Australia has slipped a spot in the annual EY rankings of renewable energy attractiveness because of doubts over its ability to reach its 82 per cent renewables target for 2030, and whether it can attract investment for massive green hydrogen projects.

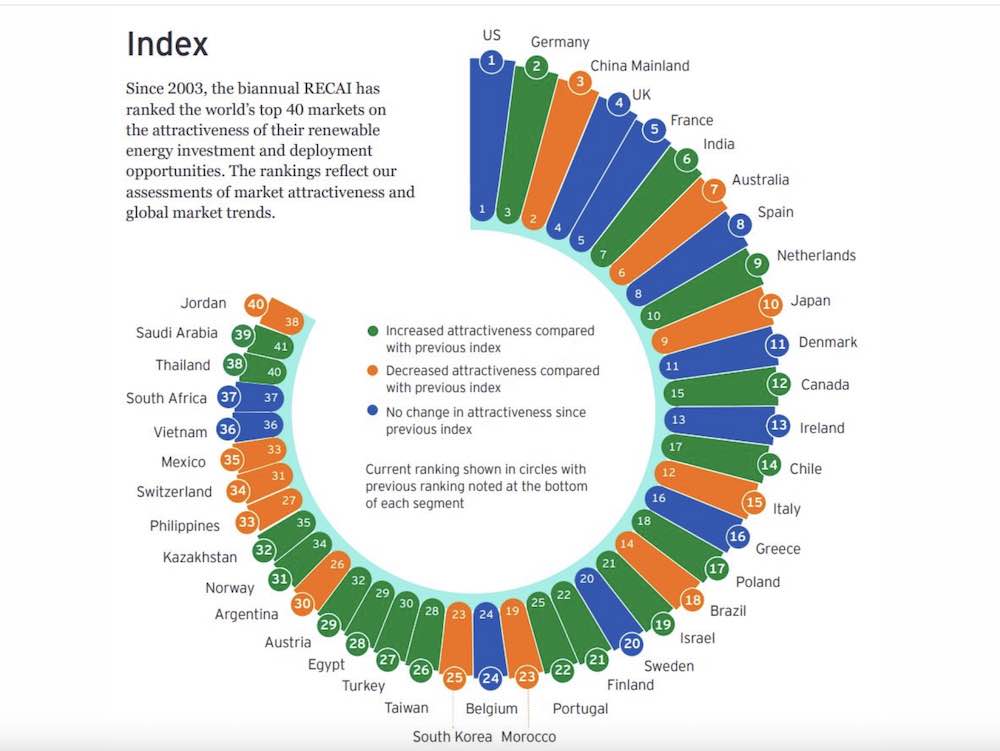

The EY Renewable Energy Country Attractiveness Index, or RECAI, places the United States at the top of the rankings, with Germany overtaking China to grab second place. Australia slips a notch from sixth to seventh.

EY has been publishing the index since 2003, ranking the world’s top 40 countries markets on the attractiveness of their renewable energy investment and deployment opportunities.

Despite a record year for renewable energy project commitments in 2022, Australia has slipped further down the rankings because EY deems that Australia is currently not on pace to reach the federal government target of 82% renewable generation by 2030.

It says – as do many other observers – that deployment rates of new wind and solar need to at least double to achieve the target. Australia was ranked third in the world in late 2020, but has steadily fallen down the rankings in the last few years, despite efforts by state and federal governments to lift their targets.

The US continues to dominate the market, thanks to the power of Inflation Reduction Act (IRA), which was . passed in 2022 and is primarily a climate and clean energy spending bill that offers a host of tax incentives and benefits to companies with local production capabilities.

“Legislation has sparked a race to the top among international markets eager to boost the competitiveness of their renewables industry,” said Arnaud de Giovanni, EY global renewables leader.

“And with investment in green technologies benefitting from an impressive 19% rise last year, testament to the accelerating pace of the energy transition, a unique opportunity has emerged for the industry, worldwide, to double down on efforts to stimulate renewables supply and demand.”

That means that countries such as Australia are at risk of losing out on potential renewable energy investments.

EY also notes that companies that were considering Australia for investments in green hydrogen are rethinking their plans in light of the IRA’s ability to bring down the costs of production in the US.

“In comparison, Australia’s competitiveness in the nascent green hydrogen space now looks reduced,” it says.

EY pointed to the proposed Capacity Investment Scheme, which will start to roll out at the end of this year to provide support for energy storage projects, as a potential means for Australia to lift its rankings.

“There is still, I think, a potential revenue gap for storage projects, because of the range of revenue streams,” said Michael Newman, EY Oceania renewables leader.

“So that is the first lever, and there is also a question mark over whether a broader capacity investments scheme could be brought in to help renewable energy from a global attractiveness perspective.”

India edged out Australia for sixth spot. It currently boasts the fastest rate of renewable electricity growth of any major economy. In 2022, according to EY, solar accounted for 63GW of the market’s total 163GW renewables capacity, followed by renewable hydropower at 47GW and wind power at 42GW.

Germany’s climb into second place, overtaking China, was driven by Germany’s efforts to accelerate a reform of its power market as it aims to achieve 80% renewables in its power mix by 2030.