The Australian Energy Market Operator has warned of potential widespread load shedding in Australia’s most coal-dependent states – Queensland on Monday and NSW on Tuesday – because of the lack of supply, or more pointedly, the lack of will to offer supply under the newly imposed price cap.

The warning of potential forced outages came just hours after the market operator extended its price cap for a second trading day in a row after prices in Queensland breached the trigger point of $1.359 million over the previous seven days.

The deepening crisis came as one quarter of Queensland’s coal capacity remain sidelined because of maintenance and unexpected outages, and a number of gas and diesel generators were also not operating. In all, little more than half of the registered capacity in the state is being made available.

AEMO says the risk of load shedding was made worse because some gas and diesel generators were not interested in providing power under the price cap. It said it would take action to force them online.

If the shortfall does occur, it will occur in the early evening, as the state’s solar generators wind down and as the market operator struggles to source enough operating thermal capacity to keep the lights on.

AEMO later flagged an intervention under its reserve trader mechanism, which could include demand management, rather than forced outages. Ultimately, it was successful in dodging forced outages, although price caps were soon imposed on other states – NSW, Victoria and South Australia.

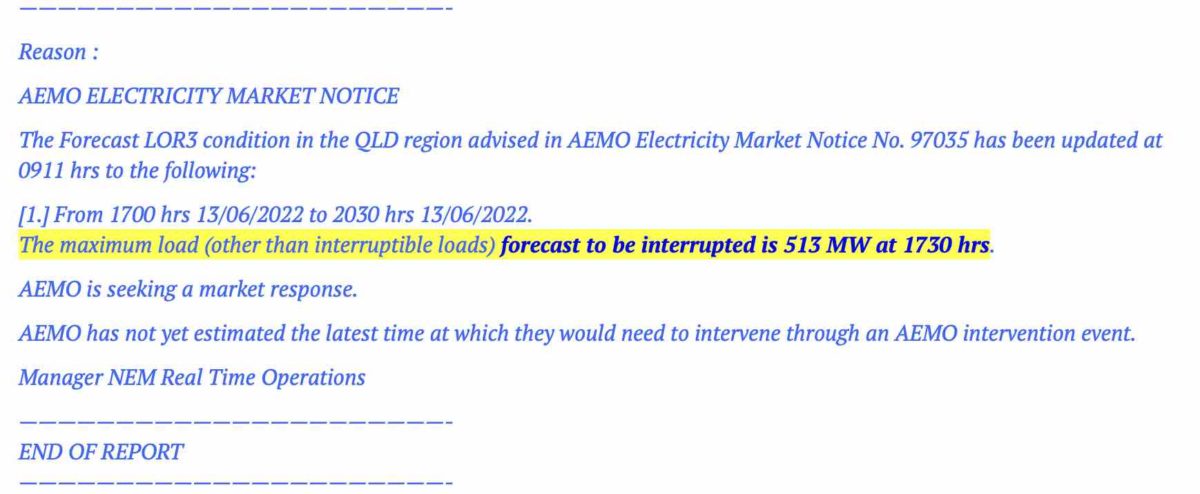

AEMO initially said up to 173MW of load may have to be curtailed between 1730 and 1900 AEST. It quickly updated this to a potential shortfall of 513MW – or the equivalent of one quarter of Brisbane’s total demand, according to analysts at WattClarity.

Just before noon, AEMO lifted the potential load shedding to 1454MW, getting close to the power needs of a large city such as Brisbane. It later cut this to 800MW, before the RERT mechanism was called in, but then at 3pm warned the shortfall could be 1147MW.

In all some 2GW of capacity was withdrawn because of the price caps, although most were ultimately forced back on line under AEMO directions. Powerlink and the state energy minister also issued a call to consumers to use less power, indicating how tight the situation was.

In NSW, the situation was little better, with multiple outages at Liddell and Bayswater. At around 1pm, AEMO warned of an LOR3 in NSW too on Tuesday evening, with potential of load shedding of up to 409MW between 6pm and 11pm local time. It later revised this down to 50MW. But that could change again.

It warned that price caps could be imposed in other regions – and most analysts suggest NSW as the most likely – leading to yet more problems with potential shortfalls as generators withdraw capacity and use their supply as a bargaining chip for more money.

In a statement, AEMO said generation had been reduced and withdrawn in Queensland as a result of the price cap administered on Sunday, and extending through to Tuesday morning, which begs the question about whether this included state owned generators that dominate the Queensland market.

“AEMO has seen generation bids reduce and has issued Lack of Reserve (LOR) notices in both Queensland and New South Wales, signalling a reduction in pre-determined electricity reserve levels,” AEMO said in a statement.

It said it had already been forced to directed some generators to continue meeting consumers’ demand to improve reserve conditions and would continue to do so. But it may not be able to force back enough capacity to avoid “load shedding” later in the day.

Some energy insiders suggested it could be a deliberate move by generators to withhold capacity because the rules around payments under a price cap are not clear. However, if a generator is “directed” to operate, there is more clarity.

One of the problems is that no gas generator can profitably produce power under the price cap given the current market price for gas, which requires closer to $400/MWh, just to break even.

And the situation may not be able to be resolved quickly. The prices have been so high in Queensland that the administered cap may need to be in place for another few days, begging the question about whether more directions will be issued.