The Australian Energy Regulator has published the latest of its regular reports into power price surges on the wholesale electricity market – when prices go way beyond the cost of production to more than $5,000 a megawatt hour, and up to the market cap of $15,500/MWh.

The reports tell a familiar story of broken coal generators – up to 3.5GW in Queensland and NSW alone at one point – and the use of market power by various fossil fuel and hydro generators when supply is tight and demand is hot.

But it also introduces a surprising new element – the role of Queensland’s first and only fully operating big battery at Wandoan in some of the price peaks recorded in the first quarter of 2023.

The 100MW/150MWh Wandoan battery is owned by Singapore based Vena Energy, and was switched on last year, but it is operated on a daily basis under contract by AGL Energy, the biggest coal generator and polluter in the country.

One of the high priced events highlighted by the AER highlights the market power of some of the players – something they likely exercise on a daily basis, and not just in the high priced events that the regulator is obliged to investigate.

On March 16 and 17, Sydney and Brisbane were experiencing something of a heat wave, but there was 3.3GW of coal capacity unavailable due to mostly unplanned outages (3.53GW on March 17), about one quarter of the total coal capacity in those states.

There were also multiple constraints on the network which limited transfers, with the link between Queensland and NSW reduced by half because of fears of transmission lines tripping around the about-to-be-retired Liddell coal plant in the Hunter Valley.

That helped set the conditions for the generation companies to do their thing.

On March 17, most of the capacity was offered below $5,000/MWh, but approaching 6pm a tiny fraction of total capacity – between 8 MW to 80 MW – was needed to meet demand and set the price.

The AER reports that several market participants rebid capacity from low to high prices including AGL, Origin and Snowy Hydro. The most significant, it says, was AGL.

Over several rebids from 2.46 pm AGL reduced 105 MW of low-priced capacity at the Bayswater coal fired power station in NSW, due to “milling limits.”

At 4.44 pm, AGL rebid 65 MW of capacity at the Wandoan battery in Queensland from low prices to around $15,000/MWh, in response to a “change in the forecast price.”

And at 5.51 pm, effective from 6 pm, AGL rebid 100 MW of capacity at Bayswater from the price floor back up to the price cap, in response to a “change in the forecast price.”

“This short-term strategic rebidding to capitalise on market conditions had the effect of exacerbating high prices,” the regulator observed.

“Again, while this behaviour may not be a breach of the rules, the ability of these participants to increase price through these rebidding strategies highlights the market power that participants may be able to exercise at certain times.”

This is a crucial point. The power of the big generators to control prices is well known, if rarely acknowledged in the media, and when they are they are often portrayed as some sort of corporate hero. See: Powered up AGL Energy gets its mojo back

This market control, borne from the lack of competition and driven by short term KPIs, is one reason why renewables have struggled to deliver the price reductions promised by the transition to green energy.

Only in those markets where the influence of fossil fuels has been eliminated (the ACT), and where it is much reduced by the sheer scale of wind and solar (South Australia), have wholesale prices fallen significantly. And even in the latter there are lengthy periods where the fossil fuel generators reign supreme.

What is surprising from the AER report is the use of the Wandoan battery for these purposes by AGL. It now seems that battery storage has emerged as a new tool to massage prices for the generators’ benefit.

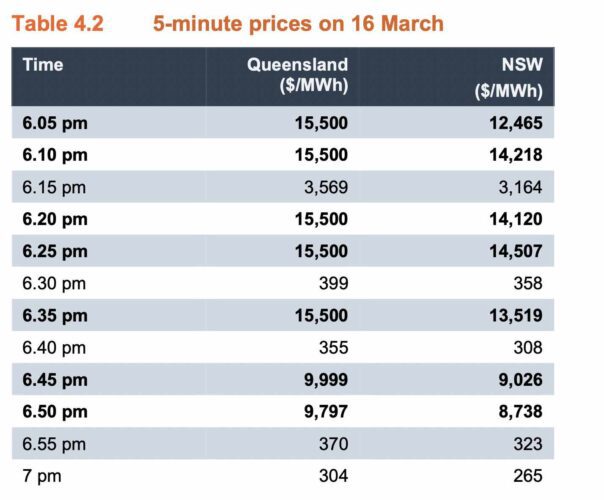

The AER report notes that the Wandoan battery had been deployed in a similar manner the day before, on March 16.

Late in the afternoon, about 600MW of low-priced coal capacity was withdrawn to “manage plant issues,” and later 325MW of capacity from the Wivenhoe pumped hydro facility was withdrawn just before 6pm due to “technical reasons” and because one of its unit had failed to start.

AGL then rebid 91 MW of capacity at the Wandoan battery from the price floor (minus $1,000 a megawatt hour) to around $10,000/MWh and set the price, the regulator said.

“The reason given related to its low state of charge,” the AER wrote. “The rebid shifted 27MW of capacity from the price floor to around $10,000/MWh for 6.50 pm when just 26 MW of high-priced capacity was needed.”

On occasions, it only needs a single megawatt of high priced capacity to turn the entire 20,000 megawatts plus being supplied into the grid from low cost power to high cost power. And guess who pays for it? You, the reader, and other consumers.

The Wandoan battery had been used for similar purposes earlier that month on March 1, when a series of rebids took away a significant amount of low priced capacity. Again, the big generators took advantage of the conditions that they had helped create.

“Millmerran (coal fired) power station rebid a total of 62 MW from the floor to the price cap, based on a change in price sensitivities. AGL’s Wandoan battery also rebid 65 MW of lower priced capacity to a high price, based on a later forecast high price,” the AER wrote.

“Both these rebids contributed to the high 5-minute price at 6.30 pm.

“This short-term strategic rebidding to capitalise on market conditions had the effect of exacerbating high prices in Queensland.”

It had nothing whatsoever to do with the cost of supply. It’s about the power of the big market players, as it always has been.

And now big batteries are being used for the same purpose, which provides one reason why the big generators are so keen to sign contracts to take operate these new facilities on a daily basis – The Wandoan, Riverina, Ballarat, Ganawarra and Torrens Island batteries are all run by one of the big three gen-tailers.

It’s all about market power. Plus ca change. Time for market reform, perhaps.

See also: Energy industry loses plot again as greed trumps strategy and regulator fails consumers

And RenewEconomy’s Big Battery Storage Map of Australia