Ontario Green Lights Nuclear Refurbishment of Pickering CANDU Units

Ontario Power Generation (OPG) will refurbish four units at the Pickering Nuclear Generating Station, Canada’s first major commercial generation plant— marking a major turnaround for the 3.1-GW plant slated to close by 2025.

Officials from Ontario’s government and OPG on Jan. 30 announced plans to refurbish Units 5–8 at the massive power plant east of Toronto, citing energy adequacy and affordability concerns as the province sets out to decarbonize its system by 2040.

Once entirely refurbished by the mid-2030s, the Pickering station will have a 2 GW capacity, officials said on Tuesday. OPG intends to kick off the massive project this year with the project initiation phase, which includes engineering and design work, as well as securing long-lead components.

According to Ontario Minister of Energy Todd Smith, the project will initiate with C$2 billion (US$1.49 billion), providing funding for scoping engineering design work that is expected to begin “over the next year or so.” He suggested that the scoping and engineering work is expected to inform OPG’s future steps, including a firm schedule and accurate cost estimates.

A Big Step that Staves Off an Imminent Closure

The 3.1-GW Pickering station in Ontario comprises six CANDU reactors at two distinct facilities—Pickering A (Units 1–4) and Pickering B (Units 5–8). The Pickering A units came online between 1971 and 1973 but were voluntarily removed from service in 1997. Units 1 and 4, however, were refurbished and returned to operation in November 2005 and September 2003, respectively. Pickering B—Units 5 through 8—began operating between 1983 and 1986.

While the plant supplies about 14% of Ontario’s needs, OPG has sought to shutter Units 1–4 at Pickering A in 2024, when the units’ current license granted by the Canadian Nuclear Safety Commission (CNSC) ends. However, acknowledging a need for additional electricity through 2026, the utility in September 2022 kicked off a process to seek regulatory approval to operate Pickering B—Units 5–8—through September 2026.

Ontario had then asked OPG—a Crown corporation wholly owned by the province—to update its feasibility and cost assessment (last conducted between 2006 and 2009) for refurbishing the units to help meet the province’s growing needs. While OPG has acknowledged further operation of the plant beyond 2026 would require a “complete refurbishment,” it has underscored refurbishment could result in an additional 30 years of power from the facility.

Pickering Refurbishment Will Be Modeled on Similar Projects at Darlington, Bruce

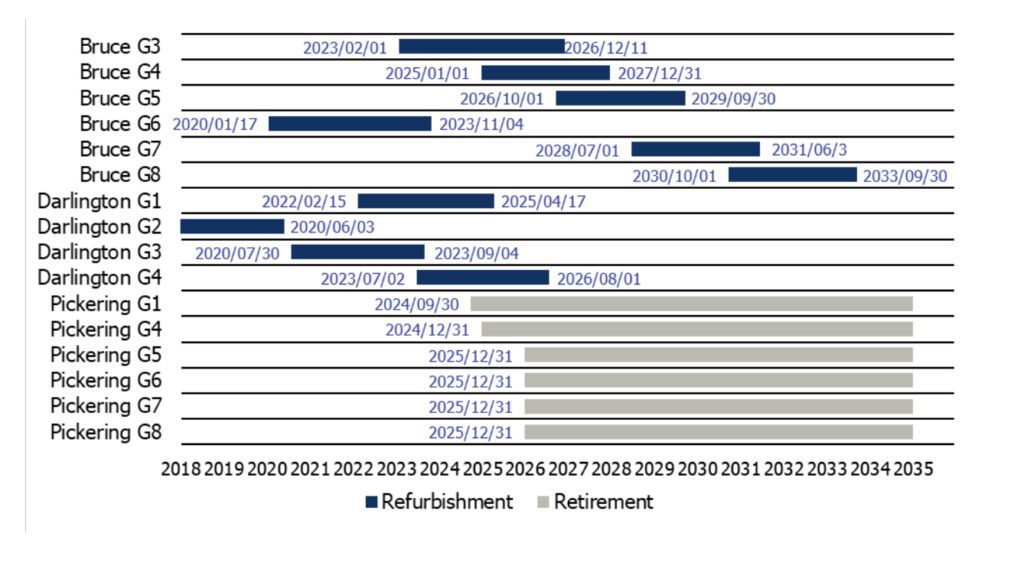

On Tuesday, OPG CEO Ken Hartwick noted that all units at Ontario’s other two nuclear facilities—Darlington and Bruce Nuclear generating stations—are scheduled for or have completed refurbishment.

“Over the past 10 years, we have learned a lot about what it takes to refurbish a nuclear station the right way—with thousands of lessons learned from Darlington and Bruce Power that we will apply to Pickering. And we have mobilized an experienced nuclear workforce. We have a robust nuclear supply chain that is already tooled up and rolling,” Hartwick said. “In short, we have all the tools, talent, and experience to make Pickering refurb as successful as Darlington refurb, and we intend to advance this in a similar manner.”

Pickering will also benefit from prior engagement with the CNSC that OPG initiated to allow Pickering B to operate through 2026, Hartwick noted. “So there’s a very established and mature regulator that we have to work with, which gives us confidence that ultimately we’ll be in a place that can achieve the necessary regulatory approvals to be successful.”

While total project costs to refurbish Pickering remain unclear until the utility can establish a firm schedule, Hartwick noted that the provincial government, OPG’s sole shareholder, will hold it accountable to schedule and cost estimations. “But again, we remain very confident that this will be a very competitive source of energy for the province as we go forward,” he said.

Ontario Minister of Energy Smith on Tuesday said the decision to move forward with Pickering’s refurbishment was based both on OPG’s feasibility study and analysis by Ontario’s grid operator, Independent Electricity System Operator (IESO), to compare the Pickering refurbishment to adding renewables paired with battery storage.

The analysis found that to replace Pickering’s power, the province would need 18,000 MW of wind and 2,000 MW of battery storage, he said. “What they found was [the refurbishment], by far, made the most sense. This was what was going to be the best bang for the buck and provide the certainty that ratepayers in the province are looking for,” he said.

Pickering Recently Achieved ‘Best Performance in its History’

Hartwick on Tuesday underscored Pickering has operated reliably and safely despite the looming closure of Pickering A units. According to OPG, in 2023, Pickering produced 21.5 TWh, recording its highest generation output since 2019 (and its second-highest output as a six-unit station).“In the last few years, the station has achieved its best performance in its history. In 2022, all six operating units ran simultaneously to supply energy for 109 consecutive days, a station record. And in 2020, Pickering’s Unit 4 experienced a record consecutive run of 730 days. Both feats are a testament to the station’s continued reliability,” it said.

The station also produces around 20% of the world’s supply of Cobalt-60, a medical isotope used to irradiate and sterilize single-use medical devices like syringes, gloves, implants, and surgical instruments. The isotope emits gamma radiation, which makes it ideal for enhancing the safety of medical products and perishable foods such as fruits, meats, and spices, OPG explains. Cobalt-60 is extracted from reactors at Pickering and Bruce Power’s Bruce B plant every 24 to 30 months.

According to Canadians for Nuclear Energy (C4NE), a grassroots non-profit led by Dr. Chris Keefer that advocated for Pickering’s refurbishment, the station’s importance has grown since 2009, when OPG decided to forgo Pickering B’s refurbishment. The 2009 decision was based “in part to conserve resources for refurbishments at Darlington as well as an anticipated new CANDU build at Darlington B that was ultimately canceled in 2013. At the time, it looked like there were supply alternatives,” C4NE noted in a 2022 detailed report, Save Pickering.

The report notes that a series of significant developments have since added new pressures on OPG. “Facing new challenges, it no longer makes sense from a climate and electrification perspective to dismantle hard-earned, reliable, low-carbon energy infrastructure at a time when Ontario’s secure energy future depends on crisis-level mobilization toward new capacity procurements,” it says.

In 2020, OPG set out to become a net-zero carbon company by 2040. As of September 2023, the utility’s generation portfolio, a combined 18.2 GW, was served by 66 hydroelectric stations, two nuclear stations (Darlington and Pickering), a biomass station, a dual-fueled oil and gas station, and four combined cycle gas plants. Additionally, OPG owns two other nuclear generating stations in Ontario, which are leased long-term to Bruce Power.

And in 2022, forecasting a surge in demand from electrification and economic growth, OPG formally set out to build its first small modular reactor (SMR) deployment—a GE Hitachi BWRX-300 reactor—at its Darlington New Nuclear Project (DNNP) site east of Darlington Station in Bowmanville, Ontario. In July 2023, the Ontario government also announced approval to proceed with planning and licensing for three additional SMRs for a total of four SMRs (a combined 1.2 GW) at the DNNP. The first SMR is slated to be ready for commercial operation in 2029, and the others could be built by 2036.

Ontario Facing Supply Shortfalls in the 2030s

But while OPG’s new nuclear units could substantially bolster the grid over the medium term, Ontario clearly needs to prepare diligently to meet a coming onslaught of new power demand.

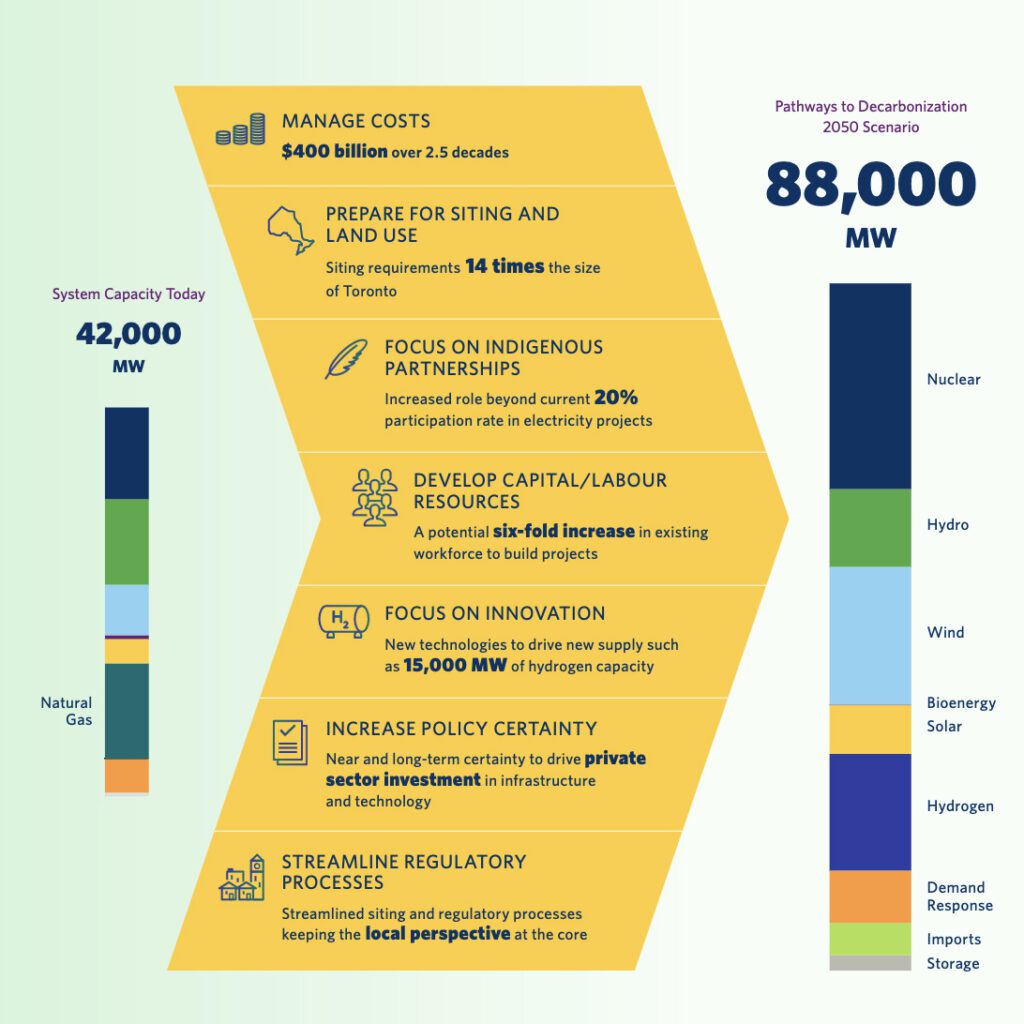

In its most recent Annual Planning Outlook (APO), the IESO projects demand will grow at an average annual rate of 1.9%, fueled by population growth, electric vehicle adoption, and industrial sector growth that electrifying or supporting electrification. IESO’s December 2022–released Pathways to Decarbonization (P2D), meanwhile, suggests that Ontario’s power system capacity requirement could more than double from 42 GW today to 88 GW by 2050. “This means that Ontario may be required to build upwards of 69,000 MW of new generation by 2050 to ensure that a reliable and operable electricity system is maintained,” IESO stressed.

“As we look at our needs forecast and our options to address them, we’re starting to see significant uncertainty on the supply side,” said David Devereaux, IESO director of Resource Planning, during a public webinar on Jan. 25. “We’re already starting to see challenges in managing outages through a period of tight supply. We are already there with the refurbishments in flight, and it’s getting very challenging to have outages in the summer, in particular,” he warned. Securing adequate supply will become even more critical as Ontario’s system evolves into a winter-peaking system (by 2036, as the APO projects), he suggested.

It means that while Ontario expects to be “sufficient” until the late 2020s, a “significant need” for energy will start to arise through the 2030s, said Devereaux. Over the last decade, “much of our need has been characterized by our peaking need that could be addressed through hourly products,” he explained. However, “this is evolving into a need for sustained energy production, and a big driver of this is the retirement of the Pickering plant.”

Canada’s Proposed Clean Electricity Mandate Could Exacerbate Ontario’s Supply Outlook

Compounding Ontario’s prospects, however, are Canada’s proposed Clean Electricity Regulations (CER). The federal rules are poised to limit carbon emissions from fossil-fired power plants to eliminate emitting sources in Canada’s public electricity grids. A draft rule proposed in August 2023 is expected to be finalized this year and could come into force by January 2025.

While Ontario’s power system is already almost 90% emissions-free, recent IESO studies found that 8 GW of natural gas generation—representing about 17% of Ontario’s total projected installed capacity—will need to remain available in 2035 to maintain system reliability. The grid operator notes that gas generation represents about 10.5 GW, or 28% of Ontario’s total installed capacity.

“The CER, as drafted, will severely restrict the ability of the natural gas generating fleet to contribute to these reliability needs, creating a significant capacity deficit for Ontario’s system,” IESO said in response to the proposed rule in November 2023. “Currently, there are no like-for-like replacements, at scale and with similar operating flexibility, for natural gas generation on the system.”

Still, Ontario has already set out to explore alternatives, including to develop a “robust energy storage fleet,” the grid operator says. That includes contracts to build almost 1,000 MW of battery storage by 2026 and a further 1,600 MW of storage capacity by 2035. “The plan has also led to the province initiating work on four new small modular reactors (SMR) at Darlington Nuclear Generating Station, as well as examining the opportunity for the refurbishment of the four nuclear-generating units at Pickering B and developing new nuclear generation at the Bruce site,” it noted.

Work is also moving forward to tap into distributed energy resources so small-scale generation, flexible load, and storage in distribution networks can participate in the energy market. At the same time, IESO is investing in hydrogen and low-carbon fuels “to determine how they can provide flexibility,” IESO said.

However, Devereaux said that carbon policy and its impact on the gas-fired fleet are just one of many uncertainties on that side of the equation. “We’ve got aging assets, refurbishment schedules, construction schedules, and the supply chain to work with. We expect to see significant competition for materials for new resources as we build out the fleet,” he noted last week. “Everyone, it seems, in the Western world is doing the same thing at the same time,” he said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).