The Australia Energy Market Operator is warning again of potential future gas supply shortages in southern Australia, as it manages the tricky balancing act of juggling a technology that it says will play a diminished yet important role in the country’s switch to renewable energy.

In its latest Gas Statement of Opportunities – the annual what-do-we-need-and-when-do-we-need-it summary of gas supply and demand – AEMO recognises that gas demand is falling, due to a combination of the big switch to wind and solar, and electrification in the home and industry.

The main problem it faces in the grid is that while the amount of gas generation will inevitably fall in the face of increased wind, solar and storage – despite the exit and decrepitude of the remaining coal generators – it will be badly needed at certain times.

And, because nearly all of Australia’s gas production is focused on export markets, consumers in Australia – including home and industrial consumers, and gas generators – may struggle to get enough gas at certain times.

“Gas for generation of electricity is forecast to provide a key firming role as the NEM electricity supply adapts to reduced availability and installation of coal generation,” AEMO notes.

“It is likely, as demonstrated in AEMO’s scenario collection, that annual gas generation volumes will decline as renewable energy penetration grows, but maximum daily demands will continue to be high.”

In summer, when wind and solar output is strongest, the reduction in gas generation will be significant. But in winter, gas generation will play an increasingly important role, particularly as demand is increased by households dumping gas appliances and using electric power to stay warm.

“While gas volumes may decline, the key role for gas generation will be to provide flexible and firm electricity supply, albeit less frequently than operations occurred historically, but with greater importance to maintain NEM reliability,” AEMO notes.

This means that so-called “mid merit” and “baseload” gas will have little role to play in a grid increasingly dominated by wind, solar and storage, but big amounts of capacity will be needed at certain times.

Many big utilities have already worked this out, which is why they are building some “fast’ start” gas generators that may only be used for 100 hours a year, and they are closing less flexible gas plants designed to run for longer periods.

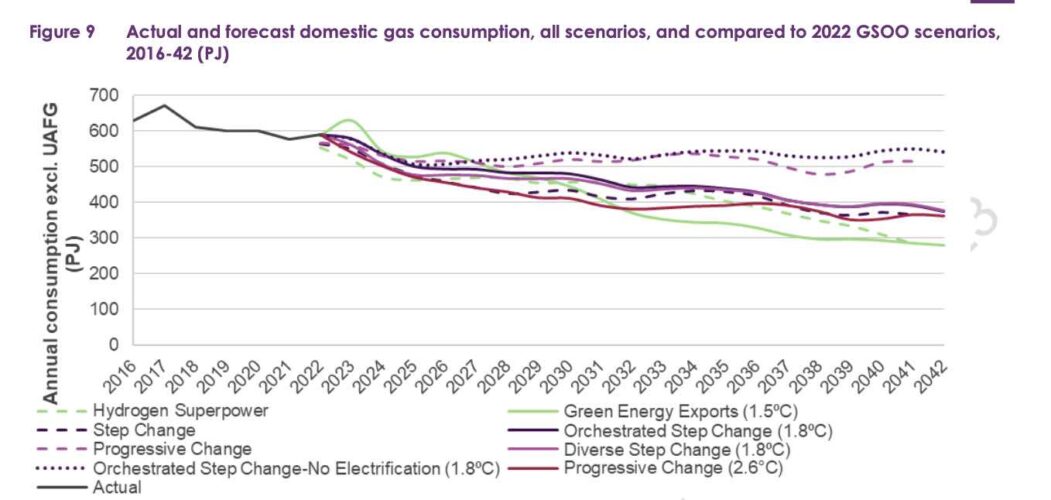

The decline in domestic gas demand is illustrated in this chart above. The anticipated decline is greater this year (unbroken lines) than last year (broken lines).

The number of gas connections to homes and businesses is expected to fall from around 4.9 million to 1.9 million, as most people go electric. And those still connected will use less. So much for a “gas led recovery.

“And under the “Green energy exports” scenario, which is what the federal government and many industries are pushing for because of the opportunities for Australia as a green energy superpower, and because it is the only one consistent with 1.5°C, gas demand falls by more than half over 20 years.

Of course, the Australian gas supply situation is complicated by the fact that nearly all the gas the industry produces is marked for export as LNG. That demand is forecast to fall too, but not by nearly as much.

And amid all this, AEMO still questions where the gas will come to meet the domestic demand, particularly in very cold weather in the middle of winter when heating demand is at its greatest.

“The risk of gas shortfalls each year from winter 2023 to 2026 in all southern jurisdictions remains under extreme weather conditions and periods of high gas-powered electricity generation, with those risks further exacerbated if gas storage levels are insufficient,” AEMO CEO Daniel Westerman said in a statement.

Westerman said the southern states are most exposed, due to a combination of colder weather, limitations on pipeline capacity from the north, and the decline of production in the Gippsland region in Victoria.

He says a forecast 16% reduction in production capacity this winter compared to 2022 in Victoria, would be mitigated by committed upgrades to key pipelines transport gas from the north, and other infrastructure.

“To minimise shortfall risks, committed infrastructure and supply projects must be completed on time, while demand-side solutions, additional gas storage and pipeline development, and liquified natural gas (LNG) import terminals could potentially play a role,” Westerman said.

“Investments are needed in the near term to ensure operational solutions from 2027, despite falling gas consumption.”

The report has not gone down well with gas industry critics, who say the report – based on information from gas industry participants – is designed to give legitimacy to an industry with decreasing relevance in Australia’s low carbon future.

“As Australian gas exports and profits surge the gas industry is again scaring us into believing there is a gas shortage,” said Polly Hemming, climate & energy program director at the Australia Institute. “The GSOO is informed by the gas industry. Of course, the take-home message of the report is ‘we need more gas’.

“Short and medium-term gas supply issues are the result of Australia being held to ransom by the gas industry. Australians will continue to be faced with skyrocketing prices across the board until this is addressed.”

Federal energy minister Chris Bowen says the gas production on the east coast of Australia increased 300 per cent between 2014 and 2021, and AEMO had been warning for years of the need for reforms to ensure that domestic customers did not miss out and pay more than needed for their gas.

He said the previous government did nothing, but Labor is now taking a number of steps to ensure that Australian users can access Australian gas at a reasonable price, while honouring contracts with international partners. This includes the introduction of a mandatory gas code of conduct.