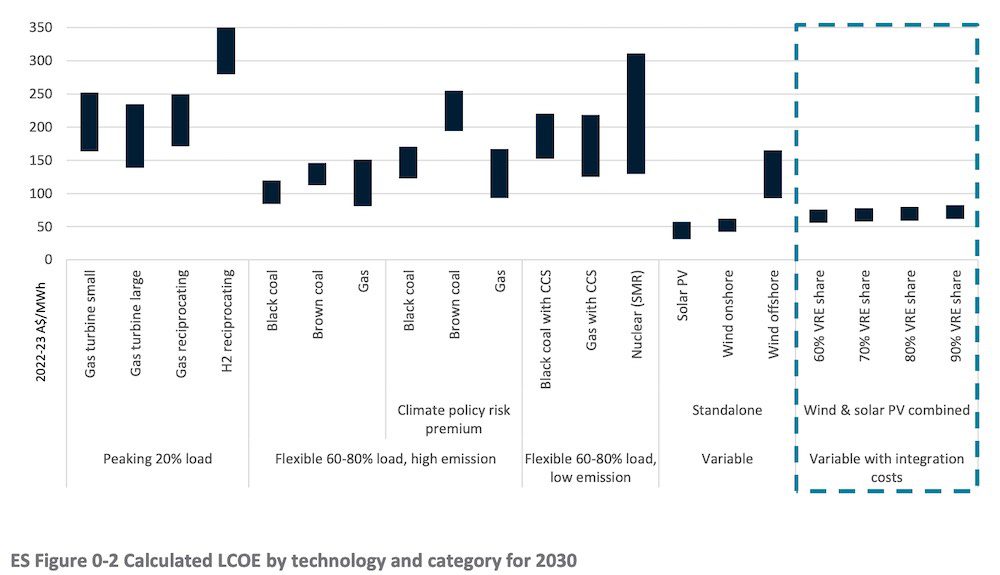

Firmed renewable energy from a mix of solar and wind remains by far the cheapest source of new-build electricity generation in Australia, despite a jump in costs across all technologies due to global inflationary pressures.

This is the conclusion of the draft 2022-23 GenCost report from CSIRO, the latest annual update from the national science agency on the costs of electricity generation, energy storage and hydrogen production.

The draft report finds that compared to 2021-22 data, technology costs have increased 20% on average for 2022-23, but with significant diversity across different technologies, ranging from 9% for solar PV up to 35% for wind, and 31% for open cycle gas.

CSIRO says this jump in technology costs can be attributed to upward pressure from global supply chain constraints and inflation, following the Covid-19 pandemic and exacerbated by the war in Ukraine.

But despite these cost increases, the CSIRO says the findings of the latest GenCost report remain consistent with previous years: that integrated renewables – onshore wind and solar PV supported by transmission and storage – remain the lowest cost technologies.

The report comes at the end of a year that has seen soaring coal and gas costs drive the average wholesale price of electricity in Australia to record highs up around $320/MWh.

Such has been the impact of fossil fuel costs on the affordability of electricity that the federal government this week rushed a controversial gas price cap legislation through parliament, along with measures to urge and help households quit gas and go electric – a measure that is already achieving some drops in electricity futures prices.

Predictably, the move to cap gas prices has been slammed by the federal opposition and by the fossil fuel industry, with Santos CEO Kevin Gallagher describing it as a “Soviet-style policy” and a “form of nationalisation.”

But IEEFA’s electricity and renewables analyst Johanna Bowyer says the measure is designed to work together with coal price caps, an electrification package and the capacity investment scheme announced last week, to ease upward pressure on energy prices while we shift to renewables.

“While coal and gas price caps will put downward pressure on electricity prices in the short term, the proposed electrification package could help businesses and households cut energy bills permanently, by helping them reduce reliance on expensive and high emission gas and improve the energy performance of their buildings,” Bowyer says.

“The capacity investment scheme announced last week, to drive $10 billion of public and private sector in renewables and storage, will also help insulate Australians against volatile fossil fuel prices and enable emissions reductions.”

Not surprisingly, the latter view – and not the view of the Coalition, or of the gas lobby or even some mainstream media outlets – is the view that aligns most closely with the data presented in CSIRO’s latest annual report and the trend it projects.

“Globally, renewables (led by wind and solar) are the fastest growing energy source and the role of electricity is expected to increase materially over the next 30 years with electricity technologies presenting some of the lowest cost abatement opportunities,” the CSIRO report says.

And this is true even after factoring in the additional costs of new transmission build-outs, investment in energy storage and the ongoing use of peaking gas capacity to support the reliable supply of electricity under high shares of variable renewables, CSIRO says

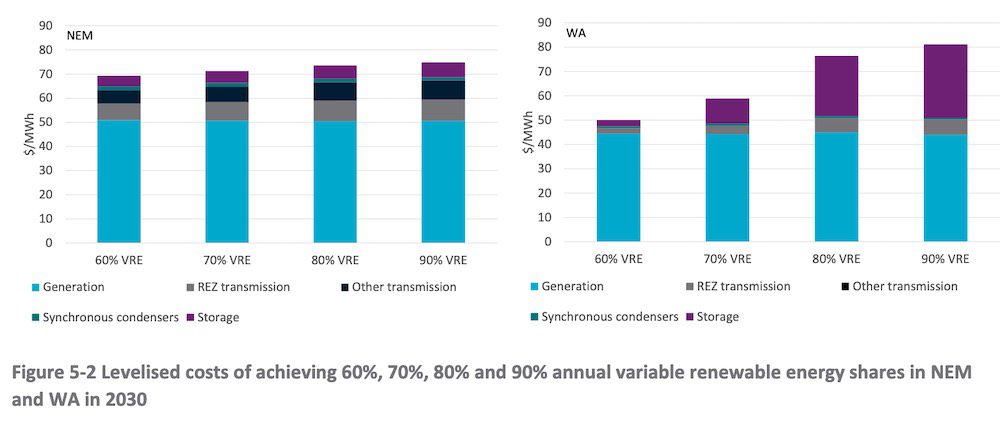

The report finds that factoring in the inflationary effect CSIRO expects will linger until around 2027, the additional costs to support a combination of solar PV and wind generation in 2030 is estimated at between $16 to $25/MWh depending on the share of renewables.

As you can see in the charts above and below, by CSIRO’s calculations this puts the levelised cost of energy from firmed renewables somewhere between $50-$100/MWh, even with a share of up to 90% of variable renewable energy.

This is beats out every iteration of coal or gas generation and comes in well below the LCOE projections for coal and gas with carbon capture and storage in 2030, as well as for nuclear.

“The annual process to update electricity generation, storage and hydrogen technology cost trajectories is incredibly valuable as we plan for an accelerated transformation of the National Electricity Market,” says Merryn York, the Australian Energy Market Operator’s executive general manager of system design.

“The GenCost project assists us, and industry stakeholders, to together identify the assets needed to efficiently achieve a secure, reliable and, importantly, an affordable electricity supply for consumers into the future,” York says.

The final GenCost report will be delivered mid-2023. It is prepared in consultation with the Australian Energy Market Operator, which uses it as a guide to its Integrated System Plan, its 30 year blueprint for the transformation of the energy industry.

See: Consumers and green hydrogen the big swing factors in AEMO’s new planning blueprint