A common tactic used by the proponents of nuclear energy in Australia is to cite the situation in Germany, where coal fired power stations are being allowed back into the market to guard against any supply shortfalls – proof, the nuclear proponents say – that Germany can’t rely on renewables alone.

What is less discussed is that nuclear dependent France has done exactly the same thing, and delayed the closure of the country’s last coal generators – again – to ensure that there are no blackouts this winter.

Nuclear accounts for around 70 per cent of France’s annual power needs, but often produces too much power, forcing France’s state owned nuclear generator to sell the excess output at discount prices to neighbouring countries – not much different to what occurs with renewables.

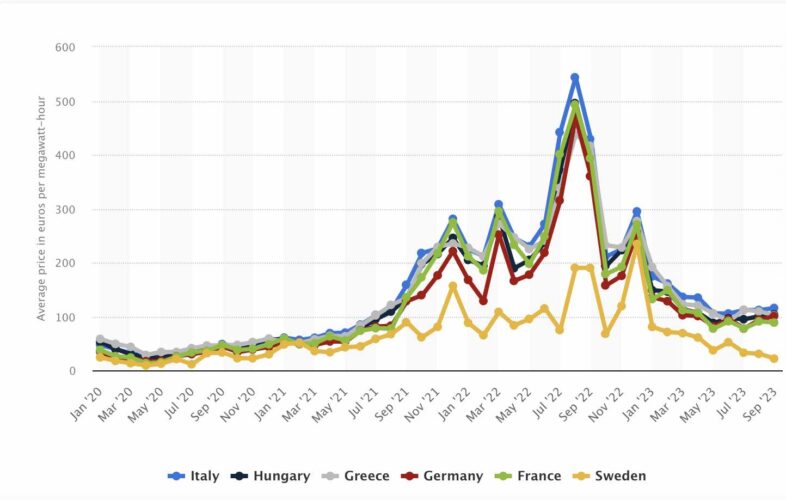

Last year, however, outages at more than half of France’s fleet of 56 nuclear generators – largely due to corrosion issues – forced the country to become a net importer, relying – ironically – on renewable power from Germany for at least part of its electricity needs.

This year, French authorities are taking no risks, and in a little reported decision made in August allowed two 50-year-old coal-fired power stations, the 1.26GW Cordemais facility in the centre-west and the 650MW Saint Avold brown coal generator in the north-east to extend their operating licence until at least the end of 2024.

The French government had promised to close the last of the coal fired plants before 2022, but last November decided to reopen the the Saint-Avold brown coal generator to help wean itself off Russian gas – as Germany was trying to do – and make up for the energy shortfall caused by its having half its nuclear fleet out of action.

Saint Avold was supposed to close again in March, but will now be allowed to operate until the end of 2024, although it could be extended again.

French grid operator RTE warned in September that it needs solution out to 2030 because of the growing unreliability of nuclear, and is also looking to battery storage and demand response.

“As a precaution, we are taking all the measures to ensure French electricity production,” the ministry said in its statement.

Speaking on LCI in late August, French energy transition minister Agnès Pannier-Runacher said although the risk of a blackout was considered low for the moment, there is no question of taking the risk of “depriving the French people of electricity over the winter”, as Euractiv reported.

In the interview, Pannier-Runacher reiterated France’s intention to phase out coal definitively by 2030. Germany also intends to close the last of its coal generators by 2030 in its “ideal case”, or at worst in 2038.

One interesting point to note, according to Le Figaro: The coal plants will have to pay a carbon price equivalent to €50 ($A77) to operate.

That’s less of a problem in the French market, because wholesale electricity prices there are generally higher than, say Germany, particularly over the last two years. French electricity bills are lower than Germany’s because power bills are heavily subsidised by the government, rather than used as a taxation source as in Germany.