Investment in clean energy is rapidly outpacing fossil fuel spending – with investment in solar poised to overtake oil for the first time ever – thanks in part to affordability and security concerns triggered by the global energy crisis.

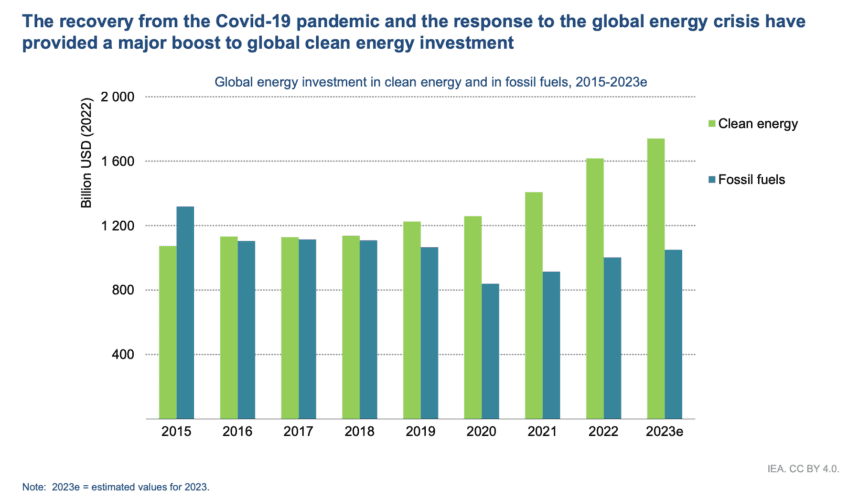

That’s according to the IEA’s new annual World Energy Investment report that finds about US$2.8 trillion will be spend on energy globally in 2023, of which more than US$1.7 trillion will go to so-called ‘clean tech’, including renewables, EVs, nuclear, grids, storage, low-emissions fuels, efficiency, and heat pumps.

The remainder of this year’s investment, just over US$1 trillion, will go to coal, gas and oil.

Annual clean energy investment is expected to rise by 24% between 2021 and 2023, the majority of which will be driven by renewables and electric vehicles as countries race to meet their climate commitments. That’s compared with just a 15% rise in fossil fuel investment over the same period.

According to the report, low emissions technologies are expected to account for 90% of investment in power generation, with solar leading the charge.

But consumers are also driving the soaring figures, with global heat pump sales seeing double-digit annual growth since 2021, and EV sales expected to jump by a third this year alone.

“Clean energy is moving fast – faster than many people realise. This is clear in the investment trends, where clean technologies are pulling away from fossil fuels,” said IEA Executive Director Fatih Birol.

“For every dollar invested in fossil fuels, about 1.7 dollars are now going into clean energy. Five years ago, this ratio was one-to-one. One shining example is investment in solar, which is set to overtake the amount of investment going into oil production for the first time.”

Oil and gas spend to match 2019 levels

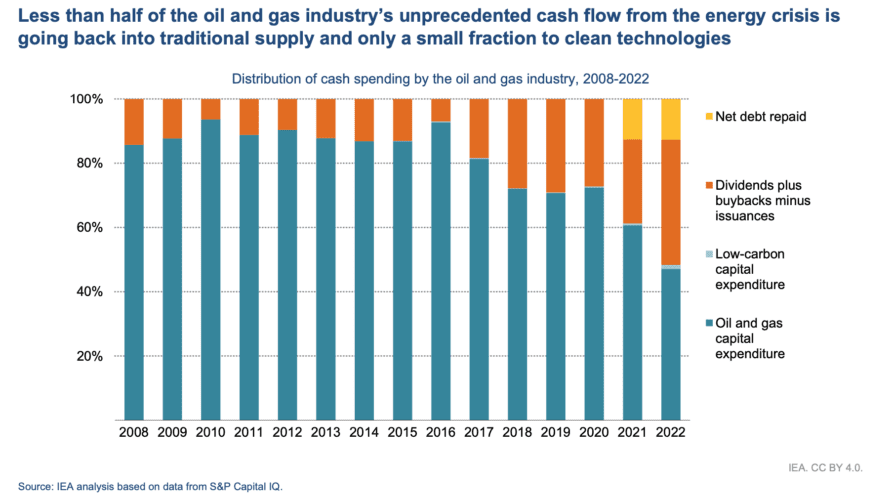

The report finds that spending on upstream oil and gas will rise by 7% in 2023, bringing it in line with 2019 levels. Those oil companies spending more than pre-pandemic are mostly large nationals in the Middle East.

Many fossil fuel producers made record profits last year because of higher fuel prices, but the majority of that cash flow went to dividends, share buybacks and debt repayment – rather than traditional supply.

But the report notes the expected rebound in emissions investment means the investment hike in 2023 alone will be more than double the levels needed in 2030 under the IEA’s Net Zero Emissions by 2050 scenario.

Global coal demand reached an all-time high in 2022, and coal investment this year is on course to reach nearly six times the levels envisaged in 2030 in the Net Zero Scenario.

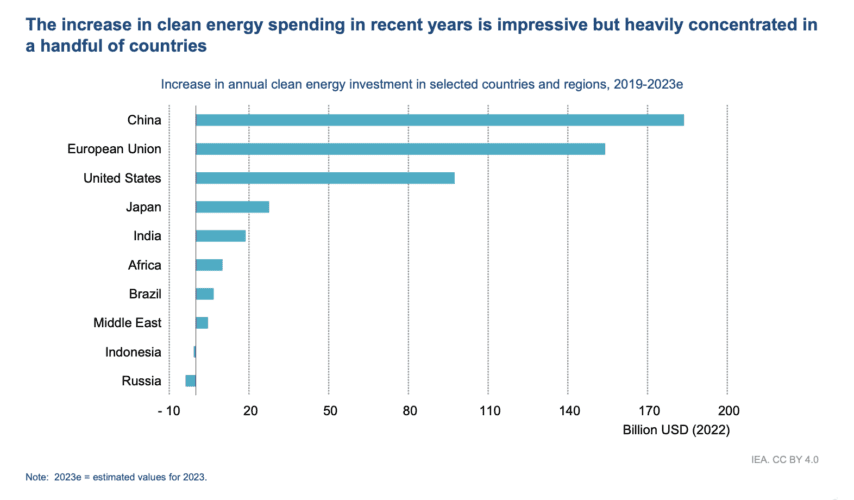

Clean energy spend not distributed evenly

More than 90% of the increase in clean energy spending, though, comes from advanced economies, including China, which the IEA warns could be a warning sign of a deepening global divides between so-called MECDs and LECDs, recreating the economic dynamics of the last great energy revolution.

The report found “some bright spots”, like solar investments in India, and renewables in Brazil and the Middle East, but ultimately investments in many countries were held back by higher interest rates, unclear policy, weak grid infrastructure and strained utilities.

The authors of the report say the international community must work to drive investment in these lower-income countries.