When it comes to climate investment funds, diverse management is imperative

GreenBiz

APRIL 13, 2021

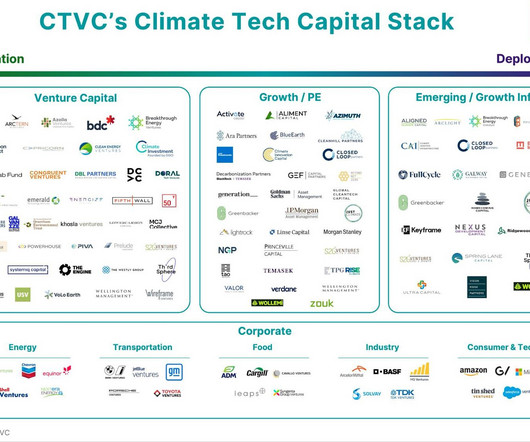

When it comes to climate investment funds, diverse management is imperative. The engine behind green business is the same as any business: capital. Venture capitalists decide who gets to be a billionaire and what solutions reach billions in market penetration. Marilyn Waite. Tue, 04/13/2021 - 02:00. In a 2019 study , the U.S.

Let's personalize your content