Australia’s main power grid faces the “real” possibility ageing coal-fired power plants will drop out before sufficient generation capacity and transmission lines are in place, the Australian Energy Market Operator has said.

The comments, contained in a draft report on Aemo’s main blueprint for the national electricity market, come a day after New South Wales faced its first grid strains of the summer. Authorities called on consumers to reduce non-essential power use as temperatures hovered in the high-30s across much of Sydney.

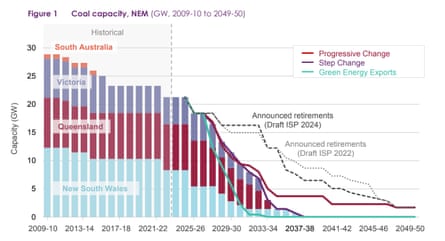

Aemo’s report, known as the integrated system plan, noted that 10 big coal-fired power plants had shut in the national electricity market since 2012. The remaining coal fleet may shut as much as three times faster than companies have flagged in their own public announcements.

Aemo said in the mostly likely scenario about 90% of the current 21 gigawatts of coal capacity would retire by 2034-35 and all by 2038. Even in its “progressive change” path, only 4GW of coal generation would remain in 2034-35.

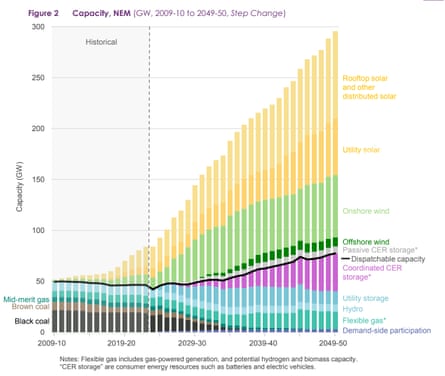

The scale of the replacement capacity needed is huge. Solar and windfarms will need to triple by 2030 to 57GW and expand seven-fold by 2050 to 126GW.

To support the variable renewables, new storage, hydro- and gas-powered generation will need to increase four-fold to 74GW by 2050. Roof-top solar, already installed on a higher percentage of houses, will also need to expand four times by mid-century to 72W, Aemo said.

“While significant progress [in the transition off fossil fuels] is being made, challenges and risks are already being experienced,” Aemo’s report said. “Planned projects are not progressing as expected, due to approval processes, investment decision uncertainty, cost pressures, social licence issues, supply chain issues and workforce shortages.”

Under two of the three main scenarios examined, the grid will also need an extra 10,000km of transmission by 2050. The report said if Australia pursues a policy of developing so-called green energy exports, such as hydrogen, more than twice the transmission construction will be needed.

after newsletter promotion

The energy industry itself has been calling for an acceleration of new investments if Australia is to meet its 2030 decarbonisation goals – but also to ensure power supplies can meet demand. New investment decisions have been dwindling, despite the urgency, with some firms complaining of changing rules in states such as NSW.

The federal government’s plan for a capacity investment scheme to provide minimum prices for as much as 32GW of new renewables and storage was aimed to accelerate new projects but has raised concerns by some private companies of excessive state involvement in the market.

The draft integrated system plan may be at odds with some firms’ plans. Victoria, for instance, may have closed coal plants entirely by 2033, Aemo predicts, while AGL Energy says its Loy Yang A power station will shut by the end of the 2035 financial year.

“To identify the optimal development path to 2050, we used Australia’s most comprehensive set of power system and market models to assess the benefits and risks of more than 1,000 potential pathways,” Aemo’s chief executive, Daniel Westerman, said.

“Delivering the transmission projects identified in this plan is expected to avoid $17bn in additional costs to consumers if those projects were not delivered,” he said.

Separately, the NSW government on Friday released the design of a proposed new plan that aims to bolster energy reliability as coal-fired plants close.

If applied, the national orderly exit management framework would provide “a clear process for governments to manage situations where owners of a coal-fired power station seek to bring forward its retirement date”, the government said. “If required, it also enables a government to temporarily extend the operation of the power station while new renewable infrastructure comes online, through a voluntary agreement or a direction,” it said.

NSW’s energy minister, Penny Sharpe, said the government was “committed to getting as much renewable energy into our grid as quickly as possible to meet our emissions reduction targets and provide a reliable supply of clean, affordable electricity”.

“We don’t want coal-fired power stations open a minute longer than needed,” Sharpe said. “This framework provides a back-up for the energy transition, to be used only as a last resort where we don’t have enough time to feasibly get new renewables or storage into the system.”