It’s been a big year for the energy transition, but it’s ending on a good note, with the newly released draft 2024 Integrated System Plan, the expanded Capacity Investment Scheme, and steady if slow progress from the global climate talks at COP 28.

It’s not just coal, but gas which gets hammered in this year’s ISP modelling. Readers should remember it is just modelling. As a modeller of various sorts for most of my life I caution against using models for anything except improving your thought process or marketing.

But in this case the modelling holds out the hope of lower electricity prices in the near term, if only we can build a few more big wind farms.

Acknowledgement of country is an important thing, but my acknowledgment is to future generations and a reminder that the world’s biggest battery – the oceans – are being charged at 20 times the energy content of all the world’s coal, oil and gas, produced each year.

For investors, corporates and stakeholderes uncertain about the direction of policy, science is the North Star.

So long as we keep adding heat to the ocean and air, then policy towards decarbonisation will get stronger. It must. And it will likely happen faster than consensus expects. The scale of what we are doing dominates all other considerations.

Meanwhile, back in the energy jungle, or at least in Australia, the following is extracted from a longer piece and looks at both the CIS and the 2024 ISP.

CIS impact summary of expectations

- The CIS is likely to be successful in procuring substantial new supply but wont be enough to meet the ISP 2030 “target” or to get the NEM to 82% renewable.

- The CIS is likely to lower prices in the first instance, but….

- The CIS induced new supply will bring forward coal generation closures and those closures will lift prices. Therefore:

- The outlook for prices remains “bouncy”.

- Neither the CIS auctions still less the modelled new generation in the draft 2024 ISP can possibly be achieved without major reforms to State planning processes particularly in NSW and Victoria. The ISP assumes 39 GW of new wind and solar are built by 2030 across the NEM a rate of about 6 GW per year. The rate is similar to the rate expected to be financed by the CIS but sustained right out to 2030 rather than just 2027.

Planning Departments have to approve 6 GW every year

The planning departments of the various states in the NEM have to approve 6 GW of projects every year. This won’t be achieved without immediate and urgent reform.

But it can be done. Frankly, it’s a political or people job. That at once makes it impossible and very achievable at the same time. Where is Bob Hawke when you need him.

To restate, at least in NSW and similar in other States right now every project needs an EIS. The EIS demands similar studies typically these days taking two years or longer and then if there are more than 50 objectors the project must be referred to a planning commission which typically takes another 6 months.

There are lots of ways around this, in NSW one approach is to declare either projects, or in my opinion the entire REZ, as State Critical Infrastructure.

Basically, if your project is in the REZ approval should be fairly easy with limited objections. The issues for an REZ might be sorted out at the beginning but they would start from the premise that X GW of renewable energy will be built in an REZ, so where are the best places for it?

Developers need a big say in where the best places within an REZ are, but equally so do other stakeholders. But the long and the short of it is that 6 GW has to be approved in the NEM every year for at least a decade.

Starting now. Planning Departments need to make it work. Forget about development round train lines or stuff in the cities, this is where it’s at.

Analysis – forget about gas for a decade

Before getting to the CIS its interesting to look at the modelling outcomes from the 2024 ISP. One “artefact” from the model is that for 8-9 years almost no gas generation is required. This of course is good news for prices and for the availability of scarce gas resources.

The chart shows that if we build the wind and solar modelled in the ISP then essentially next to no gas is needed from 2026 through to 2025. How good is that?

Gas is needed once coal generation has gone away and is the longer term volumes are presently modelled to return. Personally I don’t think they will, but never mind that now.

Firming is provided by extra wind, by the remaining coal and by batteries (I don’t show the batteries in the graph because they are energy consumers). Depending on the extent of battery/gas and within battery competition there is a good chance that peak prices will be lower and this will greatly reduce average prices.

In turn this will reduce the total revenue available to coal generators, who will also be facing losses in the middle of the day and will as AEMO forecasts hasten their exit.

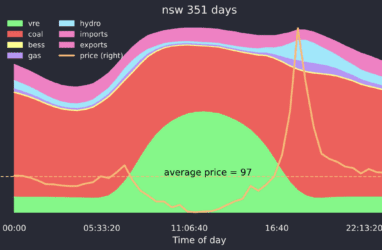

For context here are some charts that illustrate the role of gas in peak pricing and the contribution that the small window of peak daily prices makes to overall prices.

I show the whole year but the effect is basically exaggerated in Spring. Spring is going to get longer every year. What we see in Spring now will be six months of the year soon and soon after will be most of the year.