For a half hour in the middle of a Saturday last month, enough renewable energy was available to meet all but 1.4% of eastern Australia’s entire electricity demand – the closest to reaching 100% clean power in the grid’s history.

Renewables also supplied 38.9% of average demand across the national electricity market (Nem) in the September quarter, the most for any third quarter, according to a report by the Australian energy market operator (Aemo).

Total carbon emissions from the power sector, Australia’s biggest single source, were down 11% on a year ago. The share of generation from gas fell by almost a third and black coal by 7.5%, even though both fuels were slapped with price caps this year by the Albanese government.

Sunny skies as rain clouds disappeared contributed to an abundance of solar output, driving prices on the wholesale spot market negative for 19% of the time. That proportion was more than double that of the September quarter of 2022, and smashed the previous record 9.2% share in the June quarter of this year.

For the September quarter, wholesale power prices in the Nem averaged $63 per megawatt hour, down 41% on the previous three months and 71% lower than a year earlier, as Guardian Australia reported. Average wholesale gas prices on the east coast cratered to $10.41 per gigajoule from $25.94/GJ a year earlier.

Wholesale price reductions, though, would need to be sustained to make much difference to households’ retail energy bills. These are typically set annually.

Electricity demand is also expected to reverse recent declines, with prospects of a hot summer firming as an El Niño takes hold. Air-conditioner use was limited during the past three relatively damp and cool La Niña summers.

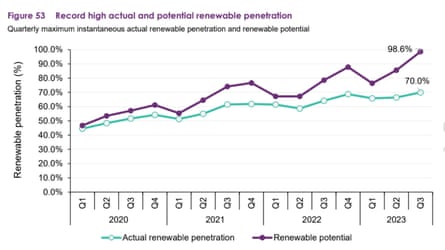

During the noon-12.30pm period on 16 September, renewables met a record 70% of power demand in the Nem, including 39% from rooftop solar. Clean energy was sufficient to meet almost all demand in eastern Australia and Tasmania.

“Potential renewable output hit a record 98.6%, which combines dispatched generation and available wind and solar farms that were bidding above the spot price and therefore not dispatched into the wholesale market,” said Violette Mouchaileh, an Aemo executive.

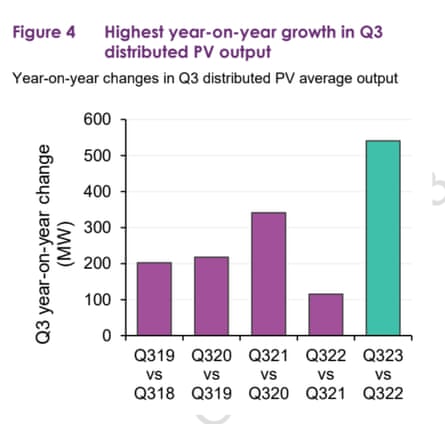

Despite the September quarter covering most of winter, when sun irradiance is relatively low, rooftop solar output reached as much as 11.9 gigawatts, 3% more than the previous record.

Solar farms’ maximum output during the quarter also rose 7% from its previous quarterly peak to just under 6GW, while wind farms generated as much 8GW, or 10% more than their previous high.

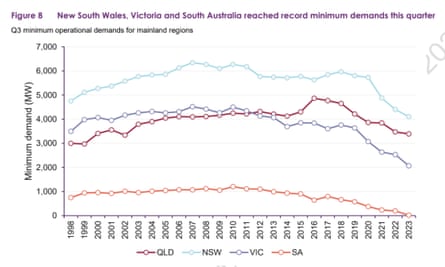

Challenges continue to mount for the Nem’s dwindling fleet of coal- and gas-fired power plants. One issue is that demand is often low, particularly during the middle of the day when many customers are sourcing power from their rooftops. A half-hour spell on Sunday 17 September saw operational demand slump to 11.393GW, almost 0.5GW below the previous Nem low set on 6 November 2022..

South Australia’s supplies from the grid almost disappeared entirely during a 30-minute stint on 16 September, with operational demand at a record low of just 21MW.

New South Wales and Victoria also set record minimum operational demands during the quarter, while Queensland had its lowest since 2002.

The market easily absorbed the closure in April of AGL Energy’s Liddell power station in NSW’s Hunter Valley.

Other NSW coal plants expanded available capacity but actual average output sank 166MW as they struggled to compete with renewables.

Aemo will provide an update next month about the grid’s readiness to cope with expected extra demand this summer.

Mouchaileh said 1.7GW of new renewable plants were “progressing through registration”, with a further 10GW of plants finalising contracts and under construction.

“The pipeline of new renewables, if supported by firming generation – batteries, hydro and gas – and transmission, will help meet reliability gaps and share low-cost, low-emissions energy to homes and businesses,” she said.