The switch to five minute settlements that was introduce in the final quarter of 2021 has already delivered dividends – albeit small at this stage – to the operators of some big batteries in Australia’s main grid.

The switch to 5MS was pushed for by big industrial users who were sick of what they saw as the gaming of the previous arrangements, a 30 minute settlement period, which often saw thermal generators flood the market after a what were often seen as artificially high price spikes early in the period.

It was fought tooth and nail by the owners of the fossil fuel generators, who feared losing a main revenue source, but was also seen as essential to encourage, and properly reward fast moving and flexible technologies such as battery storage, and demand response. And this has already been the case.

As RenewEconomy reported just over a week ago, the switch to 5MS has seen some big changes in bidding patterns: Thermal generators no longer bid to the market floor (minus $1,000/MWh) in the hope of cashing in on a price spike, and many wind and solar farms have also altered their bidding strategies.

One of the early winners, however, has been the handful of big batteries that operate in the main grid.

The Australian Energy Market Operator noted in its Quarterly Energy Dynamics report, a review of trading over the previous three months, that South Australian batteries – which include Hornsdale, Lake Bonney and Dalrymple – benefitted from their ability to respond quickly to price spikes under 5MS this quarter.

AEMO said net revenue rose by around $0.4 million more than what would have been received under 30-minute settlement, assuming the same five-minute price and dispatch outcome. That doesn’t sound like much, but the reality is that there are not that many batteries around.

It also noted that the new Victorian Big Battery, which only opened for business in late November, captured $400,000 in energy revenue in the few weeks before it had to give most of its capacity (250MW out of 300MW) over to AEMO under a contract to support bigger transfers on the main transmission link between Victoria and NSW.

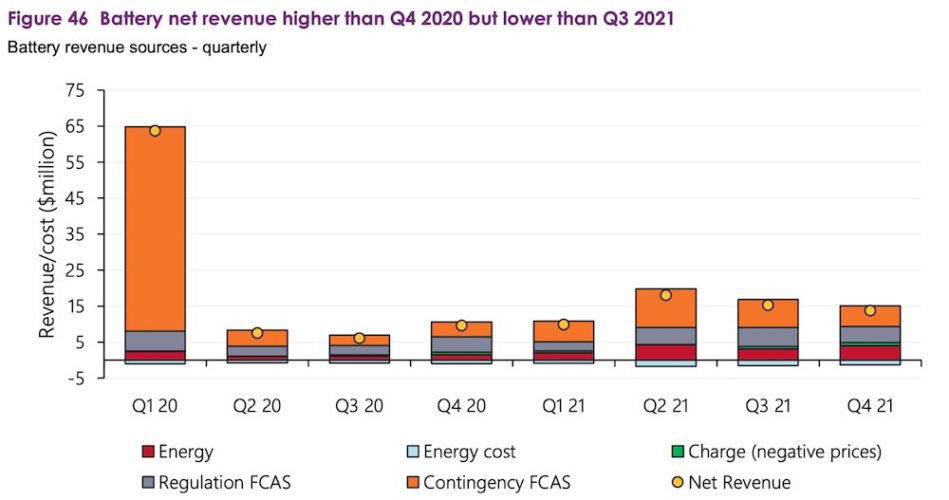

Marija Petkovic, from analyst firm Energy Synapse, says the five batteries that were operational in the last quarters of calendar 2020 and 2021 enjoyed a 26 per cent increase in total market revenue, most of which (80 per cent) from arbitraging the energy market (see attached battery market revenue chart).

“Batteries have the biggest opportunity to earn high arbitrage revenues when there is a large spread in wholesale energy prices,” Petkovic says.

“This allows the battery to charge at low prices and discharge at much higher prices. For example, the spread between the 10th and 90th percentile of pricing in the South Australian market was between 30% and 80% higher during Q4 2021 compared with Q4 2020 (see chart).

“Spreads tends to increase as the uptake of wind and solar grows. Spreads in pricing also significantly increase during extreme market events, such as when South Australia separated from the rest of the NEM for more than two weeks in Q1 2020.

“The change to 5-minute settlement is making it easier for batteries to capitalise on these arbitrage opportunities.”

That points to new batteries in the pipeline broadening their horizons beyond system services (which typically only need short duration of storate), to the energy arbitrage market, which encourages longer storage.

Some of that is already evident in the number of batteries being built and proposed that have at least two hours storage, and others that envisage at least four hours storage as the market develops.