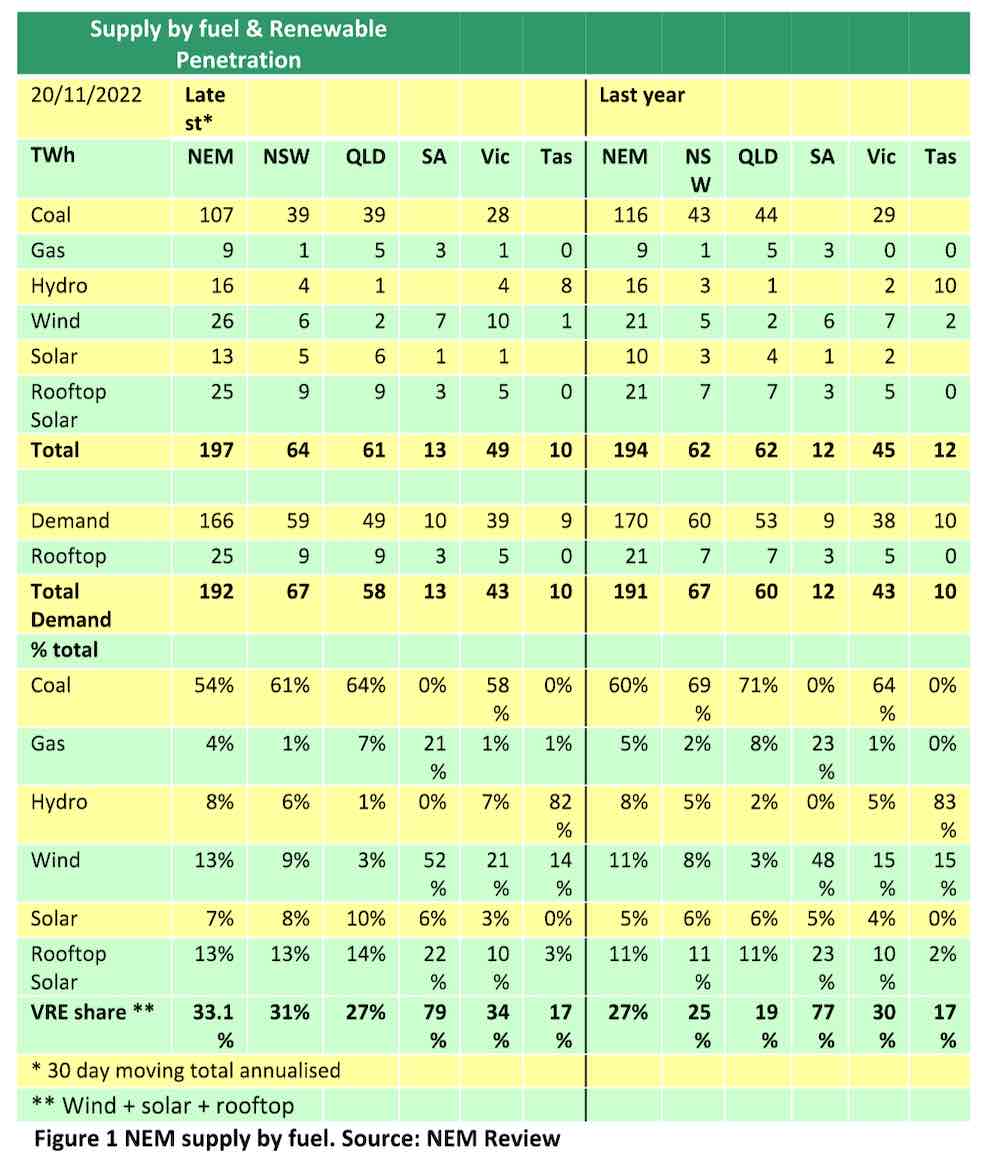

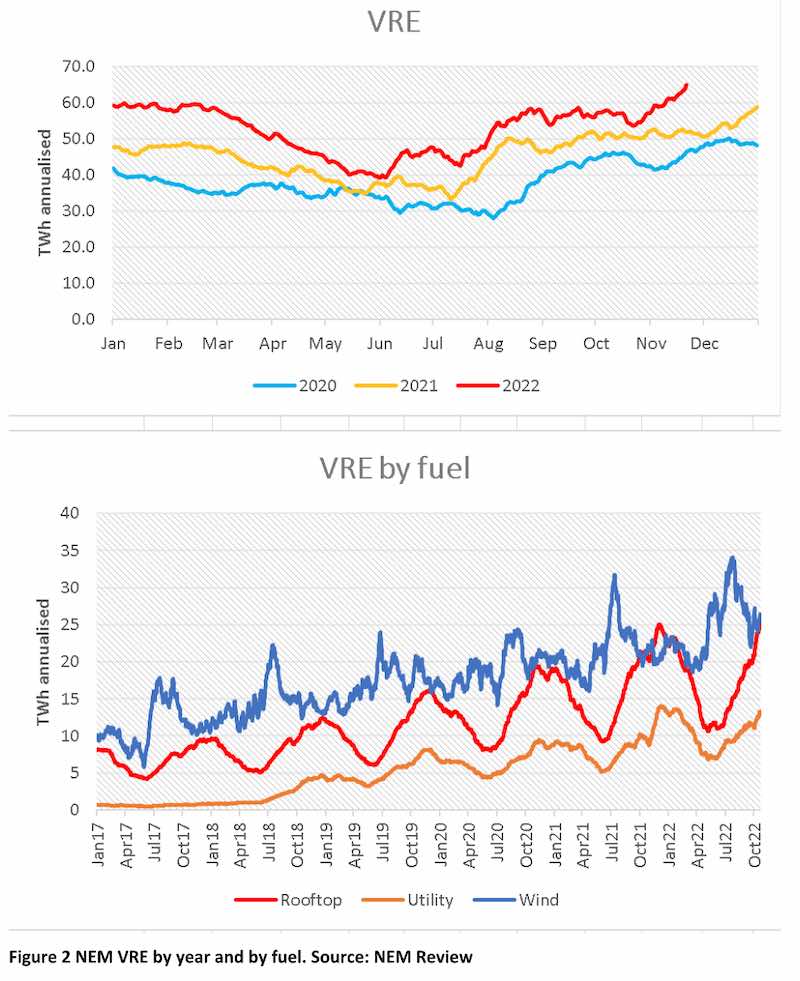

Over the last thirty days, variable renewable energy (VRE) accounted for one third of all electricity production across the National Electricity Market (NEM).

And more importantly VRE (wind and solar only) accounted for 25% of production over the full year. Including hydro, renewables were 41 per cent of the NEM in the last 30 days, and 35 per cent over the full year.

As the above table shows, coal’s share is down to 54 per cent and was 60 per cent for the full trailing 12 months.

Annual solar output is not yet at a peak, but is getting close and it makes me smile to see that rooftop solar – at 13 per cent of NEM wide supply over the past 30 days – exceeds hydro and gas. Indeed it will probably be close to double gas in another year.

Rooftop solar is 9% of total supply over the past 365 days. I don’t have the Californian data to hand but I doubt if there are many global grids in the scale of 200TWh or larger where that is the case.

The inevitable converse is that demand for utility supplied generation has fallen away sharply and total demand will have to grow quickly in future years if this is to change.

But prices are still high.

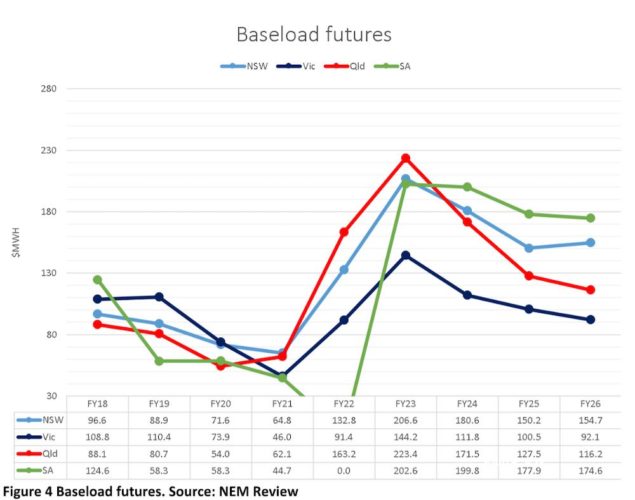

Futures prices are still strongly signalling an incentive for new investment. The FY26 data is arguably still “notional” as the quotes have only been available.

The election of a pro-renewables Board majority at AGL is yet to feed through into market prices, as measured by futures. That’s because anything that happens to LYA certainly wont happen for a few years and beyond the futures curve.

What does surprise me looking at the futures is the high “forecast” in South Australia. This probably reflects the gas price and its importance in setting prices in Winter.

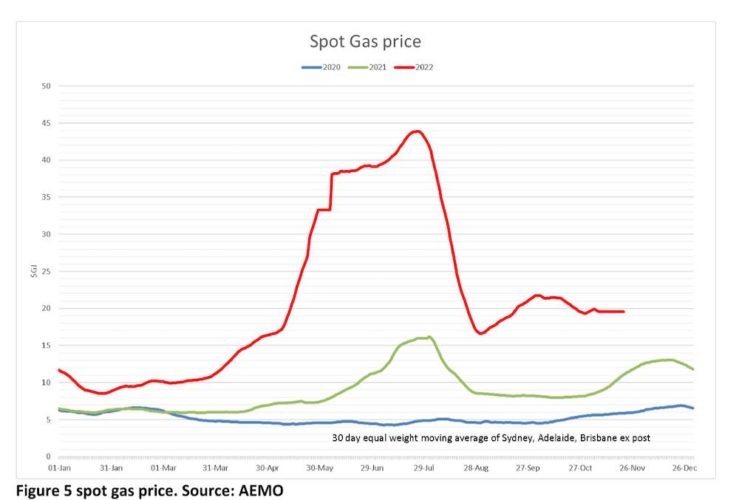

Speaking of gas, the short term trading market price has “settled” down to around A$20/GJ and gas suppliers will be conscious of “over pricing” whatever that is.

Personally I see high gas prices domestically as a price paid by Australian consumers as a result of the war in Ukraine. I don’t favour domestic reservation for a variety of reasons.

In my view, high gas prices – like the high price of any other commodity – will encourage new investment, substitution and lower consumption. Two of those – i.e. substitution of gas with pumped hydro or batteries in electricity markets and the electrification of heat process in industry – are exactly what we need along with lower consumption.

However, as usual my views are not shared by everyone or in this case maybe not even by a majority.

I depart from just running through NEM numbers to point out that over the past decade at the margin, gas has been the largest contributor by far, to the annual growth in fossil fuel emissions globally.

So gas is “only” 20% of global emissions, but coal and oil consumption have been relatively quiescent for a decade but gas has retained its tumescence. Coal may see a mini revival as China, India and Vietnam at a minimum seem determined to press on with new coal plants no matter what.

Nevertheless, we analysts “surf the margins” and there at the curl it’s gas that’s making the growth.

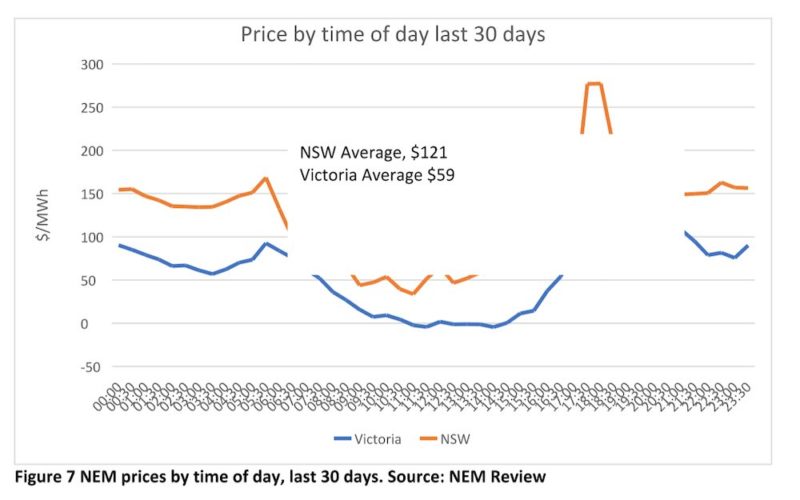

Back to price. There just isn’t enough supply in NSW – not at any time of day.

You can see (imported) coal is still setting the price in NSW in the middle of the day due to not enough wind or solar.