Our energy systems are being transformed by the dramatic increase in distributed energy resources (DER) that are now populating power grids around the world. DER assets, popularized by rooftop solar PV and then distributed energy storage, are challenging our conventional thinking in new ways. Ironically, electric vehicles (EVs), the most challenging DER asset, could also be the most transformative of all.

Once viewed as a major headache for utilities since each EV represents the equivalent load as a new house on their distribution grids, advances in digital control platforms enhanced by artificial intelligence (AI) now make it possible to charge and discharge this load capacity in creative ways that serve rather than compromise power grids. Furthermore, with the right market structures, these EVs can deliver value from the home or office all the way up into wholesale markets. The adoption of FERC order 2222 sets the stage for this possibility to become a market reality.

Given their primary function of moving people and/or goods between locations, the availability of EVs to respond to grid signals at any time is, nevertheless, sporadic. Unlike stationary storage or other generation assets, they are not always on call to participate in grid services, and only a percentage of a regional set of vehicles will be available at any moment. As a result, many early pilot programs have targeted EV charging at workplaces or company/organization-owned EV fleets, but we have a long way to go. First, the technology to sync up an EV to the grid and then deliver value from a mobility asset into a stationary grid application has to be validated. Luckily, there is good news on that front.

…advances in digital control platforms enhanced by artificial intelligence (AI) now make it possible to charge and discharge [EV] load capacity in creative ways that serve rather than compromise power grids…

This article highlights how these DER assets, when optimized into mixed-asset VPPs, can help utilities meet the obligations to their customers while also reducing economic (and environmental) costs across the stakeholder landscape.

Mainstreaming of EVs: From V1G to V2G, The State of Vehicle Grid Integration

A tipping point for EVs to become mainstream consumer offerings is steadily approaching. By 2030, government vehicle fuel efficiency regulations and continued development of advanced battery chemistries and manufacturing capacity are likely to make EVs cheaper to purchase than competing liquid or gaseous fuel-powered vehicles. Consumer Reports notes that already today, the total cost of ownership of an EV is more affordable than a traditional gasoline-fueled vehicle.

For the electric power sector, EVs are a boon, but a boon that requires active management. While basic load growth is good for the sector — especially in an era when the focus has been traditionally to shrink loads in the name of energy efficiency — the uneven distribution of that growth within a specific location or at a specific time of day could prove burdensome for utilities. Actively managing and spreading the EV charging load across infrastructure assets and time could not only prevent infrastructure upgrade costs but may also decrease grid balancing costs. This is an important aspect as more intermittent renewable resources are added to generation portfolios.

For the electric power sector, EVs are a boon, but a boon that requires active management…Actively managing and spreading the EV charging load across infrastructure assets and time could not only prevent infrastructure upgrade costs but may also decrease grid balancing costs.

Vehicle grid integration (VGI) enables EVs to participate in grid balancing schemes as generation or demand assets for grid operators, as well as similar balancing options for smaller subsets of the grid, including microgrids and VPPs. Plug-in electrical vehicles (PEVs) may do this by modulating the rate of power at which the battery is charged, known as unidirectional V1G, or by also providing power back to the grid, known as vehicle-to-grid (V2G).

In practical terms, the primary difference between the two is that V2G enables EVs to participate in grid services to a greater extent than V1G systems. Given this complexity, V2G is also more expensive and challenging to implement. Though this may seem like a win-win for the electric power sector, V2G are fledgling solutions with significant hurdles to overcome. Opportunities for deployment vary significantly by location depending on the confluence of a growing EV population, an intelligent grid, penetration of renewable resources, and open market regulatory structures.

V2G are fledgling solutions with significant hurdles to overcome. . . Batteries of the sort in EVs can potentially respond more quickly and accurately to grid signals than other utility grid service assets, such as natural gas powered peaker plants.

Batteries of the sort in EVs can potentially respond more quickly and accurately to grid signals than other utility grid service assets, such as natural gas-powered peaker plants (They are also much cleaner, as pointed out in a recent Guidehouse Insights white paper). This speed and accuracy could boost grid efficiency, but in most markets, these performance advantages are not compensated accordingly.

The continued advancement of organized markets for grid services will improve the business case for VGI. Given that, the business case for PEVs as grid assets is confusing — because PEVs are road-facing assets first and grid assets second – this market is more conceptual than real today.

How can stakeholders help make V2X a commercial reality? Here are three recommendations:

- EV ecosystem stakeholders should support development of communication standards and shape regulations on frequency regulation services. They should also explore new energy-as-a-service business models linking microgrids, which ensure a reliable source of clean electricity for charging stations, to market-facing VPPs that can also support the larger grid.

- Microgrid ecosystem stakeholders should focus on how EVs provide value internally to the microgrid itself during emergency islanding and pair EV fleets to stationary storage devices.

- VPP ecosystem stakeholders should leverage advances in artificial intelligence, advocate for market reforms and seek opportunities in the Distributed Energy Resource Management Systems (DERMS) space, allowing EVs to not only generate grid service revenue but serve as important assets to maintaining the physical integrity of grid networks.

V2X: A Sign of Things to Come

Integration of EVs into energy markets in the form of what the U.S. Department of Energy has recently dubbed “vehicle to everything,” or V2X is a groundbreaking technological breakthrough. V2X breaks down long-standing siloes between energy and transportation sectors of the economy, setting the stage for even wider deployments of VPPs to balance loads while optimizing EV charging.

One of the best near-term opportunities for EVs to play a role in VPPs while also enhancing grid resiliency is in California. This past December, the California Public Utilities Commission (CPUC) authorized aggregated EVs for its emergency load reduction program (ELRP). This pilot program is designed to allow the state’s investor-owned utilities and the California Independent System Operator (CAISO) to access innovative ways to maintain a reliable grid when traditional generation options are not available. The goal of ELRP is to eliminate the need for rotating power outages while minimizing cost to ratepayers associated with building additional standby resources such as peaker plants. This program is designed to serve as an extra insurance layer on top of the existing resource adequacy reliability planning requirements integrated into the CAISO wholesale market. One can view this as an experiment, which will run for five years, to offer a new tool for grid operators to address unexpected power system conditions.

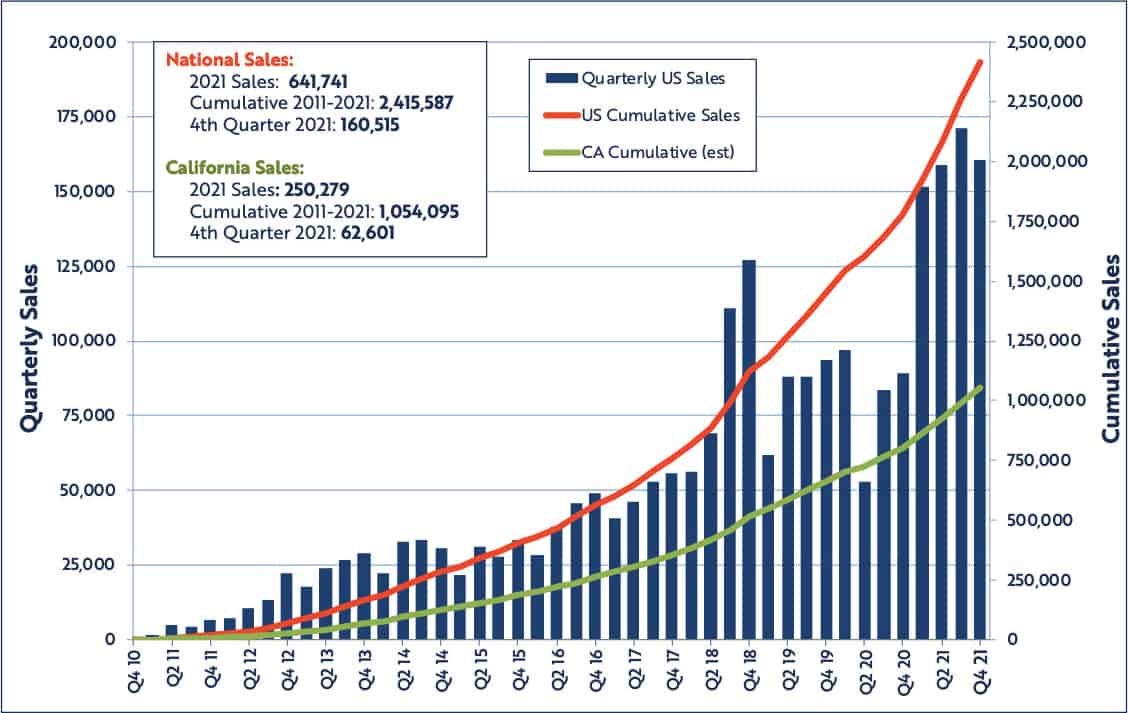

Under the program, EV aggregations that reduce load or deliver a supply of 25 kW or more for 30 hours annually during system emergencies will be paid $2/kWh. Notably, this is California’s first program that offers compensation for the V2X grid services. While traditional backup fossil generators can participate in the program, it is the use of V2X technologies that are the most ground-breaking given the huge potential resource. California already has 1 million electric vehicles on the road, which represent approximately 39% of the national total, according to the California Energy Commission (See Chart below). Given that the state has set a goal that all new vehicle sales be EVs by 2035, the role of V2X as a potential grid resource will only increase over time. Since each electric bus includes a battery that can represent 100 kW of energy storage capacity, this growing fleet represents a vital resiliency resource for California, the nation and the world.

National and California EV Sales Trends Data

Each EV represents the equivalent load as a new house. As we electrify to reduce carbon emissions across new sectors of the economy such as transportation, utilities must grapple with how to keep the lights on while balancing environmental considerations.

Conclusion: EV Fleets Are Where We Begin

Both distribution utilities and EV fleet managers are ideal candidates for advanced software platforms to optimize operations, particularly when seeking new revenue opportunities with the VPPs. . . The VPP market segment is gaining traction, and the primary new opportunity currently being explored is EV fleets, particularly municipal buses and other light-duty commercial vehicles.

Distribution utilities have traditionally viewed growing EV deployments with alarm. Unanticipated large loads can show up and disappear without warning, particularly when fast charging. However, commercial vehicles charging within a fleet configuration represents a more manageable opportunity compared to a single EV plugged in at home. In addition, EV fleet managers are working to reliably charge EVs at the lowest possible cost. Fleet managers must establish sufficient charging for transportation routes, all while managing existing utility tariff rates and tracking long-term performance. Both distribution utilities and EV fleet managers are ideal candidates for advanced software platforms to optimize operations, particularly when seeking new revenue opportunities with the VPPs.

The VPP market segment is gaining traction, and the primary new opportunity currently being explored is EV fleets, particularly municipal buses and other light-duty commercial vehicles. When clustered at a single campus parking lot, these EVs can use AI and advanced software algorithms to provide value to asset owners, fleet managers, and host distribution utilities. Combining loads, generation, and storage into a flexibility portfolio captures synergies in diverse DER aggregations. In short, EVs drive innovation in the provision of grid services by expanding the use cases for mixed asset VPPs, the fastest growing market segment worldwide. The entire VPP market is moving in this direction as diverse generation, load, and energy storage assets are bundled into flexibility portfolios to provide grid services. Please read the Guidehouse Insights white paper entitled EV Fleet Management Value Stacking for VPPs for a more detailed look into the EV fleet opportunity.

EV Grid Solution Guide

End-to-end SaaS + Turnkey Services Solution for EV and EVSE Energy Management.