AGL Energy says the latest outages at the Loy Yang A brown coal power station are expected to cost the company $73 million, with one of the plant’s four units to remain offline until August.

Last month, AGL revealed that the 530MW unit 2 of the Loy Yang A power station had been taken offline due to a generator fault – the second extended outage at the unit within the last three years.

In a statement to the ASX on Monday, AGL says the outage had been triggered by a failure of the unit’s generator rotor insulation. The electrical fault should be repairable, and restart possible at the the beginning of August.

The company says it will look to manage the remainder of its generation portfolio to account for the outage.

“AGL is focused on affordability and reliability for its customers and is reviewing whether any upcoming planned outages in the rest of the generation portfolio can be shifted to help mitigate AGL’s shorter energy position in the market,” AGL said in the statement.

AGL says assessments on the damaged unit are ongoing but the expected costs of repairs and cost revenues were set to total $73 million. AGL issued a revised profit guidance for the current and next financial years, reflecting the lost income.

“The financial impact split between FY22 and FY23 is expected to be approximately $60 million pre-tax ($41 million after tax) and approximately $13 million pre-tax ($9 million after tax) respectively,” AGL said.

“The financial impact of the Loy Yang A Unit 2 outage is not recoverable via insurance.”

In February, AGL announced that it had brought forward the expected closure date for the Loy Yang A power station, now expected to close progressively between 2040 and 2045.

AGL’s board also knocked back a takeover bid led by Atlassian co-founder Mike Cannon-Brookes, who had pledged to further accelerate the closure of AGL’s coal generators to as early as 2030 and expand its portfolio of renewable energy projects.

The latest outage occurs amongst ongoing debate about the future of Australia’s ageing fleet of coal fired power stations in the grid.

Falling reliability and surging global coal prices have seen coal plants contribute to surging wholesale electricity prices, which have reached near all-time highs in the first few months of 2022.

The global price for black coal has been sent higher by disruption to energy markets triggered by the Russian Invasion of Ukraine.

It has seen Australia’s domestic black coal prices more than triple over the last 12-months and have seen electricity prices in both New South Wales and Queensland – which source most of their electricity from black coal generators – increase by a similar magnitude

Other states, which do not use black coal in their electricity mix, and which have greater shares of renewables, have been somewhat shielded from the higher wholesale electricity prices.

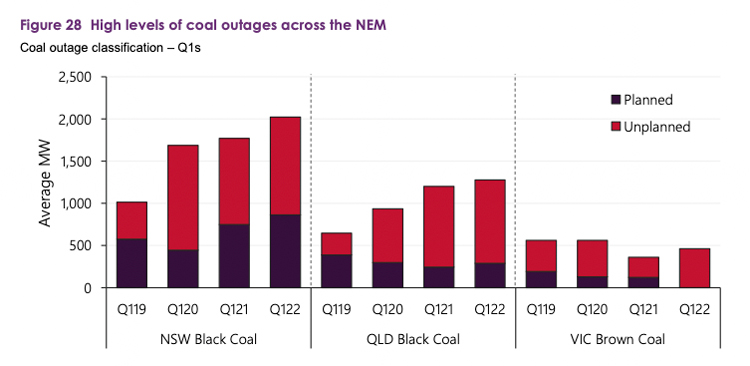

The most recent quarterly market update published by the Australian Energy Market Operator has detailed the high level of coal plant outages in the last quarter. This graph does not include Loy Yang A.