It’s becoming clear that 2022 will possibly the wildest year ever for energy prices.

Most of these charts included in today’s analysis are, unfortunately, becoming all too familiar. But the thing is, there is still upwards price momentum.

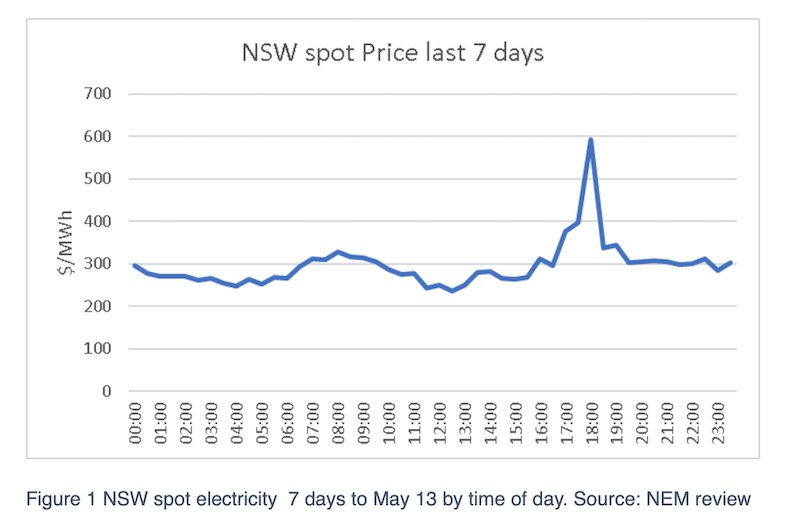

Here (in graph below) is the NSW spot price by time of day for the last seven days, and the average is an astonishing $296/MWh.

There is still a reasonable amount of solar generation during the day, but because some coal and gas and hydro is still needed, despite the solar and the wind, even middle of the day prices are higher than normal.

That’s because those fossil fuel firming products still set the price and, because coal capacity is (a) super tight, and so has no competition, and (b) the spot fuel prices are currently from another planet, even those midday prices are well over $200/MWh.

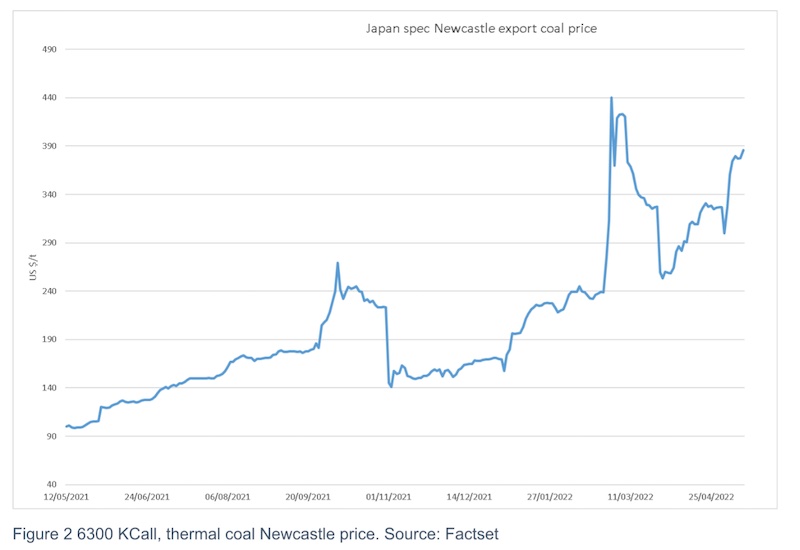

The coal price in $A is up by close to 500% in a year.

Yes, Australian generators have contracts, but there must be a terrible temptation to say to the coal miner: ‘You sell the coal and pay me most of the difference between the spot price $556 per tonne and the contract price, say, $60/t. I will keep a bit of coal for emergencies and evening peaks, but you can have the rest’.

The chart below just shows the past 12 months in US dollars. Believe me, we haven’t been here before. I don’t know what things were like in WW2 but I’d be surprised if they were much higher. We are almost in rationing space.

Not saying that is happening, but just that there is a financial incentive.

At $550/t and 0.34t per MWh you need an electricity price of $187/MWh just to cover the fuel cost. Of course, right now, you can get a lot more than $187.

But the coal price has been up at these stratospheric levels, never previously dreamed of, for ages now – say, three months. It’s old news.

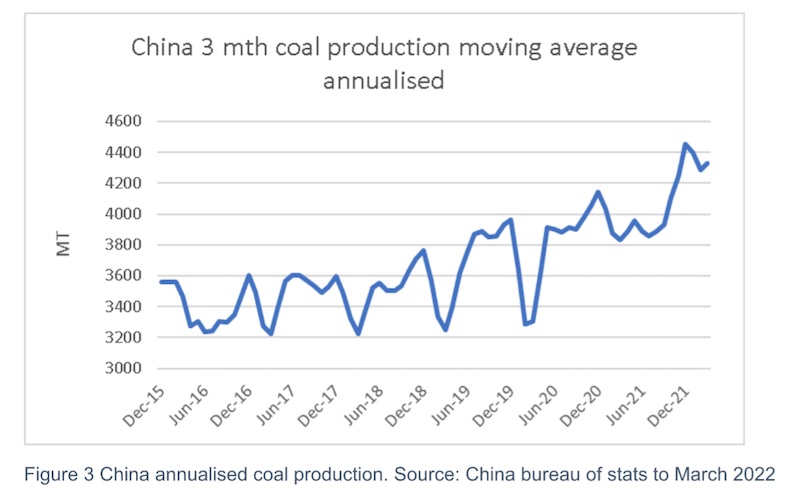

This price has occurred despite China lifting coal production by an annualised 800 mega-tonnes from 3.6 billion tonnes per year to something like 4.4 billion tonnes per year. Go China! Kill the world, kill yourselves.

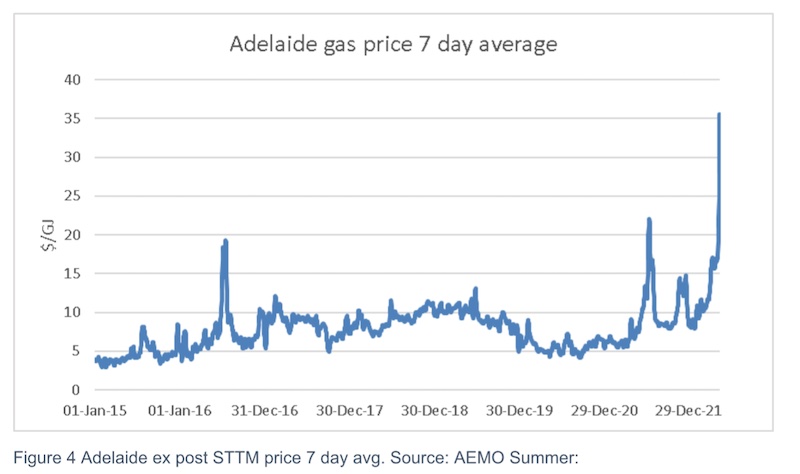

The new news is the gas price, where in the short-term market the price in Adelaide last week hit a jaw dropping $A48 per gigajoule and was over $30/GJ in Sydney and Brisbane. Burning gas in an open cycle generator at $48/GJ requires maybe a $500/MWh electricity price.

Whether spot gas prices in Australia are justified depends on where you look internationally. Ultimately gas is a lot less “fungible” – that is, tradeable – internationally than oil or coal due to limits on LNG liquefaction capacity. So in the USA the Henry Hub price is about US$8/GJ.

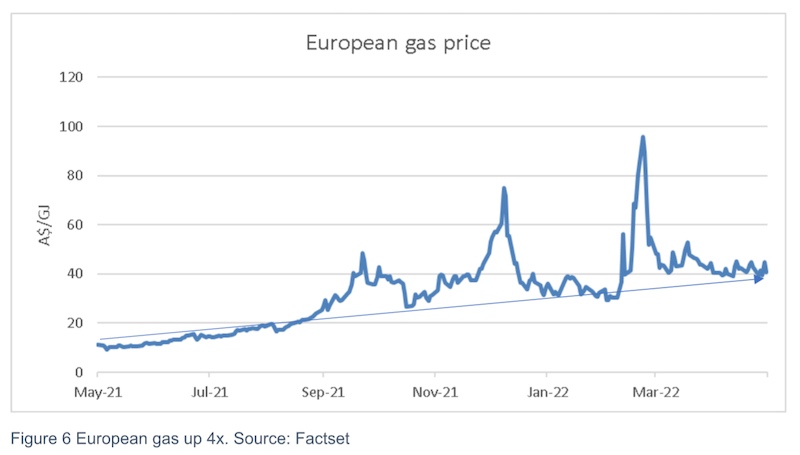

But the price in Europe is about $A44/GJ. Of course that’s a long way down from the $A100/GJ that so far represents the peak.

And this is not the end of the short-term problems. In Queensland and possibly NSW, coal supply is physically disrupted by wet weather. Queensland has more open cut mines, i.e. big open pits, than NSW and so is more vulnerable to rain.

As we previously noted some gas units (Swanbank E) sold their gas for LNG. Diesel prices are also high, although still within historic ranges, making road transport expensive.

Eleven coal units produced zero last week

And then, of course, there are the generator outages. About 6,200MW of coal capacity was out last week, about 30% of black coal capacity and 12% of brown coal. In addition, one unit of Vales Point was at half mast.

This is obviously absurd. It is indeed natural that there is some scepticism. On the other hand it’s also true that generators will have contracted some of the production currently suffering forced outage and will have to buy at very high prices to cover.

AGL shareholders do you own a crock?

Of the power stations that didn’t produce last week, AGL owned 2.4GW (two units at Bayswater, one at Liddell and one at Loy Yang A). The Loy Yang A outage will cost profits about $70 million.

If I was an AGL shareholder thinking about the demerger you’d have to ask yourself if Accel isn’t a complete crock. It struggles to produce in May 2022, yet management wants to tell shareholders it will still be doing fine in 2040.

Believe that and I have a pot of gold at the end of the rainbow I’d like to show you. So what if Grok Ventures and Mike Cannon-Brookes close them down early? They don’t work anyway. And at least you’d get management with a clear vision and a fresh plan.

Of course, if you are an existing solar or wind generator, this is fantastic news. Six months ago solar developers were facing ruin, spot prices were negative or close to it, valuations were down and the banks wanted more equity.

Right now, spot prices for solar farms are over $150/MWh, plus you are getting maybe $45 for a Renewable Energy Certificate. Happy days!

What does this mean for consumers?

Broadly speaking, most of the time maybe 40% of the electricity price that households pay for grid electricity comes from wholesale prices. (Incidentally, I have to wonder why WA wouldn’t release its figures).

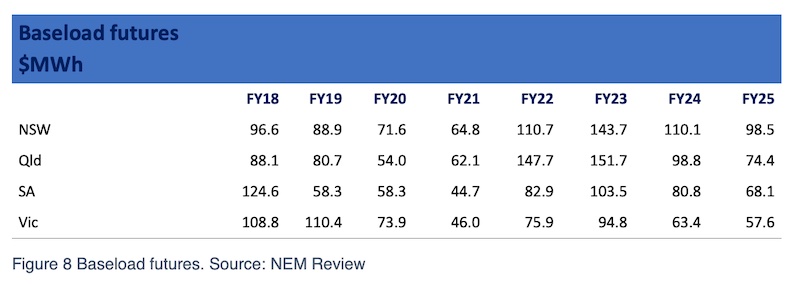

You can see that back in 2020, wholesale costs were about $100/MWh. This wasn’t just the baseload cost but included about another 30% on top of that for hedging.

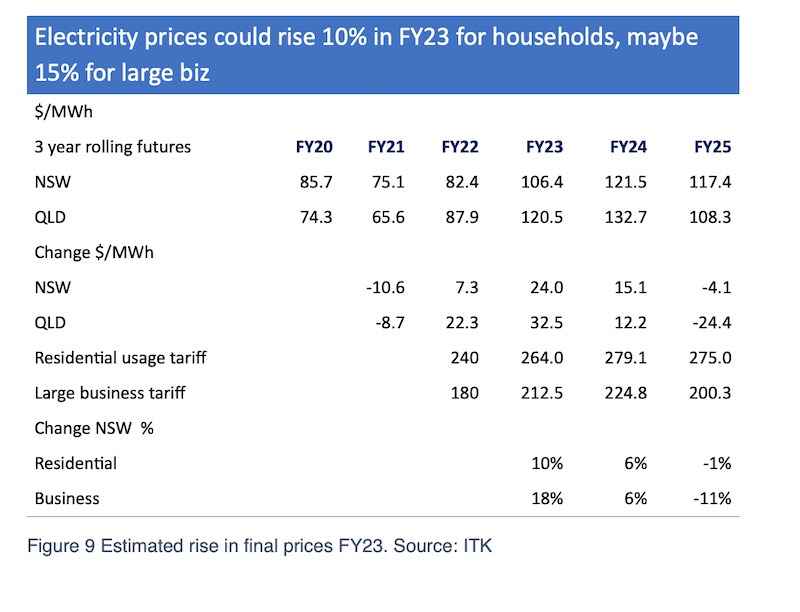

On the other hand, the large retailers will all have hedging. As I’ve discussed lots of times on these pages, a rule of thumb for a big gen-tailer is that about 25%-30% of the book is repriced each year, so that changes in wholesale prices work their way through slowly.

Baseload electricity futures history and quotes are:

If we assume a retailer’s hedge book is built around a three-year rolling average, and if we just focus on NSW and QLD, then we estimate maybe a 10% change in bills for NSW residential and maybe more than 15% for large business customers that need to cut a new deal.

This too will pass – eventually

This too will pass – eventually

In ITK’s view, what we are seeing is truly the wounded bull scenario Paul Simshauser outlined back in 2009 – although not related to a carbon price, per se.

The coal generators are wounded, they are dead on their feet, but because we can’t build new capacity fast enough the consequences are consumer costs and profits for wind and solar operators.

The coal generators really don’t care that much about the long-term impact of high prices. For sure it will encourage energy efficiency and substitution but coal generation is doomed.

Even in Queensland, the last holdout in Australia of “coal generation has a future,” management at the generation companies – even if not the Electrical Trades Union or the state government – understands that coal generation is going away.

So why not let prices go? And in any event, what really could they do about it?

The gas price and the coal price are real. So the only answer, as it is for Europe as it extricates itself from the Russian energy embrace, is to grin and bear it and get on with building new supply.

Prices could certainly go higher. When the market gets a tear like this and fear and greed take over, then an overshoot is entirely possible.

And there are still fundamental upwards drivers: even for coal, because of Russia and in spite of China’s increase; and for gas the threat of Russian gas being cut off from Europe is real. If that happens gas prices will go higher.

Yet, at the same time, some of the coal units will start to work again and gradually new capacity will start to be built. Very gradually, at the current Australian pace.

Goldwind has 500MW of wind farms that might as well be peeing into the wind for all the use they are right now. This is a black mark on all concerned and gets to the fundamental disorganisation of the NEM. Why on earth is AEMO responsible for transmission in Victoria?