Prices declined in 2023

Note that South Australia, despite having a large share of gas generation, has not had the highest prices in the NEM since 2018. Typically it comes in 3rd.

Broadly speaking New South Wales has the highest prices most years followed in recent years by Queensland. That’s because both States have moved too slowly to build new capacity.

When the Yallourn brown coal power station closes later this decade, however, things will be different in Victoria.

Looking at fuel weighted prices, what jumps out at me is that, so far, batteries are achieving higher price outcomes than gas. Surprisingly, hydro has charged less than either gas or batteries.

My theory is that batteries are so far making lots of revenue from FCAS, so they can afford to be choosy in the spot market. Alternatively, the FCAS revenue they earn happens to be when spot prices are high.

Still, gigawatts of new batteries have been announced and will certainly be built over the next couple of years. Those batteries will almost certainly result in competition in the peak pricing market.

There is still plenty of margin for batteries considering the historic data. However, one has to look forwards not backwards.

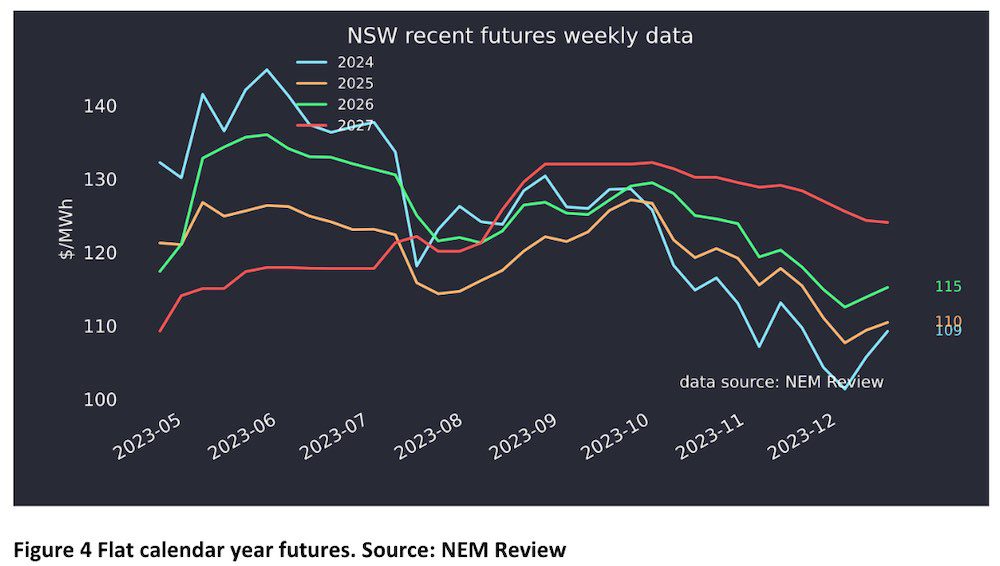

Futures prices showed few signs of falling, but I’m not really sure how deep the market is. I show NSW because, looking at the chart, it seems the most liquid market.

You can see the standard tendency of each year to be priced higher than the previous year. More or less the same tendency is evident in other states. The 2027 price in my opinion is too high and could be shorted, but I am not a trader.

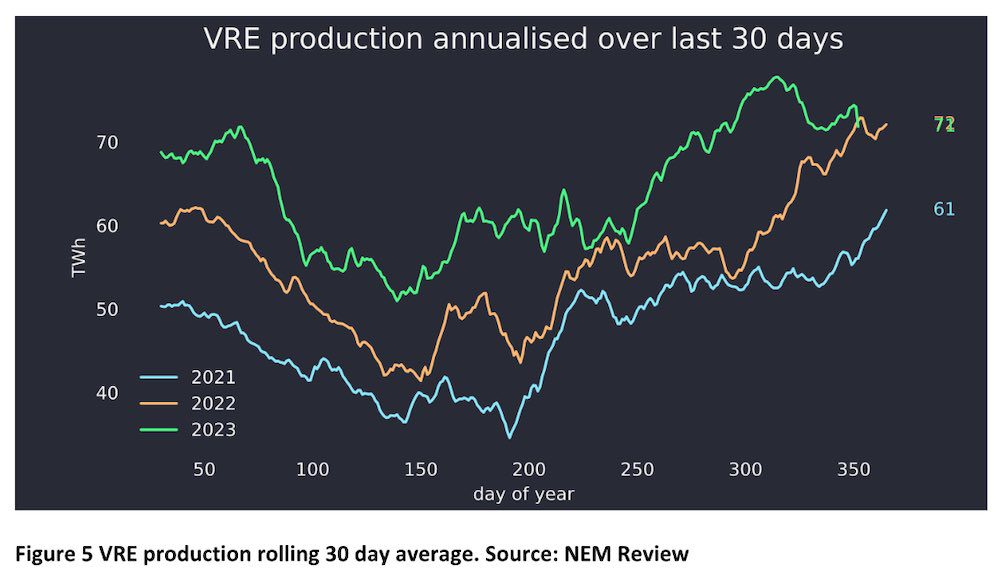

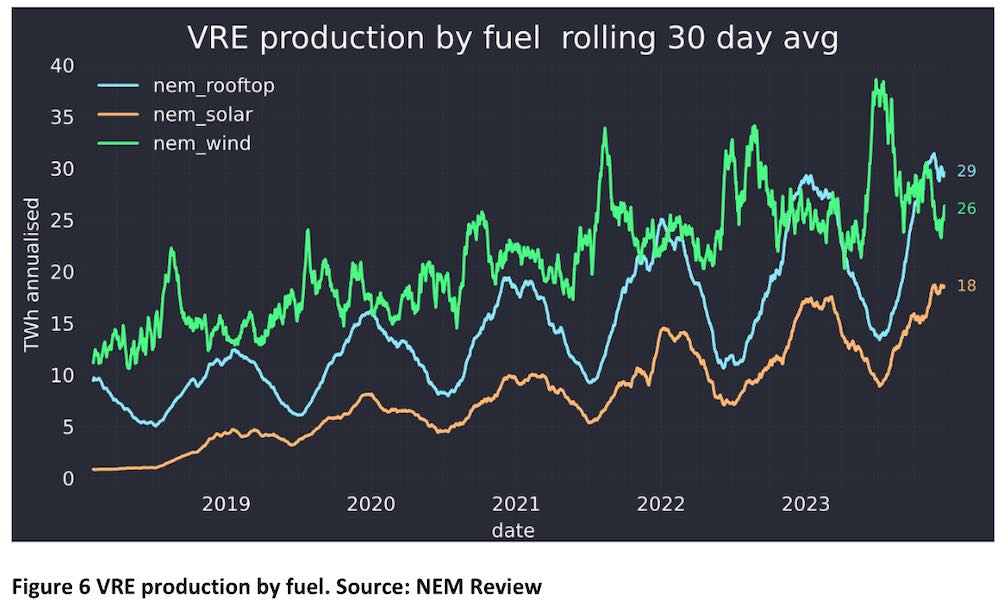

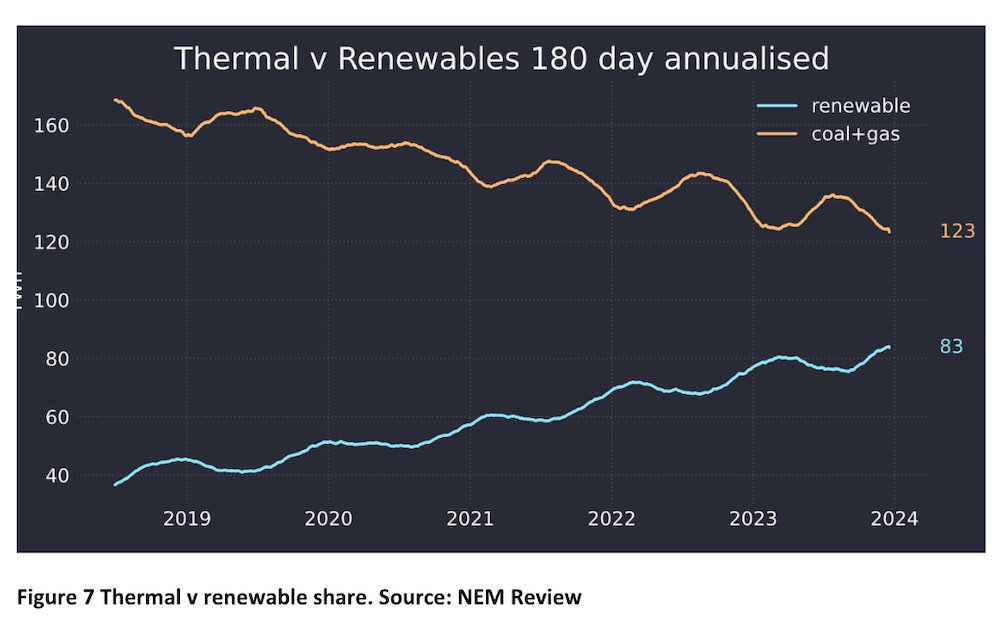

Looking at the share charts, 2023 has ended on a disappointing note, as the wind hasn’t blown much recently.

And the data makes clear that we are already past the period of peak solar production, if you look at the rooftop line. Utility peak seems to come later, influenced perhaps by new solar farms coming into production. Next year rooftop production may go quite close to total wind production.

Even so, the declining role of thermal generation is very obvious. The crocodile walk is on, as Elton John might have sung.

Batteries growth and impact on peak market

Since I last looked at the NEM utility battery market, only a month or two ago, three new projects totalling 0.9GW – that is Melbourne hub, Richmond Valley and Goulburn – have been more or less confirmed as committed.

By my rough count, and assuming I haven’t missed anything, that’s 3.2GW under construction in the NEM to add to the 1.5GW already operating.

It is notable how, for once, the forecasts – that battery duration would get longer as we move from the very short duration frequency control to the daily trading segment – have come true.

Although some batteries such as projects with a common supplier in Queensland and Canberra have run into delays, as a general statement I expect batteries to be built on time and to commission quite quickly.

What this means is the amount of utility battery power available to trade the evening peak is going to treble over the next three years.

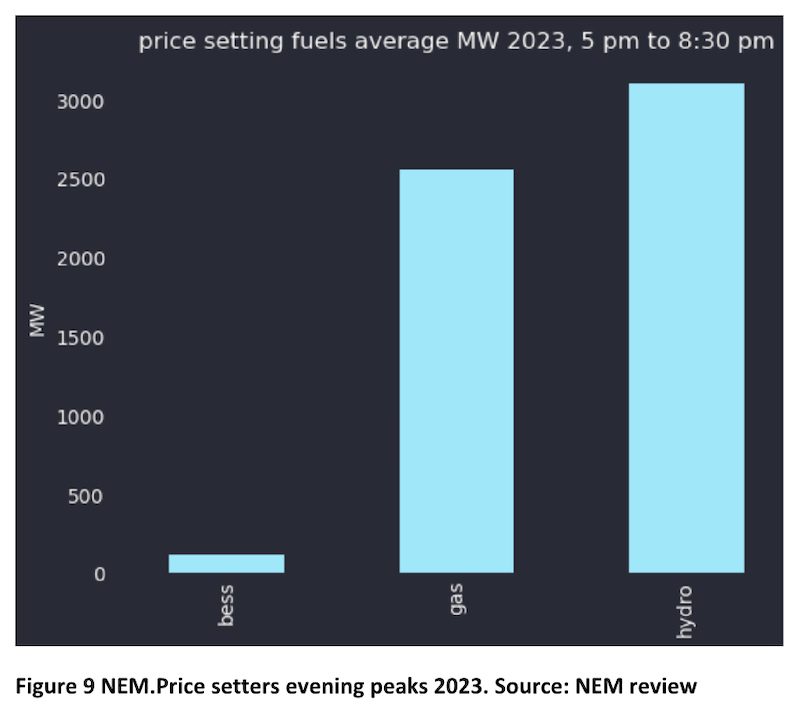

If I look over the past 12 months and focus only on the 5:30pm to 8:30pm evening peak window, it’s clear that across the NEM batteries don’t yet play much of a role.

I haven’t counted coal because coal isn’t the price setter in my opinion and most of the time. However, we must note there is 15,000MW of coal generation in the evening peak and removing that will make evening prices go up.

Also the role of hydro is a little exaggerated, because it’s used for more than peaking in Tasmania.

Although the data is, I think, accurate my interpretation of what sets price is just that, my interpretation.

Nevertheless the point is that, on average, over 2023 batteries still play only a very small role in evening peaks. Equally, though, if we add in another 2000MW of batteries, maybe more, then all of a sudden the evening peak market starts to get crowded.

Batteries, wind and solar will usher coal generation out – but it’s a cycle

Cutting the gas headroom in 2025 is only an intermediate step. Because what is going to happen in reality is that once these batteries come on line, and once even more solar and wind is online, coal generators will start to lose revenue.

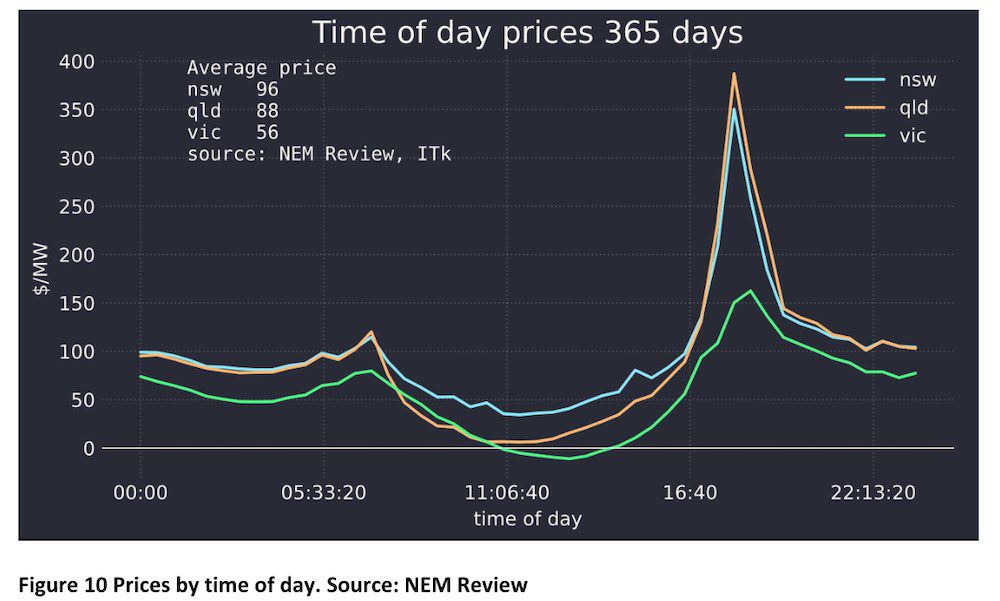

You can see the contribution that evening peaks make to average prices in the figure below and that year-long negative midday prices are already a thing in Victoria – and close to it in Queensland.

Once a coal generator such as Eraring closes then that creates space for another 1000-2000MW of capacity to operate in the peak market, and prices will go up.

After a few cycles of high prices mean more batteries and low prices mean less coal most of the coal generators will close, and the market will settle down. On AEMO’s forecasts that’s around 2035. So plenty more end-of-year notes to talk about prices, just yet.