Earlier this week we published a story about the growing share of battery storage in peak demand periods in Australia, and particularly in South Australia where its share of generation in the evening demand peak hit a high of more than 21 per cent.

That growing share is significant because it is eating into the market traditionally dominated by peaking gas generators, many of which of are designed to operate only in these periods where they can extract a king’s ransom from the market to pay off the costs of construction and fuels.

But that peak of nearly 21 per cent was not a one off. Energy analyst David Osmond, who runs a weekly assessment of how much storage would be needed for Australia to run on a (near) 100 per cent renewable energy supply, says the share of battery storage is growing on daily basis.

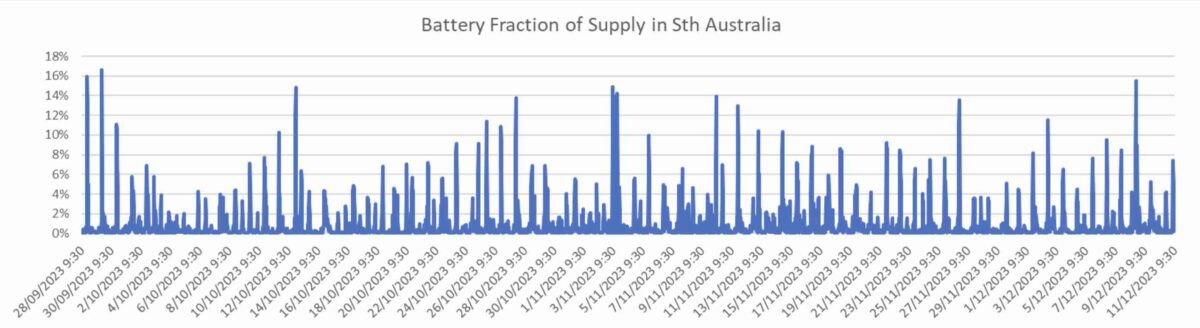

In response to our article, he published this graph below, which shows a daily assessment of battery storage market shares in South Australia over the past three months.

It should noted that this graph above plots the battery fraction on 30 minute intervals, rather than the five minute intervals of our report earlier in the week, which is why September 28 shows a peak of 16 per cent rather than 21 per cent.

The National Electricity Market trades on five-minute intervals, and one of the advantages of battery storage is that it so fast and flexible. Indeed, the NEM market was redesigned from 30-minute to 5-minute settlements precisely to encourage that speed of response and flexibility.

“Lots of people (are) underestimating batteries in Australia,” Osmond wrote on his Twitter/X feed. “While they’re only providing a small fraction of total generation, they provide a large fraction when we need it most.”

And that fraction will grow. South Australia leads the country, and the world, with a wind and solar share of more than 71.5 per cent over the last 12 months, and peaks of more than 100 per cent wind and solar on 282 days in the last year, and expects to get to average “net 100 per cent” wind and solar within a few years.

It already boasts the Torrens Island, Hornsdale, Lake Bonney and Dalrymple North batteries, with the Blyth and Tailem Bend batteries under construction and in commissioning, and Zen Energy’s Templers battery and many others in the pipeline.

Last week, the Australian Energy Market Commission confirmed that the market price cap would be progressively lifted from $16,600/MWh to more than $22,800/MWh by July 1, 2027, precisely to encourage battery storage and peaking gas generators to make themselves available in peak demand periods.

The price was lifted to allow for the increased costs of peaking gas generators, and the fuel it uses, and to encourage batteries to be available at those times. The AEMC says it will have no impact on prices 99 per cent of the time.

“These changes will encourage more generation and battery storage into the system when we need it most, reducing the risk of damaging outages for electricity consumers and keeping the system stable as we rapidly transition to higher levels of renewable energy and decarbonise our economy,” AEMC chair Anna Collyer said.

Batteries can perform a wide range of different functions, but the market operator wanted an incentive for them to be available at the price peaks, whenever they may occur, to ensure that load shedding does not need to occur.

As Rystad Energy points out in its annual assessment of the renewable energy construction market in Australia, battery storage is the one healthy part of the market, with more than 3.7 GW of new capacity (with varying amounts of storage durations) starting construction in 2023.

This is more than 50 per cent more than the combined capacity of new construction starts for wind and solar, and follows a spree of tender and contract wins in states such as NSW, Victoria, Queensland and Western Australia to boost the carrying capacity of the grid, and to shift the output of rooftop solar to the evening demand peaks.

Se RenewEconomy’s Big Battery Storage Map of Australia