Australia is close to achieving its 82 per cent renewables by 2030 target thanks to an investment boom kicked off by the new federal government, but it still has work to do, the Clean Energy Regulator says.

The country added 7.1 gigawatts (GW) of large and small scale renewables in 2022, a figure it must meet every year until 2030 to hit that policy aim.

“Over the last five years, Australia has added an average of nearly 6 GW of new renewable energy capacity per annum and increased the share of renewable generation by 4 percentage points annually,” the CER said.

“To achieve 82 per cent renewables by 2030… If current electricity demand stayed the same to the end of the decade, renewable generation share must increase by 6 percentage points each year and annual added capacity must increase to at least 7 GW on a sustained basis.”

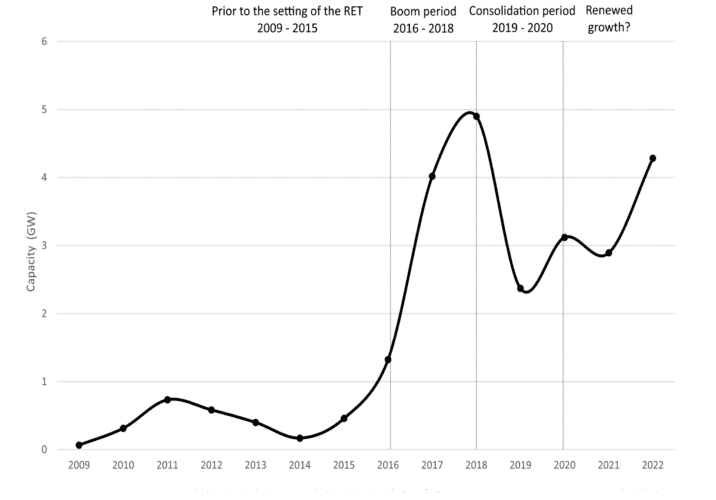

That 7.1 GW figure was made up of 4.3 GW of large-scale wind and solar reaching the final investment decision stage (FID), almost half of which came just in the last three months of the year, and 2.8 GW of small-scale installations.

The figures to watch are the proportion of renewables in the National Electricity Market (NEM), however, and this is still well off that 82 per cent.

In 2022, renewables made up 35 per cent of total NEM generation which itself was up 4 per cent on the year before. But, that figure was bolstered by November and December which saw renewables generation hitting 42 per cent of the NEW.

The CER thinks that figure could hit 40 per cent this year.

The number of projects meeting FID may improve again in 2023 — with the right push signals.

Energy analyst Rystad says there could be more than 12 GW of large scale wind and solar projects with development approval reaching FID in 2023, and there are another 15 GW further back in the pipeline.

In the land of rooftop solar, high energy prices combined with payback periods that are closing in on just three years could lead to rising installations.

The CER says the rooftop industry has form in handling rapid ramp ups in demand — during the worst of COVID-19 in 2020-21 it installed 6 GW of rooftop.

The environment is looking good for a boom

The CER says many of the key pieces are in place to support the needed renewables investment to reach that 82 per cent target — a policy in itself set the scene for a new boom time.

Supporting this goal are federal promises to invest in electricity network upgrades and storage with Powering Australia and some $25 billion allocated to clean energy spending in the last budget.

State and territory governments targets are having their own effect, as Victoria aims for 65 per cent renewables by 2030, and 95 per cent by 2035, and Queensland wants 70 per cent by 2032, and 80 per cent by 2035.

New South Wales (NSW) says it will reduce emissions by 70 per cent below 2005 levels by 2035, paving the way for a quicker transition to renewable energy, but is assuming most if not all of its coal plants close within a decade, and Western Australia is asking government agencies to cut emissions by 80 per cent by 2030.

The federal government’s Safeguard Mechanism reforms are expected to encourage heavy polluters to switch fuels, and support for a local green hydrogen industry with a $525 million investment in developing hydrogen hubs is likely to attract complementary investment in renewables, the CER says.

In order to connect the surfeit of new renewables to a grid designed for a hub-and spoke model of energy generation, the Australian Energy Market Operator (AEMO) is trying to work out how to make grid connection processes easier and faster.

By its own calculations, AEMO needs to connect at least 5 GW of large-scale renewable generation and storage capacity each year from 2022 to 2030 just to mitigate the impact of closing coal plants — some of which are radically bringing forward their shut down dates, such as Loy Yang A by 10 years to 2035.

Price signals pointing to more wind, solar

In terms of price signals, the continuing high cost of wholesale energy, created by surging prices for fossil fuels in 2022 due to the war in Ukraine, is making the investment case for renewables extremely favourable.

“LGC (Large-scale Generation Certificates) spot prices averaged $54 in 2022, 46 per cent above 2021 prices,” the CER said.

“While wholesale electricity prices have decreased from the extremes observed in mid-2022, prices are still relatively high, with Q4 2022 prices averaging 55% higher than Q4 2021. The combined wholesale electricity and LGC prices send a clear signal that more generation capacity is required.”

And finally, with CSIRO’s 2022-23 GenCost draft report suggesting the levelised cost of energy of solar is $59 per MWh and wind is $71 per MWh, both are now some of the cheapest forms of new energy.