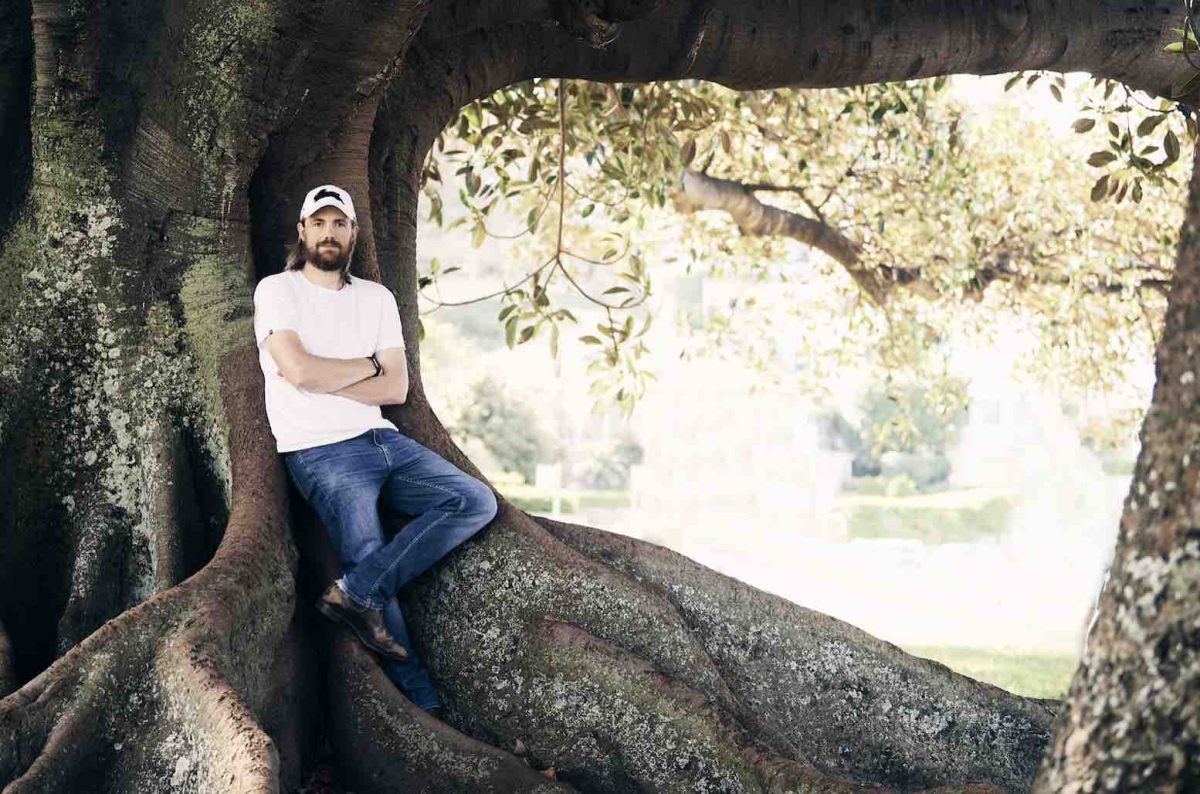

Grok Ventures, the private investment vehicle of software billionaire Mike Cannon-Brookes, says it is changing cap, and its cap logo, as it narrows its focus on climate and clean energy and keeps a lookout for “lighthouse” investments.

Grok has changed its website, its logo (Cannon-Brookes like wearing caps) and its investment focus as it exits those not at the centre of Cannon-Brookes passion for making a difference on climate and energy.

Grok CEO Jeremy Kwong-Law says the change is not so much a switch a narrower focus on climate investing across the stack from venture capital, to infrastructure and what Grok calls “Lighthouse” – the big calls that can make a difference.

The company already has an 11.7 per cent stake in AGL, and is putting pressure on the country’s biggest coal generator to accelerate its switch to green energy, having failed in a bid to take control. That goes into the “lighthouse” pot simply for the scale of what it wants to achieve e.

It is also the principal shareholder in Sun Cable, the $30 billion plan to build up to 20GW of solar in the Northern Territory, and transport it to Darwin and then on via sub-sea cable to Singapore.

That, too, fits in as a “lighthouse” investment that will be more like infrastructure once it gets going. Its partner in at least the domestic part of Sun Cable, Quinbrook Ventures, is classified as infrastructure.

Grok’s support of Sundrive, the Australian solar start-up trying to change the way PV is manufactured by replacing silver with copper, fits in with the “venture capital” column, as does thermal energy aspirate Antorra Energy, Gridmo, and grid 3D specialist Neara.

“We’ve done our best to keep our heads down over the past 7 years, investing in climate and tech to deliver a Better Tomorrow,” the company says in a LinkedIn post.

“In this time we’ve deployed more than $US1 billion ($A1.5 billion) into climate technology and infrastructure, making a bit of noise here and there.

“We’ve reflected on our hard earned lessons and set a course for the future of Grok Ventures: Backing a better tomorrow by investing in the biggest opportunities in decarbonisation. And we’re zeroing in on a problem we know how to solve: the climate capital stack.

“What does this mean? We back early-stage climate technology startups via our Venture team – helping founders set commercial and technology milestones that unlock non-dilutive structured funding solutions.

“We’re talking funding solutions like project finance and mezzanine debt. As companies prepare to scale their tech – our Infrastructure team delivers these solutions as an alternative to venture funding, resulting in less dilution to founders and venture investors.”

Grok says it is interested in owning, operating, or just licensing technology, or doing all three.

“We’re combining (our) experience to focus entirely on decarbonisation; delivering the most suited funding solutions to scale climate technology companies.”