The cost of Snowy 2.0, the 2,200 MW pumped-hydro water battery, was recently ‘reset’ to $12 billion, double the previous $5.9 billion estimate and six times the original $2 billion estimate.

The reset announcement included a number of dubious claims, including that Snowy 2.0 remains a commercial investment with a value of $3 billion:

“Despite the cost blowout the project still has a net present value [NPV] of around $3 billion (based on a $12 billion revised target total cost and December 2028 delivery)”

Snowy Hydro’s CEO, Dennis Barnes, cited an internal rate of return (IRR) of 7.5%, assuring Senate Estimates last Monday that “we’ve carried out an incredibly comprehensive process which looks back at the costs and effort to get us to where we are, and then extrapolates that forward with the support of a number of international renowned consultants”.

However, despite numerous requests for detailed information, especially the reset report, all that has been released is a one-page Ministerial media release, a Snowy Hydro News Sheet, and a heavily redacted response to a Senate Notice.

This is contrary to the commitment to transparency and honesty by the two shareholding ministers, Chris Bowen and Katy Gallagher:

“The result of the [Snowy 2.0] project review … is being made public today [31 August 2023]. Unlike the previous Government, we are committed to being transparent and honest with the Australian people about the challenges and opportunities for Snowy.”

Once again, the government has been snowed. If only it had undertaken some independent delving it would have seen that the reset’s $3 billion value and 7.5% IRR contradict previous estimates and continues Snowy 2.0’s woeful history of impossibly optimistic estimates.

Let’s have a quick look, using Snowy Hydro’s own numbers.

The previous government’s formal approval of the project in February 2019 was based on Snowy 2.0’s Final Investment Decision (FID Dec 2018) and Feasibility Study (Dec 2017). It was estimated then that Snowy 2.0 would cost $3.8 billion ($4.5 billion at most) and its value would be $4.3 to $6.6 billion, giving a net value between -$0.2 billion and $2.8 billion.

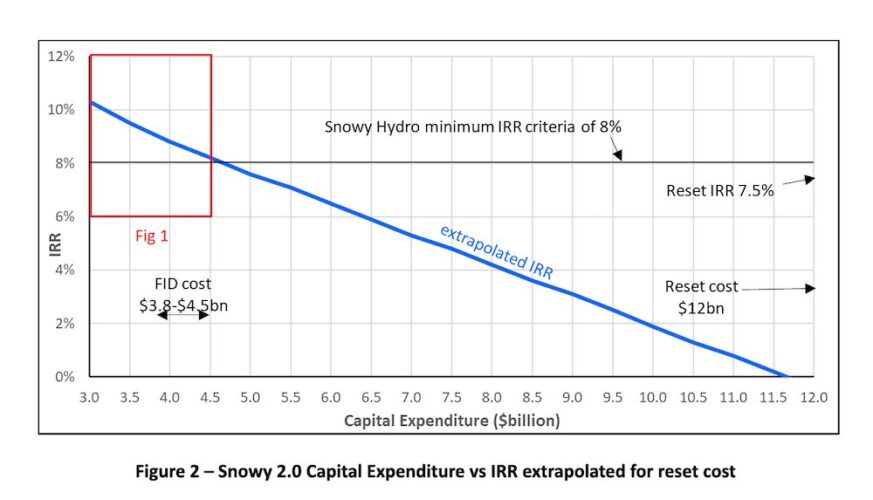

The FID claimed that the IRR would exceed Snowy Hydro’s ‘stringent investment criteria’ of 8%. At the expected cost of $3.8 billion the IRR was estimated to be 9.0%, and at the maximum cost of $4.5 billion the IRR was estimated to be 8.2%, as shown in Figure 1.

At the time many energy experts considered the IRR estimates to be exaggerated, not least because the capital expenditure estimate was significantly understated and did not include all cost components.

The underestimated cost in the FID was exposed just four months later in April 2019 with the signing of the main works contract for $5.1 billion (alone). (Note that it was promoted as a fixed-price contract, another false assurance.)

Nevertheless, let’s accept the Snowy 2.0 FID estimates of $3.8 billion cost and 9.0% IRR, and extrapolate the IRR for the latest reset cost of $12 billion.

Figure 2 shows the result is that the IRR drops to zero at the reset cost.

While this is only an indicative analysis (e.g. not correcting for $real), it demonstrates that the reset IRR extrapolates to well below Snowy Hydro’s stringent investment criteria of 8%, well below the reset’s estimate of 7.5%, and even well below the current bond rate of 4.5%.

Clearly, at such levels of IRR Snowy 2.0 would have a negative NPV and is far from being a commercial investment – no commercial board would ever approve such a project.

The actual IRR will probably be even lower than extrapolated, as it is almost certain there will be further cost blowouts and the reset cost probably still doesn’t include all project components (such as financing, design, project management, owner’s costs, exploratory and other works, the segment factory). Collectively, these missing components will add many $billions by the time the project is completed.

And of course there is over $10 billion of transmission lines being built primarily to connect Snowy 2.0 to Sydney and Melbourne (HumeLink, Sydney Ring South, VNI West).

The all-up cost for Snowy 2.0 and its transmission connections is now approaching $25 billion, an absurd amount for a 2,200 MW water battery – at such a cost the IRR would be nonsensical.

Also note that the $3 billion reset value is subject to two provisos – a $12 billion target cost and 2028 delivery – neither of which is achievable.

Further evidence that Snowy 2.0 couldn’t possibly attain a NPV of $3 billion is that, if so, this would result in a gross value of at least $15 billion [$3bn plus $12+bn].

This is $10 billion higher that the FID estimate of $4.3 to $6.6 billion, when the cost was $3.8 billion, and would mean that the value of Snowy 2.0 has somehow increased threefold since 2019.

How is it that every time Snowy 2.0’s cost blows out its value increases by a greater amount?

When will the government finally twig to the fact that not one of the estimates and claims for Snowy 2.0 over the past six and a half years has been anywhere near correct, and that this latest reset seems to be no different?

Maybe I am wrong. Maybe Snowy Hydro has got it’s estimates right for the first time.

We won’t know until the reset report is released and the government demonstrates its transparency and honesty with the Australian people, the people footing the bill for this gargantuan project.