Oil & Gas Group

This group brings together those who are interested in topics around oil and gas exploration, drilling, refining, and processing.

Post

Dallas Fed's Survey Of Oil Supply

Summary

- Sept 28, 2022, the Dallas Fed surveyed 153 oil companies.

- 85% expect a significant tightening of oil supplies in 2024.

- "Shale will likely tip over in five years, and U.S. production will be down 20 to 30 percent quickly"

- Supply issues will drive oil and gas prices much higher in 2024.

- Oil is at $77 a barrel now, $95 is likely by year end, and higher in 2024.

2008 Banking Collapse

In May 2008, the Dallas Fed issued a warning - Crude Awakening: Behind the Surge in Oil Prices. Doing nothing on this warning, policy makers and businesses stumbled into the Great Recession in September 2008.

The 2008 pattern could repeat by 2024, based on the Dallas Fed's September 2022 survey of 153 oil companies.

The purpose of this article is to provide background data for:

-

The Dallas Fed's findings that policy makers and business leaders who can use to act in advance to mitigate a replay of the 2008 Great Recession.

-

The solution identified to avoid future hardships experienced during the 1973 Oil Embargo by Congressional Study PB-244854, "Automated Guideway Transit".

The cost of the 2008 Great Recession was documented by the Dallas Fed:

-

2013, Jul, Dallas Fed: Bottom-line Cost of 2007-09 Financial Crisis Estimated at $6 Trillion to $14 Trillion.

-

2013, Sep, Dallas Fed: Assessing the Costs and Consequences of the 2007-09 Financial Crisis and Its Aftermath.

Survey:

-

Question: Do you expect a significant tightening of the oil market by the end of 2024, given the current underinvestment in exploration?

-

Answer: 85% agreed.

-

Comment: "Shale core exhaustion and inventory concerns are mainstream and well-documented issues. Shale will likely tip over in five years, and U.S. production will be down 20 to 30 percent quickly. When it does, this feels like watching the steamroller scene in Austin Powers. Oil prices in the late 2020s will be something to behold."

-

Question: Do you expect the age of inexpensive U.S. natural gas to come to an end as liquefied natural gas exports to Europe expand?

-

Answer: 69% agreed that it would happen by 2025.

-

Comment: "As to the question regarding natural gas, the age of inexpensive gas has already ended."

Geological Pace of the Approaching Crisis:

This crisis of unaffordable oil in an oil-powered economy has been unfolding at the slow pace of oil field depletion for decades.

-

Admiral Rickover, 1957 Energy Slave speech: "For it is an unpleasant fact that, according to our best estimates, total fossil fuel reserves recoverable at not over twice today's unit cost are likely to run out at some time between the years 2000 and 2050."

-

President Obama, 2010: "For decades we have known that the days of cheap and easily accessible oil were numbered."

-

Link to 10 US Presidents issuing unanswered calls to action to cut oil use by 1/3rd to end foreign oil addiction.

Current Underinvestment:

The qualifying point of the Fed's question was "given the current underinvestment in exploration."

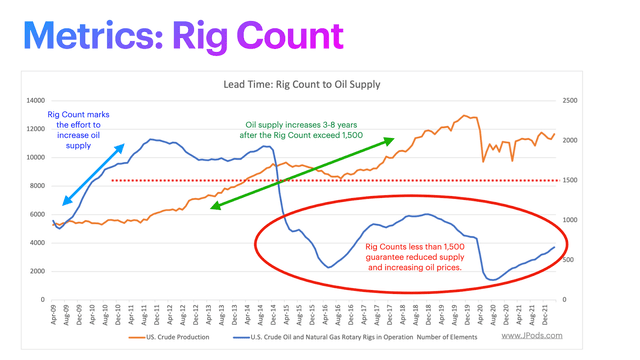

Rig Count is at 674. The supply of oil in 3-8 years is determined by the Rig Count today. The Rig Count of over 1,500 between 2010 and 2014 provided affordable oil between 2015 and 2019 and a massive number of DUCs (Drilled UnCompleted). The Rig Count since 2015 indicates future supply shortages.

JPods

Rig Count Follows Price:

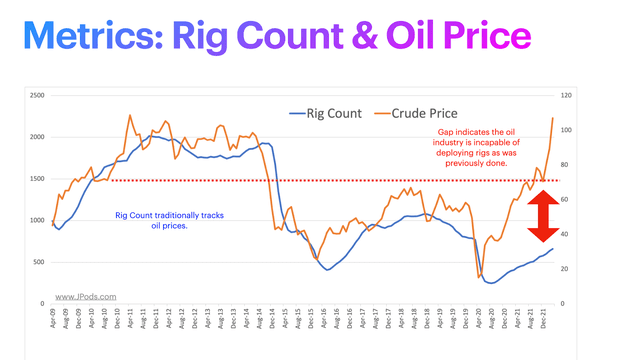

The Rig Count previously increased with increased oil prices. This increase is small today, likely because the fracking industry lost $300 billion with significant bankruptcies and policies hostile to the industry. The Rig Count is not increasing with oil price as it has in the past. Rig Count sets future supply.

JPods

Consuming DUCs:

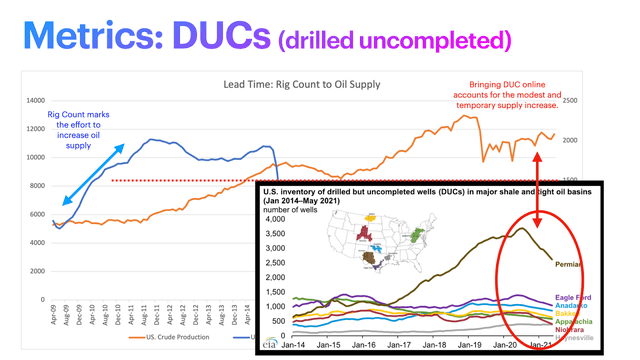

It appears that consuming DUCs, longer horizontal drilling, and a 41% decrease in demand during COVID accounts for affordable gasoline from 2020 to the date of this article, April 2023.

JPods

Energy Cliff:

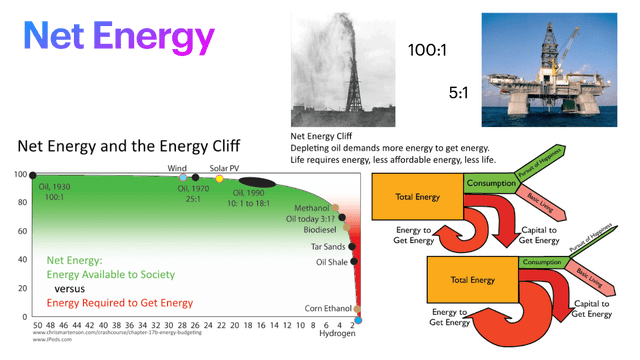

Generally, the best and most profitable oil fields are extracted first. As the quality of fields diminish, Net Energy - the amount of energy obtained relative to the amount of energy expended to extract it - decreases. The Federal highway monopoly began when oil's Net Energy was 100:1. With fracking, the Net Energy is falling off an Energy Cliff at less than 5:1. Bankruptcies and the loss of $300 billion were a consequence of this decreasing Net Energy. Solar and wind have adequate Net Energy of over 20:1.

JPods

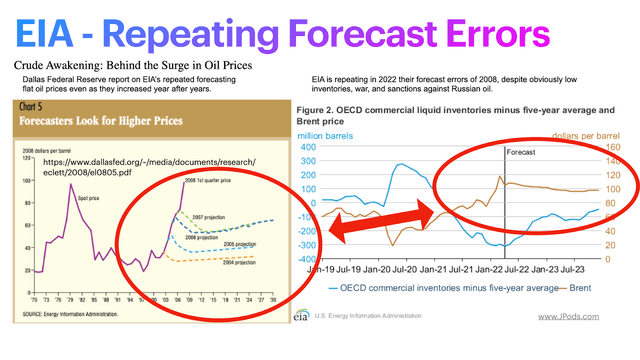

EIA Repeating Forecast Failures of 2008:

The May 2008 Dallas Fed report, "Crude Awakening" shows how the EIA repeatedly failed to adapt its forecasts to reality. Each reporting period, EIA would forecast that the higher oil prices would decrease and then stabilize. Policy makers and business leaders who relied on EIA forecasts were doomed to be surprised. EIA seems to be repeating their 2008 behaviors in failing to warn policy makers of risks that the Rig Count's 3 to 8-year lead time makes clear.

EIA Forecast (JPods)

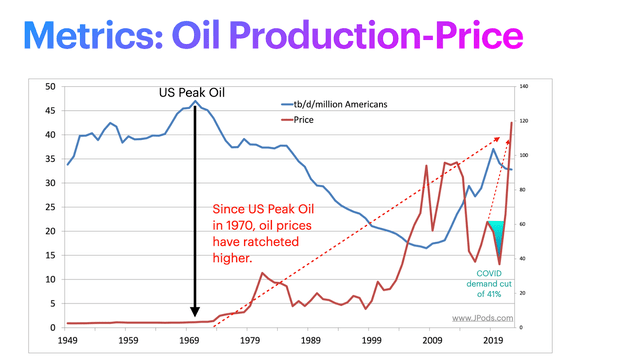

Geological Pace of Approaching Crisis:

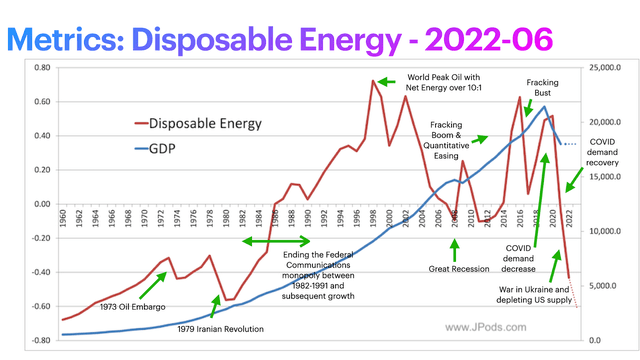

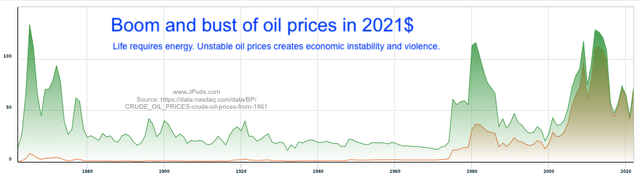

Oil's affordability crisis has been unfolding at a geological pace and with geological certainty since US Peak Oil in 1970. Life requires energy. Energy production should reflect the number of people whose lives depend on it. Since US Peak Oil prices have been ratcheting higher. Decreasing supply will force price increases to suppress demand.

JPods

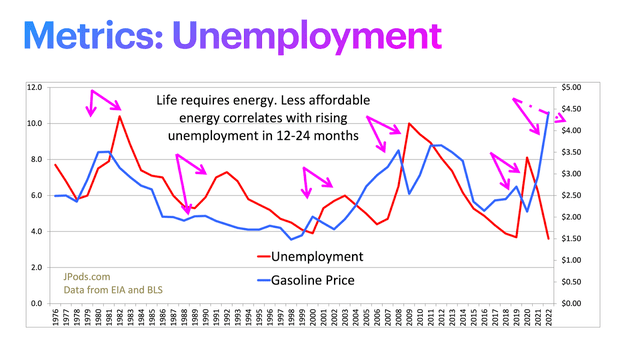

Unemployment and Social Unrest:

Life requires energy. The more affordable energy is, the more people can be employed to increase economic well-being. As gasoline prices rise, disposable incomes decrease and fewer workers are required to apply energy. Unemployment follows rising gasoline prices by about 18 months. When unemployment is significant enough, social unrest follows.

JPods

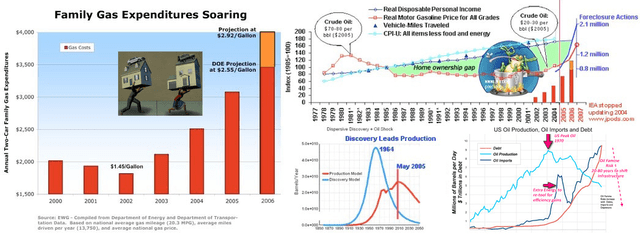

2008 Data to Senate Staffs and Metric Disposable Energy:

In July 2008, I briefed campaign and Senate staffs of Senators McCain and Obama on how ordinary people were using their mortgage payments to buy gas to keep their jobs. Only Bud McFarlane, former National Security Advisor, saw the risk. Others thought the Federal policies could manage the foreclosure issue. The follow graphs were used in those presentations:

JPods

These graphs were provided and combined into a new metric of Disposable Energy, how much energy people can buy with their take-home pay. Disposable Energy began warning of the 2008 crisis as early as 1998. GDP gave no warning of the 2008 crisis. Today, both GDP and Disposable Energy are warning of an approaching crisis.

JPods

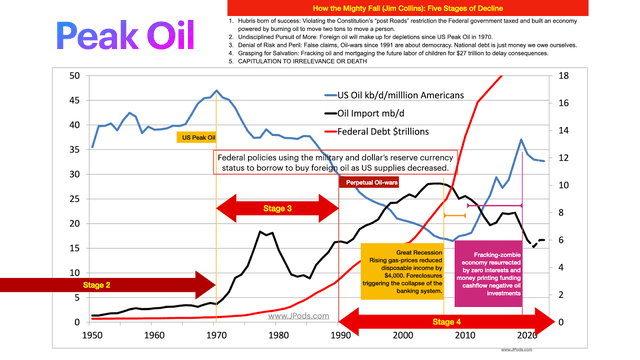

How the Mighty Fall (Jim Collins, link)

US Peak Oil was in 1970. Instead of adapting, US policy makers implemented the 5 Stages of Decline. There is limited time to adapt.

-

Hubris from Success: The 17th Amendment shifted America from a compound republic to a consolidated democracy with power consolidating in the Federal government. The concept of "natural monopolies" was applied to nationalize/socialize communications, transportation, and energy networks.

-

Undisciplined Pursuit of More: The New Deal wiped out the renewable energy industry that was making 80,000 windmills a year in favor of central grids. The Interstate Highway network replaced 46% of the 470 ton-mpg railroads with 25 mpg roads, sprawling American cities. Instead of the diverse state economies that had forced an end to Federal support for slavery, a unified economy was consolidated that depends on cheap oil and coal.

-

Denial of Risk and Peril: US Peak Oil does not matter. The US can buy foreign oil by printing dollars. Debt is money we owe ourselves. Ignoring calls to action by 10 Presidents to end foreign oil addiction deny the risks of Climate Change. Claiming oil-wars will spread democracy.

-

Grasping for Salvation: American soldiers can be sent to secure access to foreign oil. Fracking will save us. Money printing can buy foreign oil. The debt ceiling can be raised.

-

Capitulation to irrelevance or death.

JPods

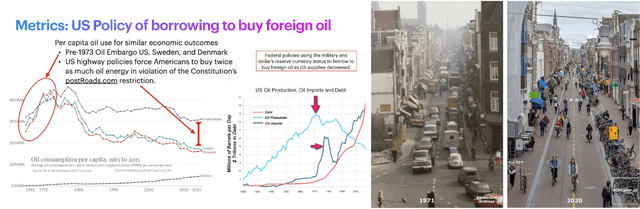

What Is Known as Practical:

In 1972, per capita oil use in the US, Sweden, and Denmark were about the same. Following the 1973 Oil Embargo, the Danes and Swedes adapted to make their cities walkable and bike-able, cutting oil needs by 2/3.

JPods

Congressional Study PB-244854, "Automated Guideway Transit":

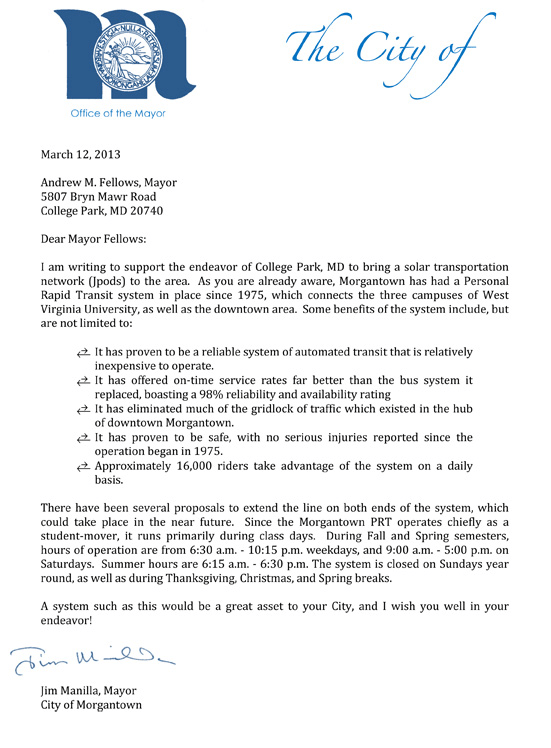

In 1974 Congress initiated a study to find solutions to the hardships of the 1973 Oil Embargo. The study, "Automated Guideway Transit" was published in 1975. As its name suggests, the study found that the solution to city traffic congestion and foreign oil dependence are grade-separated networks of electrically powered, self-driving vehicles. It specifically identified the Morgantown PRT (Personal Rapid Transit) as an example. The study also found that government "institutional failures" blocked urban transportation innovation for "four to six decades (aside from some relatively minor cosmetic changes). Compared with many other areas of entrepreneurial endeavor, the environment for innovation in transportation should be favorable. Urban transportation needs are extensive… In retrospect, the new systems efforts have served not to stimulate interest in new technology but to discourage already reluctant local transit operators from considering it."

The Morgantown PRT was so important that President Nixon sent his daughter Tricia to open it in 1972. President Nixon's policy towards energy was that, "At the end of this decade, in the year 1980, the United States will not be dependent on any other country for the energy we need. We will hold our future in our hands alone." PRT networks in dense urban areas can accomplish the objective of cutting US oil use to within domestic production, a 1/3rd cut in oil consumption.

The PRT has now been working for a half a century.

JPods

A Letter from the Mayor of Morgantown explains the benefits of PRT networks:

JPods

Changes in Long-term Investment Opportunities:

Macon, GA and the North Central Texas Coalition of Governments (DFW area) have approved the building of modern PRT networks. There is also a bill filed in the Massachusetts Legislature for deploying such networks. Currently, these networks are privately funded. Public funding mechanisms will follow.

Oddly, as solar-powered urban transport networks deploy, the value of oil companies will increase. Oil field depletion rates will slow, prices and margins can increase without collapsing the economy and oil prices. Creating stability through diversity of transportation energy sources is identical to creating investment stability through diversity of stock holdings. Diversity of transport energy sources may diminish the boom and bust nature of the oil industry and provide consistent profits and reduce the epic losses.

Discussions

No discussions yet. Start a discussion below.

Get Published - Build a Following

The Energy Central Power Industry Network® is based on one core idea - power industry professionals helping each other and advancing the industry by sharing and learning from each other.

If you have an experience or insight to share or have learned something from a conference or seminar, your peers and colleagues on Energy Central want to hear about it. It's also easy to share a link to an article you've liked or an industry resource that you think would be helpful.

Sign in to Participate