 which includes several changes that should simplify investments in the geothermal sector. For example, geothermal procedures shall be accelerated, open access to geological and geothermal data will be granted and subsidies should be made available, which are needed for smaller projects and also to initiate innovation on new technologies like the Eavor-Loop.

However, those changes are not enough for attracting O+G to geothermal averting the climate crisis. In fact, some O+G players are not very keen on subsidies, since given their better know-how and their large scale, experienced O+G drilling companies can make big geothermal projects profitable without subsidies and state insurances for drilling risks, thus also avoiding the bureaucratic limitations which come with subsidies.

Arguably, a better solution would be for the EU member states to install tax credits (or holidays for RES investments), similar to the US Inflation Reduction Act 2022, to push O+G toward geothermal. This strategy could be complemented by the establishment of an effective European Trade System (ETS) for CO2-certificates, which could at a later stage extend to the fossil fuel import to the EU and fossil energy production in the EU.

The gradual abolition of subsidies for fossil fuels and sufficient national and EU subsidies for the District Heating Network can ensure the smooth transition to geothermal heat distribution from O+G. In this way, the EU member states could coordinate and collaborate with O+G on transformation and produce a push effect for O+G to go geothermal, while investment risks would be shouldered by the latter. Moreover, tax holidays are often cheaper than subsidies.

If the EU and, later, other governments adopt this model, a leverage of factor 5 in CO2 reduction could be possible (from max 7,5% of CO2 emissions within the EU to max 40% on the planet). That way, a suction effect from O+G to geothermal could be triggered when O+G realizes its assets could get stranded because of a drastic decrease in demand for burning oil and gas, which could entail an even more drastic reduction of CO2 emissions on a global level and a run of O+G to the most profitable (large-scale) geothermal projects.

If the EU were successful in changing the car industry from combustion to e-cars and Germany was successful to phase out coal for its industry before 2038, the EU and its member states can change from fossil to geoenergy and geothermal from the currently globally 900 geothermally drilled wells in 2021 to up to 65.000 geothermal wells p.a. after 2024.

Geothermal can also match the expectation to lower the current expensive energy prices in the EU vs USA: E.g in Denmark, the legislation forces geothermal companies to offer the cheapest price for renewable energy, which e.g. the Danish geothermal company Innargi can match, precisely because it has established geothermal plant on a large scale, which makes geothermal cheaper than any other RES production of heat.

The current cheap power in the US is 80% based on fossil fuels14 and might become very expensive in the 2030s, when the US will be forced to also take countermeasure against rising CO2 damages. The global change of O+G to geothermal, together with the global phasing out coal (which has already begun) could mean that our planet could be saved from a climate disaster.

Conclusions of the risk assessment

If major oil and gas companies accurately evaluate the risks associated with impending climate change in the coming years, it is probable that their traditional business model will no longer support the establishment of new oil and gas plants and investments. For strong measures of national governments and the EU against CO2 emissions in the 2030s are almost inevitable when climate disasters occur.

Geothermal is the best way to reduce these risks for O+G. The EU and its member states like Germany have the chance to create a market design to not only reduce CO2 emissions in the EU (7,5 % of global emissions) but also to incentivize big O+G to invest into geothermal, thus creating a suction effect for geothermal to facilitate a reduction of 40 % in global CO2 emissions in the energy sector, which would help to avert the climate crisis.

As Europe once overcame the division between the communist and the democratic worlds through “Wandel durch Handel” (= “change by trade”) in the late 20th century, now it has the chance to create this market design which incentivizes the change from O+G to geothermal, which can reconcile the viability of O+G businesses with the urgent need to address the climate crisis, in addition to regaining European energy autarchy.

1 The European “Wandel durch Handel” (meaning “change by trade”), as introduced by former German Chancellor Willy Brandt in the 1970s, was a concept, by which Western Europe decided to trade and exchange culturally with the then hostile countries of Eastern Europe that played a pivotal role in overcoming the division of Europe in the 1990s, effectively reconciling the antagonism between the communist and the democratic worlds).

2 “Global Energy Perspective 2022”, McKinsey & Company, 2022.

3Earlybird Analysis 2021, McKinsey Global Institute 2020, Zeit 2019.

4 https://www.nature.com/articles/d41586-019-03595-0, access: 28.02.2023.

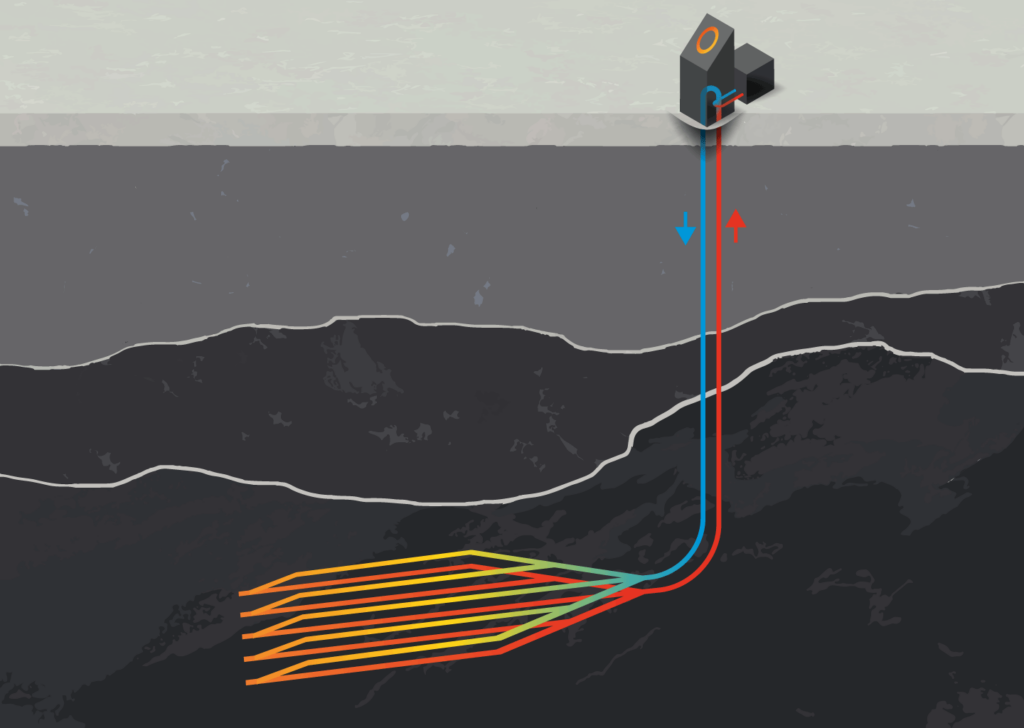

5 While hydrothermal drilling relies on pumping naturally occurring hot water from an aquifer to the surface for energy production, followed by reinjection into the subsurface, petrothermal energy production operates differently. It involves pumping cool water from the surface down a well to a depth of typically 2-5 km, where it is heated by the significantly higher subsurface temperatures. The now heated water is then brought back to the surface for energy production, whether for heat or power generation.

6 https://www.rechargenews.com/transition/unlimited-on-demand-renewable-energy-anywhere-in-the-worldis-eavor-loop-climate-changes-holy-grail-/2-1-901385, access: 17.10.2023.

7 Shallow geothermal production uses the difference in temperature in the subsurface until a depth of up to 400m, which in the case of water is pumped to the surface and often stimulated to higher temperatures by heat pumps to be used for heating by different techniques. The shallow geothermal potential in Germany is estimate higher than hydrothermal energy production and can be mainly used in households.

8 Hearing of the EUP`s energy commission on October 10, 2023 in Brussels.

10 https://www.theguardian.com/environment/2022/jul/21/revealed-oil-sectors-staggering-profits-last-50-years, access: 21.02.2023.

11 https://www.iisd.org/articles/press-release/planned-new-oil-and-gas-investments-incompatible-15degcwarming-limit-could, access: 08.02.2023.

12 https://www.bbc.com/news/business-61581251, access: 14.02.2023.

13 https://www.weforum.org/agenda/2021/08/hydrogen-carbon-intensive-energy-solution/, access: 07.03.2023.

14 https://www.eia.gov/energyexplained/electricity/electricity-in-the-us.php, access: 17.10.2023.