Greetings, Agents of Impact!

Featured: Circular Real Estate

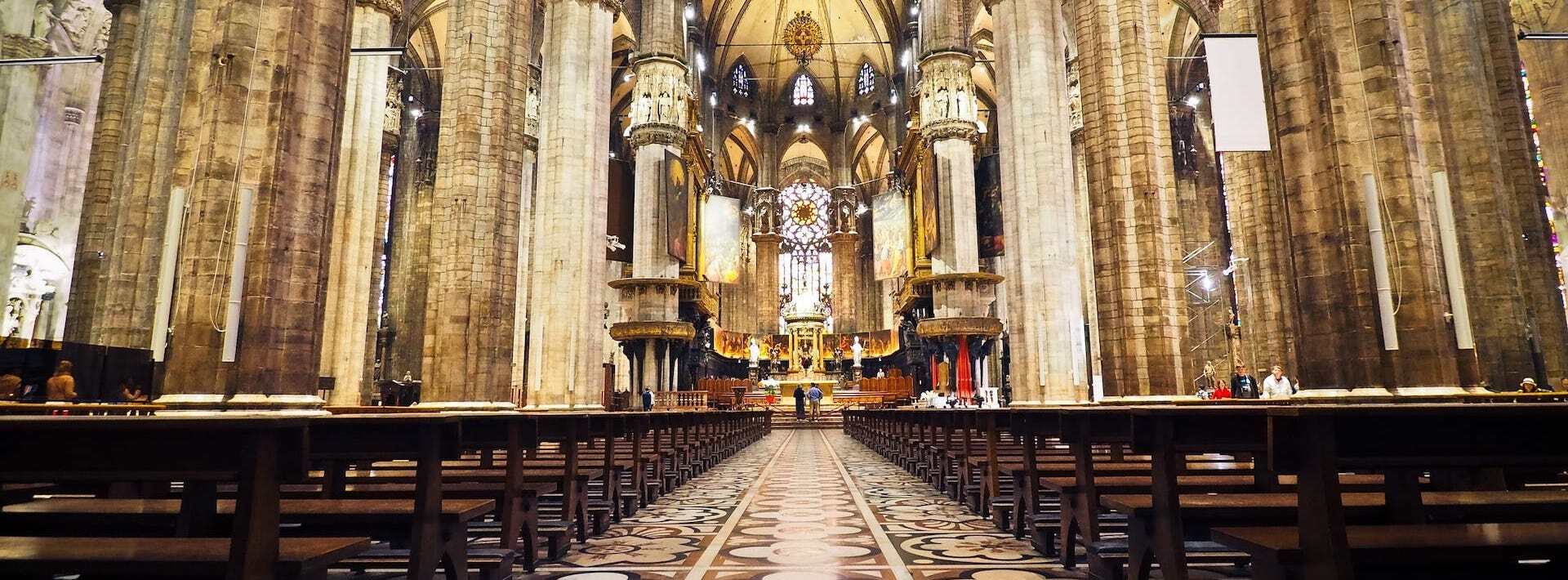

Surplus church properties in Canada get new life as community hubs and affordable housing (video). Church steeples dot the skyline in cities and towns across North America. But with congregations shrinking, aging and going broke, many church buildings are in need of repair – or rebirth. In Canada, approximately 4,000 churches closed between 2009 and 2018, and an equal number are expected to shut their doors in the next decade. Many are sitting on valuable property in prime locations. Montreal-based Trinity Centres Foundation is creating financing structures to underwrite the transition of surplus religious properties into community centers for social services, art exhibits, nonprofit organizations and even other religious congregations, or to convert the property to affordable housing. “Go and find a big old white church steeple in the middle of a city,” suggested Trinity Centres’ Graham Singh on the sidelines of this month’s GIIN Impact Forum in Copenhagen. “What if the folks who run that property actually wanted to see that place serve the poor and community and impact?”

- Repurposing. Trinity Centres has helped redevelop dozens of properties. St. Jax’s Anglican congregation in Montreal now shares space with a circus company. With its four-acre site, the Bow Valley Christian Church in Calgary is considering plans for 700,000 square feet of housing and a 50,000-square-foot community hub. Trinity Centres is eying about 1,000 properties in some kind of distress that are located on or near their communities’ Main Street. “We’re trying to create a financing vehicle to allow that transformation to happen with those very important urban properties,” Singh told ImpactAlpha. In the US, groups like the Oikos Institute for Social Impact helps mostly Black churches leverage their assets for community benefit (see, “Can Black churches spark a revival in Jackson, Mississippi?”). “We left behind the people in the census tracts where our churches used to be,” Oikos’ Sidney Williams said at last spring’s Neighborhood Economics conference. “And so part of it is we have to return to those communities.”

- Catalytic capital. Financing such conversions is a challenge. Nonprofit collaborations that need affordable spaces for community-based services generally can’t get bank loans to purchase surplus church properties. Trinity Centres is seeking to mobilize up to $100 million by creating a credit-enhancement facility to derisk such mortgage loans. One possible backer is Canada’s $755 million Social Finance Fund, a public facility launched this spring to help social purpose organizations access flexible finance. “That credit-enhancement vehicle then allows us to issue a bond,” Singh said. “And the intention is to get that bond to investment grade which, as we all know, is the only thing that works for many foundations and institutional investors that want to be in this impact space.”

- Keep reading, “Surplus church properties in Canada get new life as community hubs and affordable housing,” by David Bank on ImpactAlpha. And watch David’s conversation with Trinity Centre Foundation’s Graham Singh.

Sponsored by Hope Credit Union

Brighter futures begin with HOPE – and you. Since 1994, Hope Credit Union has provided critical financial resources to more than two million people across the Deep South in some of the nation’s most impoverished regions.

Now, you can make an impact in these communities, too. Make a socially responsible investment in HOPE’s mission with a Transformational Deposit. We offer two flexible account options, including certificates with 12- to 60-month terms or money market accounts allowing you to access your funds up to six times per month.

Your deposit will empower life-changing economic opportunities in low-wealth, underbanked communities in Alabama, Arkansas, Louisiana, Mississippi and Tennessee—and you can help from wherever you are. See how you can help promote greater financial equity for those who need it most. Learn more.

Dealflow: Climate + Gender

MCE Social Capital notches $41.6 million for its sustainable agriculture fund. The MCE Empowering Sustainable Agriculture fund, or MESA, builds on MCE Capital’s 17 years of support for small agribusinesses and rural financial services. MESA is focusing at the nexus of gender and climate issues with loans to agri-organizations and farmer finance institutions that improve smallholder farmers’ climate resilience and create economic opportunities for women. The US International Development Finance Corp. and Ceniarth anchored the fund with $19.5 million in February. Dutch development bank FMO added $10 million. ImpactAssets, the Visa Foundation, Blink CV, Imago Dei Fund, Sall Family Foundation and Heading for Change helped MESA get to a final close (disclosure: Heading for Change sponsors ImpactAlpha’s coverage of Climate + Gender).

- Financing farmers. Smallholder farmers in Africa, Asia and Latin America face a $170 billion annual financing gap. Since 2006, San Francisco-based MCE has invested $300 million in organizations serving smallholder farmers in Africa and Latin America. It says its portfolio companies serve 12 million people. MESA plans to finance roughly 35 agribusinesses and finance organizations over the next nine years.

- Dig in.

Proparco extends loan to Ziz Energie for solar ‘metro-grids’ in Chad. The Central African country of Chad is one of the poorest in the world. Chad’s poverty extends to energy: the country of 17 million has just over 300 megawatts of installed generating capacity. Only 6% of the population have access to reliable power, mostly in the capital, N’Djamena. Ziz Energie develops and operates mini-grid networks for smaller cities and has five such metro grids in operation. A €1.5 million ($1.6 million) loan from the French development finance agency Proparco will help Ziz deliver energy access to 500,000 people.

- Energy prospects. Mini-grids and solar home systems are Chad’s best bet for improving energy access in the near term, “in view of the serious affordability constraints, low density of the population, and the significant time and resources required to develop a national power grid,” according to the World Bank. International off-grid energy players have little presence in Chad. The country’s most notable project is the Djermaya Solar project, a $20.6 million, 42-megawatt plant financed by Proparco, InfraCo, Emerging Africa Infrastructure Fund and the African Development Bank.

- Private capital gap. Ziz is the only Chadian company to raise venture capital in recent years, according to Africa: The Big Deal. Energy Access Ventures and Dutch development bank FMO have backed the company in multiple equity rounds to boost solar and battery integration into its mini-grids, install street lighting, and develop rooftop solar for commercial and industrial companies.

- Check it out.

Dealflow overflow. Other investment news crossing our desks:

- Hyderabad-based Freyr Energy raised 580 million rupees ($7 million) from impact investment fund EDFI ElectriFi, Schneider Electric’s Energy Asia Fund, Lotus Capital and others to provide rooftop solar for India’s households and small businesses. (Times of India)

- Skeleton Technologies scored €108 million ($114 million) from Siemens and Marubeni Corp. to ramp up production of its “SuperBatteries,” a hybrid supercapacitor/battery technology, and other energy storage tech. (TechEU)

- Copenhagen Infrastructure Partners clinched a combined €2 billion ($2.1 billion) for its clean fuel and renewable energy funds, Advanced Bioenergy Fund I and Green Credit Fund I. (Bloomberg)

- Hydrogen tech developer Elcogen raised €45 million ($47.7 million) from Korea Shipbuilding & Offshore Engineering to boost manufacturing capacity at its factory in Estonia and partner on hydrogen-based marine propulsion systems. (H2 View)

Signals: Muni Impact

Chicago tries a twist on ‘tax increment financing’ to extend transport to low-income neighborhoods. A new approach to a well-worn financing mechanism is attracting attention to Chicago. The city is employing tax increment financing, or TIF, to extend the local transit authority to the city’s far south side, one of Chicago’s poorest areas. With post-pandemic public transit ridership down, transit authorities, including Chicago, are being downgraded. Borrowing costs have ballooned. Municipal bond issuance for transit projects is down 44% from last year, underscoring the need for more creative financing. City planners are “looking for ways they can use the stations and other key community resources as anchors to develop,” Lisa Washburn of Municipal Market Analytics told ImpactAlpha.

- Equity TIF. TIFs have drawn criticism for their reliance on growth projections and their tendency to gentrify neighborhoods. How it works: A city, transit authority, or other municipal entity, creates a special tax district and issues bonds to fund projects. The additional private investment and revenues spurred by the project pay back the bonds – if the revenues materialize as expected. Chicago’s “equity TIF,” as it’s being called, defines the project area broadly enough to include affluent parts of the city where rail stations already exist, effectively tapping more prosperous areas to fund development in underinvested ones. The city undertook extensive community outreach and has committed to “development without displacement.”

- More.

Agents of Impact: Follow the Talent

Don’t miss SOCAP23, Oct. 23-25 in San Francisco. Use the code s23_impactalpha to save $250.

ImpactAlpha’s David Bank will moderate “American Democracy: A new investment imperative for impact investors,” Wednesday, Oct. 25 in San Francisco… Ceres has an opening for a Midwest state policy manager… Austin Community Foundation is looking for an investment and treasury manager… Deutsche Bank’s community development financing group seeks a vice president in New York… Tides is on the hunt for a remote impact investing vice president… Gaia Impact is recruiting a pair of spring interns in Paris… ImpactAssets will accept applications for next year’s impact fund manager showcase, which highlights 50 equity and debt impact fund managers annually, until Friday, Oct. 27.

👉 View (or post) impact investing jobs on ImpactAlpha’s new Career Hub.

Thank you for your impact!

– Oct. 18, 2023