Its easy when you know how.

This note makes 2 points.

The Queensland Government owns 34 per cent of the NEM coal generation capacity, but says “there is nothing to see here”. And there isn’t. A big fat zero.

The Queensland Government owns around 5.2GW or 34% of NEM coal fired generation capacity, if we exclude the soon to be closed Liddell, Eraring, Yallourn and Gladstone.

Of those only Gladstone is not officially confirmed as closing early, even though everyone knows it’s going to.

Loy Yang B’s fate is tied to that of Loy Yang A (because it gets its coal from LYA), Mt Piper never seems to be able to get coal and most of us expect Vales Point to be gone within 5 years, assuming it doesn’t get some knuckle-headed capacity payment.

So basically, the Queensland Government is the only coal generator owner in the country yet to say anything about the future of its generation. Even allowing for the fact its generation units are bit younger, this is surely not good enough.

In fact, the only thing we do know about Queensland and its attitude to coal generation is that it is rebuilding Callide C (of which it owns 50%) that exploded last year.

The more you think about this proposal, the more unreasonable it is. The Queensland Government says it has a 50% renewable target, it says it’s committed to decarbonisation and yet it’s building a new coal generator. That’s about on a par with how China is approaching decarbonisation.

The absolute radio silence on the issue from the Queensland Government is, in my view, a poor approach to public policy. It’s as though public ownership is a reason for the public to be ignored.

Shareholders in any public company wouldn’t put up with the Queensland government’s “f*** you” attitude to its stakeholders, they’d sell their shares or insist on plans to decarbonise being released.

Indeed there is a whole institutional disclosure regime for private sector companies, but because the generators in QLD are publicly owned, dsclosure standards go straight out the window to be hidden behind the Government’s bamboo curtain.

Along these lines I’ll be interested to see what the QLD Govt says about coal generation’s participation in any capacity mechanism. Given the track record to date you don’t need to be Nostradamus to see which way the wind blows.

Meantime, the state government tries to buy itself time by having one of its generators announce a new wind solar or battery project at a regular interval. See: Biggest battery unveiled in Queensland as part of post Callide battery blitz

Increasing and extending the RET target would be a no regrets way to get the gentailers to do their share of new capacity investment

The ISP calls for 23 more GW of utility wind and solar to be operating by 2030 compared to 2024 levels. A lot of things have to be done to make that happen particularly having REZs, transmission and AEMO being able to manage the connections.

And a clear schedule of coal generation closure dates would let informed planning by the private sector proceed more confidently

But another thing that has to be done is to get the big gentailers to participate.

In my opinion one way and perhaps the easiest way to do this, one that could be pushed through Parliament in a heart beat is to increase the 2030 LRET target, from 33TWh to say 80TWh.

The ISP models around 120TWh of utility wind and solar production by 2030 but adjustments have to be made for excluded consumers, voluntary surrender etc.

Extend SREC to storage and introduce dispatchable RET

In addition, a dispatchable REC target could be introduced. Network companies might like this because it would let them put in place community batteries without having to get an increase in regulated revenue. I guess this is analogous to the retailer reliability option except its explicitly based around storage.

And in order to help the ISP cost model which actually shows the vast majority of dipatchible capacity in the NEM coming from distributed (behind the meter) resources the small scale SREC scheme could be extended to include storage, ie household batteries.

The costs of the RET are borne by consumers, but if the ISP modelling is on the right track, and it surely is, then in the medium term those costs should be low since renewable energy is the low cost way to provide electricity.

Even the gentailers will find that being forced to do their bit will actually work to their advantage instead of the situation we have now where companies like Origin are essentially saying to the NSW Govt “OK, you win, we will close Eraring but do nothing to help”.

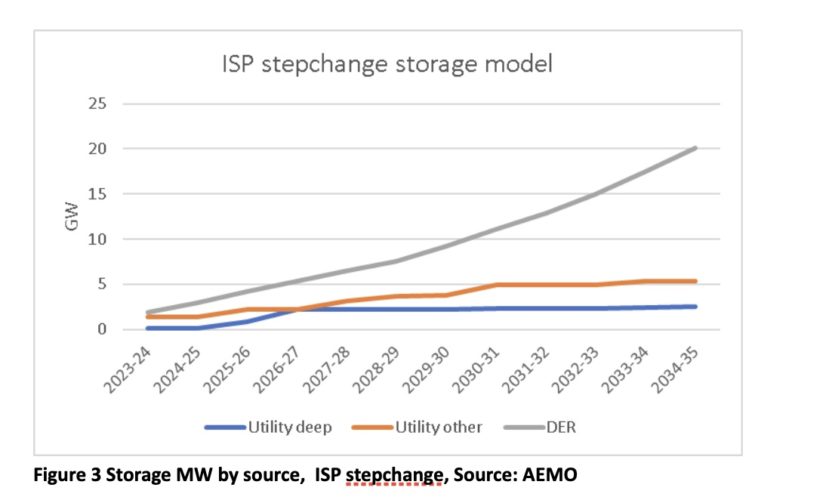

Regarding dispatchable capacity as modelled in the ISP the picture to 2035 is:

You can see the role envisaged for household batteries, something a gentailer should be able to profit from if done right.

But at the moment those batteries won’t be taken up by households as the cost isn’t coming down and there is no policy support.

And in my opinion is the contribution of distributed storage that should be the main focus of the capacity market debtate and the associated ISP modelling.

Let’s assume all that DER storage is coming from Tesla Powerwalls. the product with the largest market share in the NEM today. Powerwalls have a power capacity of 5kW

That implies something liked 370k cumulative installations by June 2024 and 4 million by June 2035.

Alternatively, and perhaps more realistically, it requires lots of EVs with vehicle-to-grid capability, and being used. But where is the EV policy in any shape or form let alone the vehicle to the grid policy?

Such a policy could easily be introduced though by allowing storage to qualify for SRECs. If EVs were to get SRECs there would have to be a way of ensuring they were connected, probably that would require some software.

And, guess what! Australians are extremely good at providing – energy related software. World class.

The only policy support for utility storage is really the NSW government’s 2GW proposal, albeit not that much more is needed across the NEM particularly on the assumption Basslink is built.

Additionally, rather than reducing the SREC support as is currently legislated it needs to be extended.

The ISP models 35GW of behind the meter capacity by 2030 essentially something like a doubling of 2022 levels. That capacity has to be installed into an increasingly saturated market and is likely to require more and not less policy support.

It is, though, in everyone’s interest to provide that bit of policy support because it means consumers directly pay for the renewable electricity that they end up consuming and reduces the investment load on the Gentailers.

A capacity market provides insurance, and is arguably the lowest priority.

So for all these reasons I don’t think the focus should be on a capacity market. The reason a capacity market has political support is that it’s a cop out. It doesn’t really require politicians to do anything. And it probably will make the Queensland government happy because its coal generators can live happily ever after.