Plug Power, one of the world’s leading producers of hydrogen electrolyser technology, says the new climate bill passed by the US Senate, and its proposed tax credit for green hydrogen, will deliver a “monumental” boost to the industry, and allow it to beat the cost of incumbent fossil fuel technologies.

Plug Power CEO Andy Marsh says the newly announced Clean Hydrogen Production Tax Credit (PTC) of $3/kg for green hydrogen will enable it to match and beat grey hydrogen in just about every application, and will be as significant to the hydrogen industry as the tax credits that underpinned the wind and solar industries.

“This bill provides a trifecta,” Marsh told analysts in a conference call after the release of the company’s results on Tuesday (New York time).

“It’s good for climate, it’s good for jobs. It’s good for national security. Our electrolyser business has already benefited from the push in Europe to become energy independent from corrupt regimes.

“We are seeing the benefits as our orders already have exceeded by 50% our projection for the year with most of that coming from Europe. Now the momentum will grow rapidly here in the states.”

Marsh cited last week’s deal with New Fortress Energy in the US, which will start off with a 120MW electrolyser order, with the potential now to grow to 500MW. It has also completed a trial for a stationary 3MW electrolyser product with Microsoft.

“We expect a boon for electrolyzer and green hydrogen business,” Marsh said. “All applications that use grey hydrogen today, such as fertiliser manufacturing, will now be able to buy green hydrogen at a competitive price.”

This included grey hydrogen applications such as steel and concrete and gas heating.

“Everyone wants greenhouse hydrogen. We believe that the first big markets for green hydrogen will be these industrial applications where it’s simpler to substitute green hydrogen for other feedstocks,” he said.

“A cost effective green hydrogen will also help us to expand our application business more rapidly as hydrogen becomes more plentiful and cost effective.”

Marsh said he expected the biggest markets for green hydrogen to be the US – thanks to the tax credit – and Europe, thanks to rush to find alternatives to Russian gas. He pointed to Danish plans to build 30GW of offshore wind to fuel a green hydrogen industry.

But there was no mention of Australia, or of Plug Power’s previously highlighted dealings with Andrew Forrest’s Fortescue Future Industries, which is building a 2GW electrolyser factory in Queensland, ostensibly to build electrolysers using Plug Power technology, at least initially.

A spokesperson for FFI told RenewEconomy the company is progressing development work on “multiple electrolysis technologies” to satisfy the demand for electrolysers.

“Plug Power continues to be a collaborative partner and we are refining the commercial nature of our relationship as we grow and build capacity within FFI,” he said.

“The rapidly evolving electrolyser supply chain remains critical to future production and is driving much of the commercial considerations on technology selection and future proofing. We remain on track to produce Australian made electrolysers from our Gladstone facility in 2023.”

Plug Power’s assessment of the impact of the tax credit is consistent with others. The publication Recharge, for instance, quotes Platts as saying that the cheapest cost of production for grey hydrogen in the world today comes in at a monthly average price of $1.71/kg in the US Midwest.

Platts put the cost of green hydrogen in the US Northwest at $3.73/kg. If $3/kg is subtracted via the tax credit, that puts renewable hydrogen at just $0.73/kg to produce. The only way grey hydrogen can now match that is if gas is priced at zero. Which of course it is not. Far from it.

The Recharge article, titled “Why the US climate bill may be the single most important moment in the history of green hydrogen” echoed Marsh’s comments that demand for green hydrogen from the steel and cement industries are likely to grow quickly.

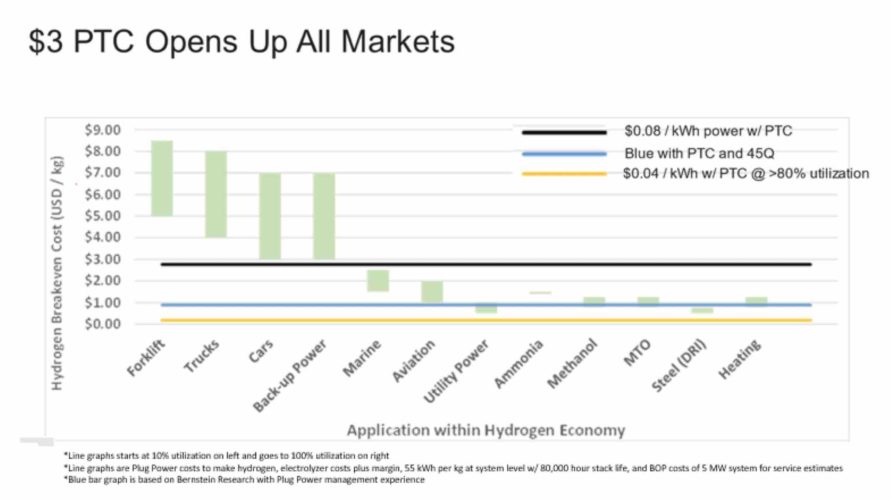

Plug Power used this graph to illustrate where green hydrogen will be immediately competitive in the US.

Plug Power notes that the refining and ammonia industries consume almost 20,000 tonnes of hydrogen per day.

“This policy backdrop has created substantial potential opportunity for on-site electrolyzers in these applications. For illustrative purposes, 20% penetration of these markets represents incremental electrolyzer demand of 10GW, just in the United States.”

The FFI spokesperson agreed the tax credit was a significant event.

“This is an historic moment that is about creating and saving jobs for Americans and reducing emissions.

“The passing of this Act will mean that coal jobs can be saved and new jobs be created in green energy – all kinds of jobs, from apprenticeships to converting career coal workers to green industrialists.

At Fortescue we are focused on eliminating emissions and creating a new green industrial industry, and are willing to work with countries that make the viable and possible to achieve.”

Something for Australian policy makers to think about if they are keen on the idea of making the country a “hydrogen superpower”.