Plugging the Leaks: An Investor Guide to Oil and Gas Methane Risk

Plugging the Leaks: An Investor Guide to Oil and Gas Methane Risk

Oil and gas companies must curb methane emissions to limit warming this decade, and address urgent risks.

Invisible Risks

In a world of multiplying energy challenges, a significant volume of methane – the main component of natural gas and a powerful driver of short-term climate warming – is being lost from the oil and gas supply chain.

A growing number of investors are recognizing the fundamental financial risk that methane emissions pose to the oil and gas industry. Despite the feasibility and cost-effectiveness of reductions, companies’ methane performance remains inadequate to mitigate methane risk.

Poor data quality, among other factors, is undermining the industry’s efforts at methane management as well as investor confidence in reported progress. Meanwhile, emerging regulatory mandates and rising stakeholder expectations are challenging the oil and gas companies’ ability to follow through on their decarbonization efforts.

The last few years have seen notable improvements in the methane-related performance of some companies. However, global pressures continue to accelerate the demand for credible methane abatement. In this report, we establish best practices for investors and companies seeking to credibly and quickly address methane emissions.

Report Highlights

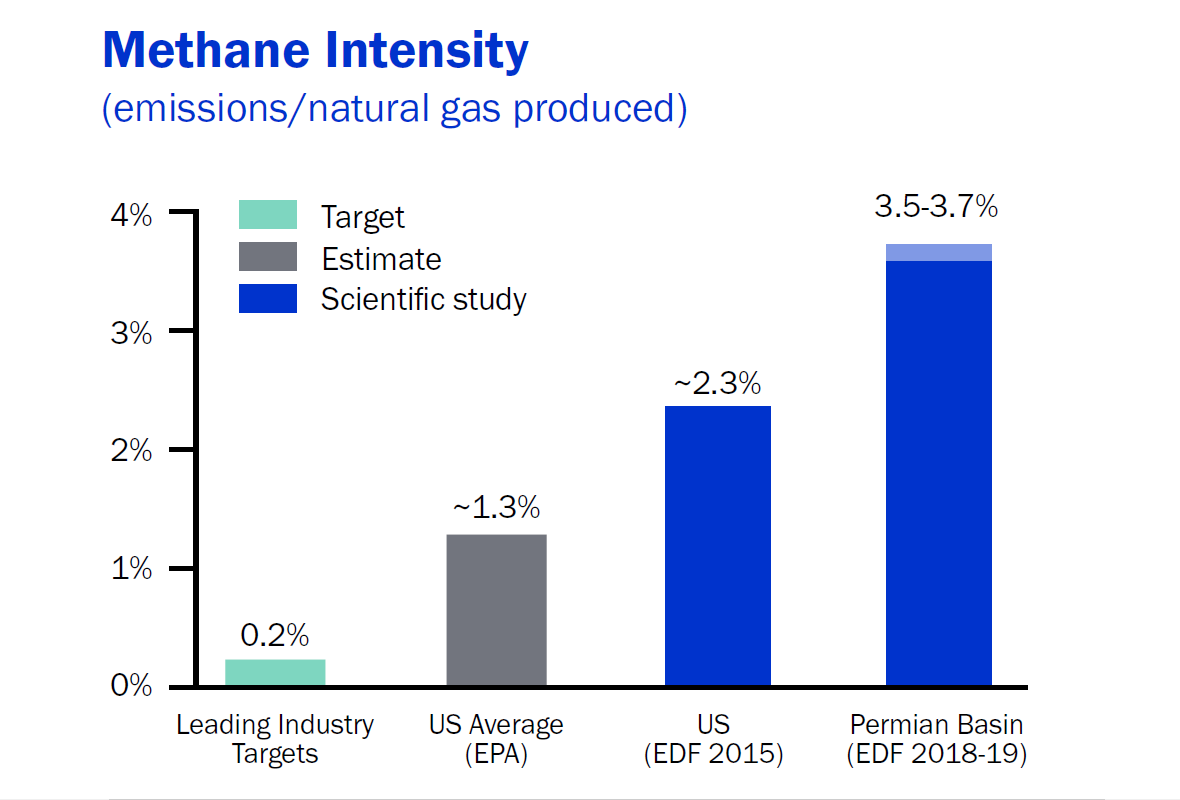

- You can’t manage what you don’t measure and disclose. Current industry standards significantly underestimate methane emissions – by more than 60% across the US. To demonstrate real-world emissions progress, companies need to undertake direct measurements and report through a transparent, standardized framework.

- Reducing flaring means reducing methane impact. Production facilities often lack the necessary capture and transport equipment to prevent flaring, a wasteful industry practice where extracted methane is burned off. However, more companies are committing to minimize flaring – resulting in far lower climate impact.

- Methane reduction must be extended to all assets. Significant shares of oil and gas company production come from assets operated by a partner (non-operated assets) and/or are jointly owned (joint ventures). However, the industry’s targets and disclosures often do not include these material assets.

- Leaders should set an example – especially through policy support. Leading companies can demonstrate their credibility on methane reduction by supporting strong methane regulations. Well-designed, ambitious policy can raise the floor, driving laggards to improve their performance.

Key Takeaways

Investors should seek the following key commitments from oil and gas companies:

- Set a near-zero methane emissions intensity target by 2025. This must be based on direct measurement methods.

- Join the Oil and Gas Methane Partnership (OGMP 2.0). The OGMP offers an industry-leading reporting framework that enables companies to directly measure and report methane across all assets, accompanied by operational best practice guidance.

- Join the World Bank’s Zero Routine Flaring by 2030 (ZRF30) Pledge. Many companies are well-placed to eliminate the harmful practice of routine flaring from their operations within the next few years.

- Incorporate non-operated assets and joint ventures (NOJVs) into both targets and disclosures. While NOJV assets are material contributors to company bottom lines, they are often unaccounted for in company climate and methane initiatives.

- Advocate for robust methane emissions policy and regulation. Supportive, detailed comments from industry leaders can counter input from those aiming to undermine action and can be critical to the quality of the resulting policy.