Iron ore billionaire Andrew Forrest has swept in to snap up leading renewable energy developer CWP Renewables, beating out a series of big competitors and entrenching him as the dominant player in the Australian renewable energy market.

Forrest’s Squadron Energy, owned via his private investment vehicle Tattarang, has paid a reported $4 billion plus for CWP Renewables, beating offers from early favourites such as Spanish energy giant Iberdrola, Tilt Renewables, and Origin Energy.

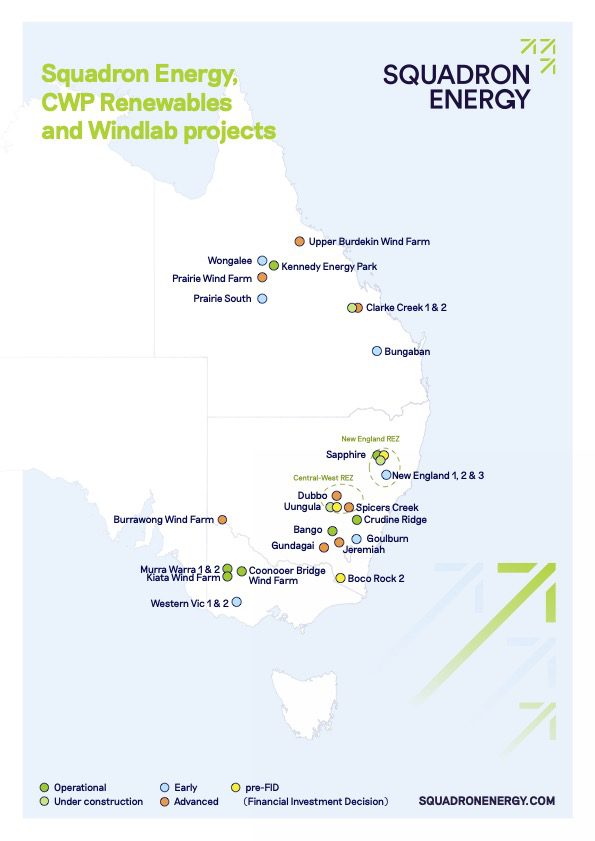

The purchase of CWP follows Squadron’s previous purchase of renewable energy developer Windlab, the start of construction of the $3 billion Clarke Creek wind, solar and battery farm in Queensland, and the unveiling of a new 10GW renewable “super” hub in north Queensland.

Squadron says the deal takes its renewable energy operating portfolio to 2.4 gigawatts (GW) with an Australian development pipeline to 20GW.

“Squadron is proud to bring a very significant portion of Australia’s renewable energy assets home to local ownership. It means that Squadron has the renewable energy critical mass to help Australia step beyond fossil fuels,” said Dr Forrest.

“Australian industries’ ability to consign fossil fuel to history, is robustly demonstrated by the strong track record and commitment of Fortescue Metals, Fortescue Future Industries and other world-leading companies committed to decarbonising.

“We share a vision of Australia and the world, looking back on the dark era of fossil fuel as an aberration in humanity’s history. One that could have ended with that fuel, but is now powered by cheap, pollution free, democratic inexhaustible energy.

Billionaires on the march

The move by Forrest further entrenches the influence of Australia’s three richest men – Forrest and software billionaires Mike Cannon-Brookes and Scott Farquhar over the future of Australia’s grid.

All three are committed to a rapid switch to wind, solar and storage, with Cannon-Brookes taking an influential stake in coal giant AGL, and co-funding with Forrest the world’s biggest solar and battery project, Sun Cable, in the Northern Territory.

Farquhar has also joined the rush to green energy, leading a bid for one of the last listed renewable and storage plays on the ASX, Genex Power, although there are questions over whether that bid will proceed after problems at the company’s flagship Kidston pumped hydro project.

Further change to the industry is coming from the planned takeover of Origin Energy by a consortium led by Canadian funds management giant Brookfield, which says it plans to spend $20 billion on new wind, solar and storage by 2030 as the switch to green energy gathers pace.

CWP is one of the biggest players in the Australian renewables market, with more than 1.1GW of operating assets, including the Sapphire, Murra Warra, Crudine Ridge and Bango wind farms, with a host of other wind, solar and battery storage projects in the pipeline.

Biggest player in Australia market

Forrest has already talked – on multiple occasions – of becoming one of the world’s leading producers of green hydrogen, with an improbable target of producing 15 million tonnes a year by 2030.

But it seems that he now has growing interest in becoming the biggest player in Australia’s main grids, with a focus still on reaching 100 per cent renewables, and producing green hydrogen at scale, but likely for the domestic rather than the export market that is challenged by transport costs.

CWP is being sold by the Swiss-based Partners Group, which has more than $185 billion of assets under management and said it had built CWP from the ground up to become a major player with a pipeline of 5GW of near-medium term projects and an additional 15GW at an early stage of development.

“We are proud to have built a major renewable energy platform that is set to play a key role in decarbonizing Australia’s energy mix and supporting the country and its businesses in meeting their ambitious net zero ambitions,” said Martin Scott, the head of Partners Group in Australia.

Forrest said it is important that Australian energy assets are owned by Australian interests.

Time to dump dangerous fossil fuels

“It is paramount that Australia continues to increase cost-efficient renewable green energy, to economically power homes and industry at pace and rid the Australian consumer of its forced reliance to increasingly expensive, dangerously pollutive fossil fuels,” he said in a statement.

“We are committed to ensuring that Australians benefit from the rising employment opportunities, and massive investment in the renewable energy sector. The new jobs, manufacturing and training opportunities, particularly in regional areas, are so important to making sure generations of Australians benefit across the nation.”

Squadron CEO Eva Hanly says the company has the “experience, people, agility and scale” to meet the huge demand for green energy from large commercial and industrial customers.

“When large industrial and commercial customers come to us, they are looking for efficient and firmed renewable power at scale,” Hanly said.

Night and daytime wind

“With this acquisition, we will develop and operate an extensive geographic portfolio of night and daytime wind, solar and storage assets that will ensure reliability of supply for our customers.

“The sooner we can get renewable energy at scale into the grid, the more quickly prices will come down for consumers. We are very focused on using our scale and smarts to ensure we are the leader, by a significant margin, in delivering the lowest produced cost of firm renewable energy to market.

Hanley says Squadron will begin construction of another 2GW worth of projects within the next 18 months.

Squadron was advised by Highbury Partnership as its financial advisor and Clayton Utz as its legal advisor. Partners Group was advised by Macquarie Capital as its financial advisor and Clifford Chance as its legal advisor.