Five Dynamic Factors Reshaping the Power Sector Supply Chain

The shift to clean energy is triggering growing concerns about the sustainability, resilience, and integration of the power sector’s complex supply chains. Here are five trends to watch.

The power sector’s supply chain has been in turmoil for several years. While it faced vulnerabilities before the pandemic, driven by the geographic concentration of component manufacturing and minerals mining, COVID lockdowns and Russia’s invasion of Ukraine introduced logistics bottlenecks and labor shortages. The hastening pace of the energy transition has triggered further complexities and introduced new uncertainties, including a precarious shortage of raw materials and components. At CERAweek by S&P Global in March, several industry leaders noted more shifts are taking place as companies put more emphasis on sustainability. Following are five dynamic factors that are affecting the sector’s supply chain, helping or hindering its security and resilience.

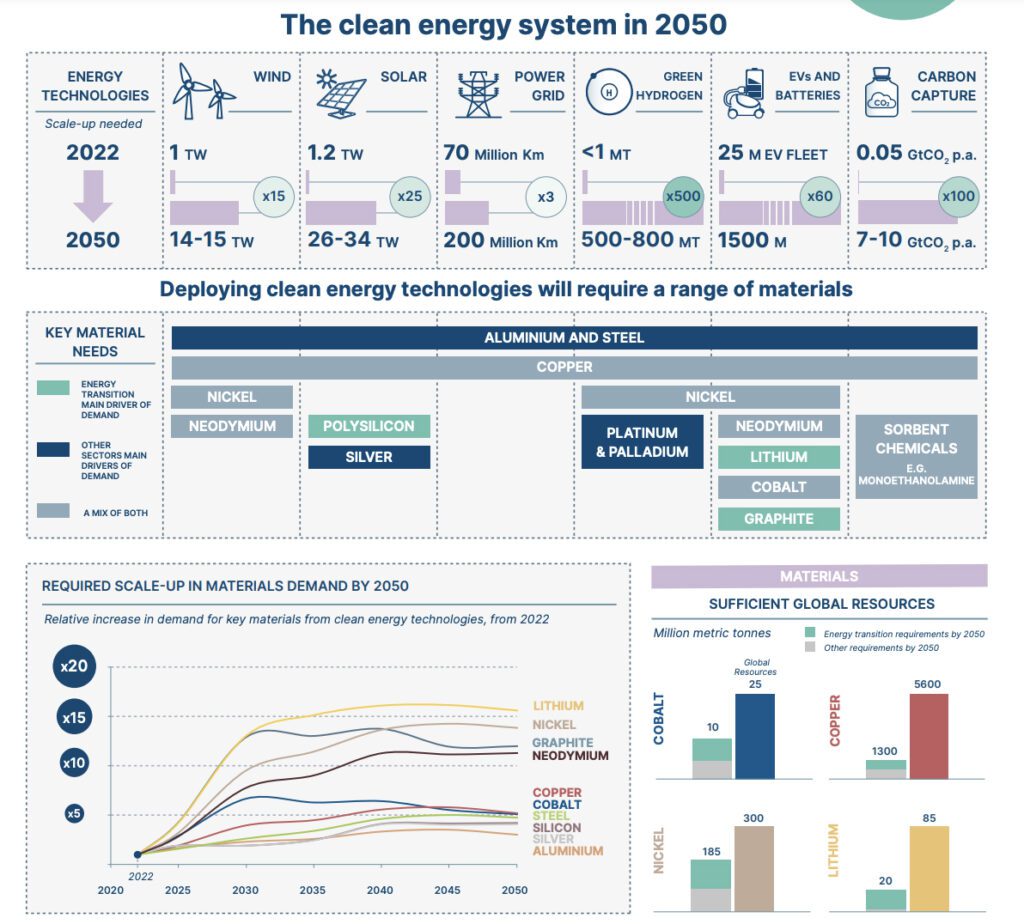

1. A Looming Scarcity of Raw Materials

Several discussions at CERAweek were dedicated to building out component manufacturing, boosting mining and production of critical minerals and materials, and committing to future demand to incentivize global investment. At one session, Jeremy Weir, executive chairman and CEO of supply chain management firm Trafigura, urged the industry to heed wildcard growth from digitalization, including artificial intelligence (AI) and up to 16 GW (for now) projected from data center growth by 2026. “That’s just pure copper, and we’re going to see significant deficits as a result of that,” he predicted.

Technology firms are taking note. “What we see for cleantech, the demand for minerals is going to grow 3.5 times to 2030,” said Tim Holt, executive board member at Siemens Energy. Siemens Energy, which manufactures wind turbines, gas turbines, hydrogen and grid equipment, and storage, is closely watching global markets for nickel, which appears to have normalized after disruptions due to the Ukraine War, and copper, which is “more critical,” he said. “I did a quick back-of-the-envelope calculation, and we at Siemens Energy buy 0.2% of the output of copper … and we are going rapidly into technologies that are using copper for wind and grid,” he said.

Competition for lithium is also ramping up, though 90% is spearheaded by the automotive industry, Holt noted. Another much-watched mineral is iridium, which will be needed as a catalyst for proton exchange membrane (PEM) electrolyzers. “Just to give you a sense, for 2 GW of electrolyzer capacity to produce green hydrogen, we need about 1 tonne of iridium. The annual production of iridium is 8 tonnes,” he said. “And the last one is rare earths, which we use in our wind turbines, especially on offshore,” he said.

According to consulting firm Deloitte, new incentives like the Inflation Reduction Act (IRA) could further drive up demand for critical minerals. “By 2035, this demand is expected to rise 15% and 13% higher than pre-IRA numbers for lithium and cobalt, respectively, which are needed for storage; 14% for nickel, which is in storage, wind, and hydrogen supply chains; and 12% for the copper needed across all energy transition technologies,” it said.

A key concern is that domestic and free-trade-agreement-country supplies that could qualify for IRA incentives are limited. China refines about half of global copper production, two-thirds of lithium, three-quarters of copper, and four-fifths of nickel. Underinvestment in mining “amid currently low prices, combined with long lead times for new projects that can stretch over a decade, could yield yawning supply gaps. Shortages ranging from 10% to 40% across these minerals are expected by 2030,” Deloitte warned.

2. Approaches to Supply Chain Management Are Shifting

So far, the crunch is already affecting every aspect of the power industry. But while it is exacerbating competition for materials and talent, collaboration is also emerging as a pivotal new attribute to effectively handle constraints.

As Anthony Allard, Hitachi Energy’s executive vice president and head of North America, told POWER in March, the necessary build-out of more efficient transmission lines, including high-voltage direct-current (HVDC) systems, relies heavily on specialized long-lead components, such as transformers and valves. “We are clearly investing really around the world in every single one of the [top bottlenecks],” he said. “But still, that’s not enough. We see that the gap between supply and demand remains, and that’s why we need to talk to our customers as an industry in terms of: ‘We have a limited supply, but how can we optimize the use of it?’ ”

Allard suggested one solution to overcome material shortages while accelerating infrastructure projects could come from creating more standardized and repeatable processes for large infrastructure initiatives. By building more projects simultaneously in a more streamlined fashion, as well as ensuring a secure supply of critical components through strategic partnerships and agreements, the industry can more efficiently scale up its project execution capabilities, he suggested.

GE Vernova, a major global original equipment manufacturer (OEM), also cites collaboration as a key attribute as it meets heightened demand for components. The company’s strategy emphasizes continuous improvement and problem-solving under a “lean” culture. “I think the only constant in the supply chain is that it’s constantly changing,” Dan Garceau, GE Vernova’s chief supply chain officer, said during the company’s inaugural investor day in March. “We’ve kind of taken the approach, let’s control what we can control, which is our end-to-end supply chain, including our partners, our suppliers, our supply base.”

For the gas component side of its business, for example, it has worked with one of its suppliers to address supply signals, which has enabled the supplier to set up “lean production cells” that support GE Vernova’s needs, Garceau said. “So we’ve improved our service levels from the suppliers and decreased operational costs, both within GE Vernova as well as the supply base. In this specific example, they reduced lead time by over 50%. And at the same time, we took about 50% of the inventory out of the system. And we have this stabilized fulfillment now.”

The stakes are perhaps higher for engineering, procurement, and construction (EPC) companies. The global supply chain “is not as bad as it was for the last few years, but it’s still not as predictable as it was going in 2018–2019,” Paul Marsden, president of Bechtel Energy, noted at CERAweek. “As the world electrifies, there’s still a lot of distress in the electrical supply chain, and based on the capacity available to make what everybody wants, it’s still choked over. That’s still a challenge for an EPC, an integrator of these facilities, to stand in front of the whole supply chain.”

How the industry will sustain growth also remains a crucial concern, he suggested. “I think the IRA certainly creates an incentive that stimulates innovation, but the challenge we still see is subsidy on a long-term basis is not sustainable.” Marsden suggested the industry will need to be “innovative with how we share the risk as this climate continues,” which could go on for another three to five years. “If another global level disruptor happens during that timeframe, we would be yet again stepping back, and it will get complicated once again,” he said.

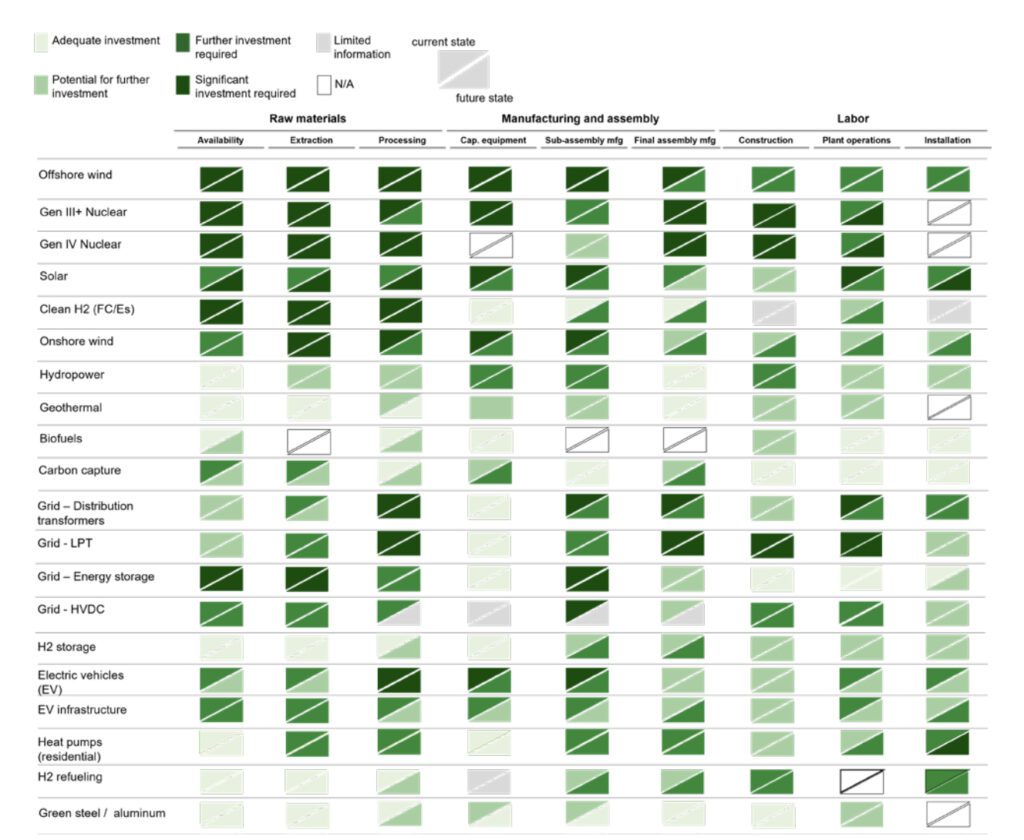

For now, at least, incentives, like those from the IRA, appear poised to enhance supply chain resilience in the solar and storage sectors. That’s despite challenges, such as overcapacity and regulatory adjustments, affecting imports and domestic content qualification. The outlook is dimmer for offshore wind, owing to component material costs and inflation that have sent offshore wind investment costs surging, prompting some turmoil in the sector. Efforts, however, are underway to ramp up manufacturing facilities, dedicated vessels, and ports. Another emerging trend that Deloitte pointed out in January is that renewable companies are pursuing “strategic reshoring joint ventures to secure a stake in the emerging domestic supply chain.”

Meanwhile, given the urgency for new, reliable, and decarbonized capacity, the nuclear industry is also working to ramp up a robust, competitive, and potentially adaptive supply chain for materials, components, and fuel. A key priority for the nuclear sector, according to the World Nuclear Association, is to procure market signals for new projects—including advanced reactors—and simplify procurement models to give suppliers a greater line of sight of tenders.

Another objective has been to analyze recent nuclear plant construction projects to develop a stronger and more agile supply chain, including through best practices. The highly regulated industry, however, is also pushing to streamline licensing processes and harmonize technical regulations and supplier requirements. All these factors will rely heavily on collaboration to fill gaps and mitigate bottlenecks across projects and suppliers.

Still, the OECD Nuclear Energy Agency (NEA) at a recent nuclear supply chain workshop it hosted alongside the World Nuclear Association in March suggested reviving nuclear deployment faces steep challenges. Prominent gaps include a declining number of nuclear-grade suppliers and a loss of skills in some regions. Supply chain development, particularly for advanced nuclear, will require a strong emphasis on quality delivery, which will require strengthened management of advanced manufacturing and commercial-grade procurement. It will also require a keen awareness of continued risks “associated with counterfeit and fraudulent activities and potential methods to mitigate risks in a constantly changing environment,” it said.

Other gaps include securing critical minerals and materials for advanced fuels. Adequate fuel procurement remains a key priority and it has been recently boosted by government efforts. For example, while the existing U.S. fleet runs on uranium fuel enriched up to 5% with uranium-235 (U-235), the Department of Energy (DOE) has ramped up efforts—furnished with $700 million from the IRA—to build out a domestic supply of high-assay, low-enriched uranium (HALEU). HALEU development is underway in the UK, too. Finally, over the long term, the nuclear industry will need to address gaps related to nuclear waste disposal and the simultaneous decommissioning of many U.S. nuclear plants.

3. The Focus on Environmental Sustainability Is Growing

Another glaring new requirement voiced repeatedly at CERAweek relates to power entity environmental, social, and governance (ESG) initiatives. The event in Houston was notably held just days after the U.S. Securities and Exchange Commission (SEC) adopted final rules designed to enhance public company disclosures related to risks and impacts of climate-related matters. (The final rule was was officially put on pause on April 8 given several lawsuits challenging the climate disclosure requirements have been consolidated in a federal appeals court). While the final rule eliminated its proposed reporting of Scope 3 greenhouse gas (GHG) emissions (including from a company’s supply chain), it requires large accelerated and accelerated filers to disclose, starting in 2025, their Scope 1 (direct emissions) and Scope 2 (indirect emissions caused through energy consumption).

Parts of the power industry, like investor-owned utilities, have embraced ESG initiatives, and some are already developing capabilities to build a circular economy. According to the Sustainable Supply Chain Alliance (SSCA)—an organization of utilities and suppliers that work together to advance sustainable supply chain practices—ESG is “defined by the growing importance of procurement practices and decisions, consolidation of related disclosure standards and regulations, and increasing interest of stakeholders in supply chain sustainability.”

The group pointed to Dominion Energy’s 2023-deployed Supplier Sustainability Index (SSI) tool as just one example of how utilities are leveraging ESG data to better inform engagement strategies and risk assessment capabilities. More companies may follow suit, the organization predicted. “The SSCA is witnessing a noticeable shift in the criteria used by members transitioning from a focus on understanding ESG topics in a broad sense to a strong inclination toward practical tools and resources for effectively implementing and addressing ESG considerations in value chain design and decision-making.”

One reason for this, it notes, is because “in the face of unprecedented levels of supply chain disruption, utilities are increasingly acknowledging the vital nexus between ESG principles and the effective mitigation of potential vulnerabilities.”

A Solid New Role Is Emerging for the ‘Value Chain’As energy demands evolve and industries around the world urgently transform their operational models to prioritize sustainability, a striking focus is being placed on building out the “value chain” over the traditional “supply chain.” Unlike supply chains, which focus primarily on the logistics of production and delivery, value chains encompass the full lifecycle of a product—from design through production to consumption and reuse—ensuring that each step adds value. “A value chain represents a sequence of values. For instance, consider the large-scale development of renewable energy, ammonia production, and transportation from ports via tankers. If you only look at one segment at a time, it is essentially a supply chain,” explained Masato Otaki, executive officer, senior operating officer of Japanese generation giant JERA’s Optimization Department, in a recent interview. “We believe that by getting involved in each of these segments, we can create a value chain that has the potential to enrich society more broadly than just focusing on a single domain.” The prospect applies to other crucial end-use materials, such as liquefied natural gas (LNG), a fuel on which Japan is heavily reliant but must import. “If we only have a receiving terminal and wait for the oil majors to deliver the LNG to us for power generation, we will not be able to grasp the cost structure and supply capacity, and we may end up relying on others to procure LNG in an economically efficient and stable manner,” Otaki said. “More importantly, that approach wouldn’t expand our business reach, nor would it foster innovation. The scope of the value we could offer society would become exceedingly narrow.” Beyond resiliency and sustainability, value chains help boost collaboration across multiple sectors, effecting a “ripple effect” that fosters economic growth at each stage of the production process. The U.S. Department of Energy’s (DOE’s) Industrial Efficiency and Decarbonization Office (IEDO), for example, is actively working to create value chains that integrate various stages of the chemicals value chain in an effort to improve existing processes as well as pioneer new methods that could revolutionize how industrial chemicals are produced, handled, and used. The chemicals industry currently converts raw materials into more than 70,000 different products, the DOE noted in March. “Due to [their] complex supply chain, reducing emissions from the production of high-volume chemicals can only address a portion of our larger decarbonization solution,” it said. “Connections must also be made at multiple steps down the value chain to build pathways from feedstocks to final products like specialty chemicals, thermoplastics, and textiles. For example, changes to upstream chemicals from sustainable feedstocks or from advanced production methods, such as electrochemical and membrane reactors, must be compatible with downstream processes.” |

4. Digitalization’s Potential Impact

The last decade, meanwhile, has ushered in more digitalization of the sector’s supply chain. Use cases are still overwhelmingly focused on automation, including the collection, communication, and treatment of information. However, more companies are also using digital twin technology and artificial intelligence (AI) as predictive analytics tools, for example, to track and order inventory more efficiently, address maintenance issues, and assess pricing data to improve supply chain risk management. Emerging technologies like blockchain, meanwhile, promise overhauls for traditional supply chain pain points, like real-time tracking, traceability, and resource allocation.

Professional services firm PwC, in a 2023 survey, found that the energy sector is generally enthusiastic about supply chain digitalization. Although budget-constrained, the sector reports “higher levels of investment and adoption of supply chain technologies than other industries,” it said. Key focus areas planned over the next two years include cloud-based common data platforms—“likely the result of industry efforts to move large enterprise resource planning and enterprise asset management systems to cloud—as well as blockchain pilots and AI-enabled “control towers” that combine traditional supply chain planning data with real-time visibility updates from carriers and suppliers, the firm said.

So far, however, nearly 98% of industry respondents said technology investments are not fully delivering the expected results, the firm reported. One reason might be that “In this industry, processes can be deeply ingrained—and often for good reason,” it said. “However, as technology changes, those tried and true practices may need to change as well.”

The power sector, meanwhile, is acutely wary that digitalization can pose a new set of risks, given that every new digital link in the supply chain poses cybersecurity vulnerabilities. The power sector has sought to ramp up its own protections through collaborations. In the U.S., it has, for example, championed Software Bills of Materials (SBOMs), which are essentially an information technology list of ingredients in software, Alex Santos, co-founder and CEO of Fortress Information Security, recently explained to POWER.

5. An Emerging but Serious Risk: Labor Shortages

Finally, labor issues are emerging as a compelling sticking point for the power and manufacturing industries. Workforce shortages requiring specialized skills can severely affect the production and logistics sectors, causing delays in manufacturing, distribution, and delivery. Quality and productivity are also key concerns.

For the power sector, the urgency to cultivate a sizeable workforce is especially amplified, given new incentives that promise to expand the market. The University of Massachusetts Amherst Political Economy Research Institute (PERI) has found investments in the three major economic policy laws enacted between 2021 and 2022—the IRA, the Bipartisan Infrastructure Law, and the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act—will generate, in total, an average of nearly 3 million jobs per year. However, the group has also identified stringent labor shortages, particularly concentrated in the construction and manufacturing sectors.

Labor shortages have only grown more profound. An April 2024–released report from the National Association of Manufacturers (NAM) and Deloitte found that the net need for new employees in manufacturing could be around 3.8 million between 2024 and 2033. “Around half of these open jobs (1.9 million) could remain unfilled if manufacturers are not able to address the skills gap and the applicant gap,” it says.

The report—which is based on the sixth (2024) manufacturing talent study conducted by Deloitte and NAM education affiliate The Manufacturing Institute—highlights three key themes. Industry’s growth is increasing demand for workers at all levels, from entry-level to engineers, while skill requirements are evolving to include technical, digital, and soft skills, it notes. However, “There is a shortage of potential candidates applying for positions—whether skilled or unskilled—and manufacturers need to retain the valuable talent they have.” The recent report also notes that “Attracting and retaining talent is the primary business challenge indicated by over 65% of respondents” in the NAM outlook survey for the first quarter of 2024.

The DOE suggests the mismatch in labor demand and supply can be pinned to several factors. These include a “wide range of social, economic, technological, and demographic factors that include declining wages in the manufacturing sector, increasing precarity of jobs, a lack of investment in worker skill development, an aging workforce, and changes in workforce preferences,” it said.

For now, both the private and public sectors are working to address the mismatch. The DOE notes the three bills are designed to promote workforce development. The agency itself has several program offices that are focused on building a clean energy workforce.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).

Updated (May 1): Includes edits to reflect more current details about labor shortages in manufacturing, which are sourced from a report released on April 3, 2024, by Deloitte and NAM. The report shares findings from the entities’ sixth and most recent manufacturing talent study (which began in December 2023). This article had previously cited materials from the previous (fifth) manufacturing and talent study, whose conclusions were based on surveys fielded between December 2020 and February 2021.