The list is in. The federal government has finally announced the winners – and the almost-winners – of the first round of feasibility licences for developers vying to install the first offshore wind turbines ion Australia, off the coast of Gippsland in Victoria.

As Renew Economy reports here, the list of six projects given a licence to go ahead with costly feasibility and environmental studies include some unfamiliar names – as does the list of six projects in line to be awarded feasibility licences, subject to further consultation.

So, with statements from the developers starting to roll in to the Renew Economy inbox, we figure now is a good time to take a closer look at who is who in the Gippsland offshore wind zone – and what they are proposing to build.

Here’s what we know so far …

Star of the South

Starting with the known knowns, the 2.2GW Star of the South (SOTS) has been awarded a licence. The project is being developed by Danish giant Copenhagen Infrastructure Partners (CIP), super outfit Cbus and its original Australian co-founders Andy Evans, Terry Kallis and Peter Sgardelis.

This consortium – long regarded as the front runners in offshore wind in Australia – is now apparently known as Southerly Ten, a name chosen to reflect its focus on Australia and New Zealand and its plans to build 10 gigawatts of new offshore wind capacity across the region.

“CIP was an early believer in Australia’s offshore wind potential, proudly working with local communities, government and industry to kick-start an offshore wind industry since 2017,” said CIP’s head of Australia Jørn Hammer in a statement on Wednesday.

“We’re excited to move forward with Southerly Ten to explore more opportunities to bring investment, jobs and energy to regional Australia and New Zealand.”

The SOTS project – proposed for at least 10km off the Gippsland coast, between Port Albert and Woodside Beach – is seen as the most likely to be first to get built and start generating power in Australian waters. When that might occur remains to be seen, but Victoria has set a target for at least 2 gigawatts installed by 2032.

Southerly Ten CEO Charles Rattray said on Wednesday that the Star of the South is “already well progressed,” the consortium having studied the area for five years under a federal Exploration Licence.

“[We] know it’s in a location with strong winds, ideal sea depths and suitable seabed conditions,” Rattray said.

Andy Evans, one of the originators of the project, told Renew Economy the awarding of feasibility licences marked a “big day” for him and co-founders Terry Kallis and Peter Sgardelis.

“Everyone thought we were a little crazy when we founded SOTS in 2012,” Evans said. “We’re delighted we now appear to have a legitimate industry!”

Evans also says the next priority is to “crack on and build a local supply chain” in collaboration with established global players and to get turbines in the water.

Kut-Wut Brataualung

A new name to the mix, this one turns out to be a second Gippsland project being pursued by the CIP-backed Southerly Ten, and has also been awarded a feasibility licence.

Like SOTS it is also has a proposed capacity of 2.2GW, but within a 689 km2 area located 45km from the southern-most tip of Wilsons Promontory.

Southerly Ten says the project is named in partnership with the Gunaikurnai Land and Waters Corporation (GLaWAC) recognising a family group of the Brataualung peoples that lived in and around the Toora area.

“Kut-Wut Brataualung is at an earlier stage, so our first steps will be to study the wind and local environment and build a really comprehensive understanding of that specific area, while consulting with local Gippsland communities,” Rattray says.

As a side note, Southerly Ten is also pursuing a feasibility licence in the Hunter region for its Destiny Wind project, with a focus on early community and stakeholder engagement to understand local views and opportunities.

Ørsted 1

Another Danish wind giant, Ørsted has been awarded a feasibility licence for its Gippsland 1 wind farm – a 2.8GW project proposed for a 700km2 area 56-100 km off the coast of Gippsland.

Its 2GW Gippsland 2 project, directly next door to Gippsland 1 on the map (below), is also among the six projects in line for a licence, pending further consultation with First Nations groups.

Ørsted says the Gippsland “cluster” has the potential to generate a combined 4.8GW of renewable energy and could be completed in phases from the early 2030s.

“With more than 30 years’ experience and unparalleled expertise in large-scale offshore wind projects, Ørsted is pleased to be awarded licences to help launch Australia’s new industry and accelerate the nation’s renewable energy transition,” the company’s CEO of the Asia Pacific region, Per Mejnert Kristensen, said.

“We believe we’ve secured the best possible sites and that our proposed projects in Victoria will deliver reliable, cost-effective renewable energy. We look forward to delivering long-term benefits for communities, the economy, and the environment in Gippsland and beyond.”

“We’re confident that Australia has all the ingredients to become a thriving and highly investable offshore wind market. We’ll continue to work closely with the Commonwealth and the Victorian State governments, and all stakeholders, to ensure the projects create sufficient value for all.”

High Sea Winds North

This project, another licence winner, is being proposed by Madrid-base EDP Renewables and Paris-based Engie as part of the two companies’ 50-50 offshore wind joint venture called Ocean Winds.

Ocean Winds says it was granted the licence through its bidding company High Sea Wind Pty Ltd to further develop a proposed project with an installed capacity of 1.28 GW in a 150km2 area off the Gippsland coast.

“We have a proven track record of turning offshore wind into a reality in new markets; mainly thanks to our focus on developing local supply chains, maintaining technical, environmental, and social best practices,” said Ocean Winds CEO Bautista Rodriguez.

Ocean Winds chief business development officer, Rafael Munilla, says the progress in Australia adds to the ongoing construction of 2GW of offshore wind projects around the globe, and safe operation of another 1.5GW.

“We are looking forward to bringing this experience to Australia, working hand in hand with all stakeholders, with a special focus and attention to First Nations, other sea users and local communities impacted by the project,” Munilla said.

Gippsland Skies

Another new name, this licence-winning project was revealed on Wednesday as being developed by a consortium of Australian and international companies, including AGL, Mainstream Renewable Power, Reventus Power, and Direct Infrastructure.

This is a powerful mix, particularly given Mainstream Renewable’s offshore wind pedigree, which includes development of the world’s largest offshore wind project in operation today; Hornsea 2 in the UK.

Gippsland Skies is proposing a 2.5GW fixed bottom project and the developers say they expect it to be one of Australia’s first offshore wind projects to reach commercial operation.

AGL, which has a 20 per cent share in the project, says Gippsland Skies could be a big part of its transition away from fossil fuels. It remains the biggest generator of coal fired power in Australia.

“Gippsland Skies will be an important part of AGL’s ambition to add 12GW of additional renewable and firming capacity by the end of 2035,” says AGL COO Markus Brokhof.

“The development of this significant offshore wind project could also be an ideal complement to the transition of AGL’s Loy Yang Power Station into the Latrobe Valley Energy Hub following its targeted closure by the end of FY35.

“The build out of new infrastructure, new skills and local supply chains will be critical for both. As we progress the development of this offshore wind project, we hope to create a new era of innovation and new careers for the Gippsland region.”

Blue Mackerel North

This is another new name, and one that – at the time of writing – has yet to be claimed by any known proponents.

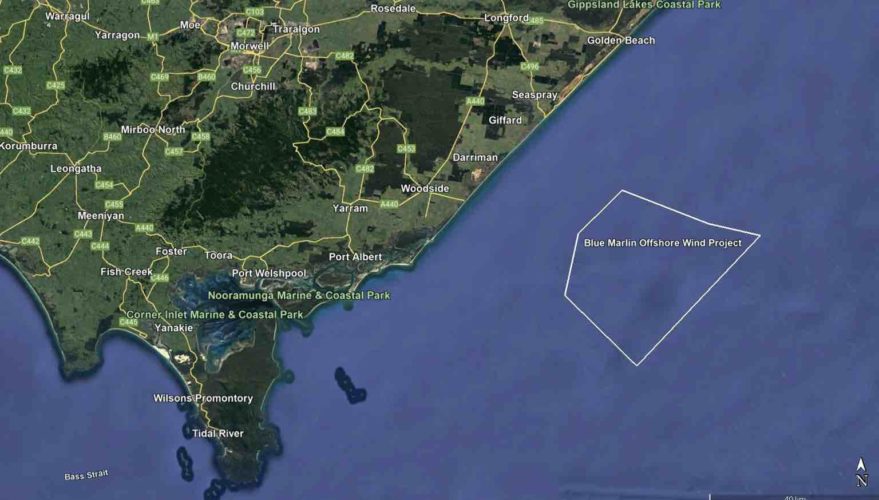

Comparing the two maps, above from DCCEEW and below, it looks to be in a similar spot to the 500MW first stage of Vena Energy’s 2GW Blue Marlin project, proposed for the Gippsland Basin off the south-east cost of Victoria, as first revealed by RenewEconomy in August 2022.

But according to a search of the Australian Securities & Investments Commission, Blue Mackerel Pty Ltd is part owned by Parkwind, a fully owned subsidiary of Jera Nex, which is the newly formed renewables outfit of Japanese coal and gas giant Jera.

Another smaller shareholder is Drillsearch Energy Ltd, which is an ASX-listed oil and gas company based in Sydney.

Iberdrola’s Aurora Green

Spanish renewables giant Iberdrola declared its interest in the Gippsland offshore wind zone back in 2022 and is now on the list of six projects expected to be awarded a feasibility licence anytime soon, following further consultation.

In a statement on Wednesday, Iberdrola Australia said the site had been under analysis for almost three years, with the proposed license area able to host up to 3GW of offshore capacity +25km offshore.

“A guiding principle behind Iberdrola Australia’s offshore license application is a commitment to sharing the benefits of the energy transition with local communities and businesses,” said CEO and chair Ross Rolfe.

“The regional communities in Gippsland have a long and proud history of providing the majority of Victoria’s electricity supplies. The Gippsland region therefore contains a large set of skilled workers, experienced small businesses and industrial innovators, all of whom will play a critical role in the development of the offshore wind industry.

“We look forward to continuing our engagement with Ministers Bowen and D’Ambrosio, the First Nations people, local communities, unions and the energy industry in Victoria,” Rolfe said.

Great Eastern Offshore Wind Farm Project

The proposed 2.5GW Great Eastern Offshore Wind farm is being developed by Corio Generation, a Macquarie Green Investment Group portfolio company dedicated to offshore wind development.

Corio said last October that it was nearing the half-way mark of the environmental survey assessment for the Great Eastern project, which is being proposed for just behind the site of the SOTS.

Kent Offshore Wind

This project, which is on the list of projects being considered for a licence, was revealed on Wednesday as belonging to German giant RWE.

In a statement, RWE said it recognises the importance of early and ongoing engagement with First Nations People, and respects their understanding and connection to Country and Culture.

“The project, close to the Kent Islands in the Bass Strait, is in Australia’s first designated offshore wind zone. If approved, the feasibility licence … would grant RWE the right to undertake environmental assessments, geotechnical surveys and obtain approvals before a commercial licence for generating electricity could be considered.

Elsewhere in Australia, RWE is working up plans to develop an up to 1000MW onshore wind farm at Campbells Bridge in Victoria’s Wimmera Region. The project would install 145 turbines on around 14,000 hectares of farmland in the Northern Grampians and Yarriambiack shires.

Gippsland Dawn

There has been no formal statement, yet, on this project, but a search of the ASIC database reveals that it is likely a project of Spanish floating offshore wind energy specialist Bluefloat Energy, with the company’s CEO Carlos Martin and Nick Sankey, the country manager for Australia, listed as officeholders of the company Gippsland Dawn Pty Ltd.

This would make sense, as Bluefloat has been proposing the bottom-fixed 2.1GW Greater Gippsland Offshore Wind Project for between 10 to 43 kilometres offshore from the Gippsland coast, between Woodside Beach and Seaspray.

The company included a socio-economic analysis by ACIL Allen with its feasibility licence application for the project, suggesting it could deliver a $35 billion injection in gross regional product, an $18.3 billion rise in household income, and “thousands” of jobs.

Navigator North

Nothing official yet, statement-wise, on this project that is also being considered for a feasibility licence, but an ASIC search reveals this is a project being developed by Australian gentailer Origin Energy and global renewables outfit RES.

The two companies revealed they had partnered up to explore Gippsland projects around this time last year, while Origin had also been dabbling in the sector with Spain’s Bluefloat.

Origin has penciled in plans to close its 2.88 GW Eraring coal generator, Australia’s biggest, in August 2025, but speculation has been increasing that NSW will agree to an extension of the plant of between three and five years.

Origin has announced a series of renewable energy project purchases, such as the 1.5 GW Yanco Delta wind farm, and new battery projects at Eraring itself and Mortlake, but none are due to be complete by August, 2025. An offshore wind farm would not help on that front, either.