Delving Deeper: New Optimism for Enhanced Geothermal Systems

Enhanced geothermal systems (EGS) have long held promise. New developments suggest dramatic progress may be on the horizon. Can innovation feasibly overcome technical and economic hurdles that have consistently challenged EGS?

In February 2024, the U.S. Department of Energy (DOE) unveiled the first round of its much-awaited enhanced geothermal systems (EGS) pilot demonstration selections. The agency’s Geothermal Technologies Office (GTO) at first announced three projects, but by March 2024, it appeared to have narrowed them down to two. One pilot will be spearheaded by California-headquartered Chevron New Energies and will use “innovative drilling and stimulation techniques to access geothermal energy near an existing field in Sonoma County in northern California. The other, led by Fervo Energy, will develop the Milford Renewable Energy Corridor on the western flank of the Mineral Mountains in Utah, next to the Frontier Observatory for Research in Geothermal Energy (FORGE), the DOE’s 2015-opened dedicated EGS underground field laboratory.

The GTO said the two projects will receive up to $40 million of the $84 million designated for the EGS pilot projects under the November 2021–enacted Infrastructure Act. (A third project unveiled in February, Mazama Energy’s “first-of-its-kind super-hot EGS,” would have leveraged temperatures above 375C near Newberry Volcano in Oregon and had been slated to receive $20 million; however, its status remains unclear.)

GTO told POWER in March that details of its selected projects were still under wraps, given that “project details and funding amounts are subject to change.” Negotiations, which will precede the final awards, could run between three to five years, which will entail “one or more budget periods.” At the same time, “Project continuation beyond the first budget period will be contingent upon several elements, including satisfactory performance and DOE’s Go/No-Go decision,” it said. However, the funding opportunity issued to select the projects will remain “rolling,” meaning that it may remain open for up to 48 months and provide more opportunities for the DOE’s original intention to select up to seven EGS pilots, depending on funding available. A second round of applications is in the works and should be issued soon, it noted.

An Ambitious Goal: Shave EGS Costs by 90%

Still, the GTO’s initial selections mark a crucial step forward for EGS, a long-pursued subset of geothermal technology. EGS are advanced engineered geothermal reservoirs that involve drilling deep wells underground in hot rock at temperatures of 175C to more than 300C but where there is little to no natural permeability or fluid saturation. Compared to other approaches, EGS distinctly enhances subsurface permeability via safe, well-engineered stimulation processes “that re-open preexisting fractures, create new ones or a combination of both,” explains the GTO. “These open conduits increase permeability and allow fluid to circulate throughout the hot rock. The fluid transports the otherwise stranded heat to the surface where clean, renewable electricity can be generated with current power generation technologies.”

|

|

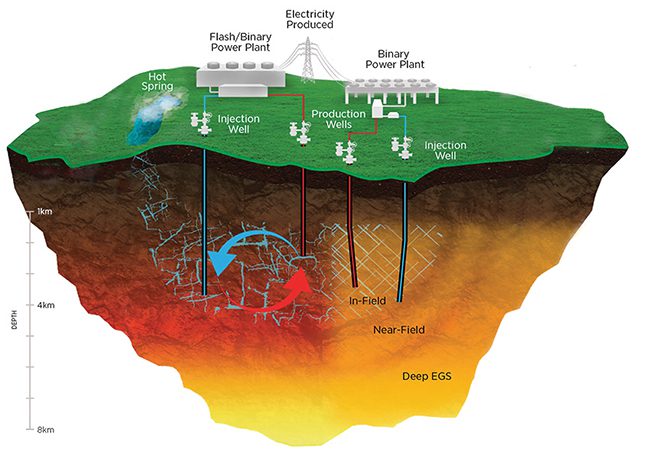

1. Much like fracking, an enhanced geothermal system (EGS) pumps liquid (often water) at high pressures into the ground in order to create a network of fissures. The water is superheated by the natural hot dry rock and then pumped to the surface. Source: U.S. Department of Energy |

According to the DOE, EGS (Figure 1) is generally categorized as near-field resources—areas around hydrothermal sites that are elevated in temperatures but lack sufficient permeability and/or in-situ fluids to be economically produced as a conventional hydrothermal resource—and deeper man-made reservoirs drilled to depths of 3 kilometers (km) to 10 km. They are thought to occur naturally everywhere on Earth.

However, although EGS has been explored since the 1970s, efforts to develop it have remained small in scale, owing mainly to insufficient reservoir volume, difficulty with drilling, and induced seismicity. Since the first EGS pilot installation at Fenton Hill in the U.S. (which ran from 1974 to 1995), experimental projects have operated at Rosemanowes in the UK; Basel in Switzerland (which, at 3 MW, has so far been the largest in the world); Pohang in South Korea; Hijiori and Ogachi in Japan; and the Habanero project in Australia. Only a few EGS projects are currently operating: the 1.7-MW Soultz-sous Forêts in France; a 1-MW installation in Groß Schönebeck in Germany, and the 27.5-MWth Rittershoffen Geothermal Heat plant in the French Upper Rhine Graben, and Google and Fervo’s recently opened Project Red.

A key source of seemingly new optimism for EGS—in the U.S., at least—stems from assessments unveiled in January 2023 by the National Renewable Energy Laboratory (NREL) that suggest there is tremendous new EGS potential compared to GTO’s 2019-issued GeoVision study. NREL posits that near-field EGS resource capacity could hover around 28 TW, while deep EGS holds a potential resource capacity of up to 7.5 TW.

NREL’s findings also point to potentially dramatic improvements in the costs of deployed EGS resources. Though the lab cautions that these vary heavily depending on geothermal resource quality and geography, as well as variations in demand and cost, it sets the range for EGS installed levelized cost of electricity (LCOE) from “a little over $30/MWhe to just under $70/MWhe.” If cost reductions—of up to 20%—are achieved in average drilling costs and increased well productivity by 2035, the capacity-weighted average LCOE of all developed deep-EGS resources could hover at $45.9/MWhe and $45.6/MWhe by 2050, the lab projects.

That analysis, notably, informed the DOE’s September 2022-announced EGS Earthshot, one of eight research, development, and demonstration initiatives launched by the Biden administration to accelerate breakthroughs for emerging technologies. The EGS Earthshot sets a target to reduce the cost of EGS by 90% to $45/MWh by 2035.

The goal, by all measures, is an ambitious one. But according to the GTO, it is achievable. “The $45/MWh target is founded in technology improvements—primarily reductions in drilling and stimulation costs, and increases in well productivity and production well flow rates—as well as larger power plants and studies to better find and characterize shallower, higher-quality EGS resources,” GTO said. While many of these improvements are “aggressive,” several of them are already happening, it noted.

New Technical Breakthroughs

A long-standing challenge that has underscored any progress for EGS has been to develop reservoir fracture networks that can deliver high hydraulic conductivity and avoid thermal short-circuiting. While the geothermal sector began to make progress as an industry in the 1960s, “all the wells drilled by the geothermal community for electricity and for EGS in the past are essentially vertical,” Dr. Joseph Moore, Utah FORGE managing principal investigator, explained to POWER. And, while EGS projects have been built all over the world, “none of them produced commercial flow rates,” ideally of up to 600 gallons per minute (gpm), he said.

Taking a page from the oil and gas industry’s horizontal drilling techniques, FORGE pioneered the first well with a high angle of deviation using a uniquely developed drill bit. It has since made quick progress. Between October 2020 and February 2021, it drilled an injection well, shattering expectations with drilling operations that finished 62 days ahead of schedule. Following stimulation activities in three stages, it began drilling the production well in April 2023. In June 2023, a University of Utah assessment indicated connectivity between the injection and production well pair.

FORGE—A Beacon for EGSIn 2014, the Department of Energy (DOE) began exploring applying emerging advances in oil and gas techniques for enhanced geothermal systems (EGS). Research efforts formally evolved into the establishment of the Frontier Observatory for Research in Geothermal Energy (FORGE), and in 2018, the DOE selected a site in Milford, Utah, as the final location for the FORGE initiative. Led by the University of Utah, the DOE’s flagship EGS laboratory today spans 5 square miles, and its primary mission is to derisk tools, said Joseph Moore, Utah FORGE managing principal investigator. “Our goal is to work at temperatures above where most oil and gas system reservoirs are, so we’re working at temperatures above 400F or 200C,” he added. “Half of our project funding is to build a field-scale laboratory, where tools can be tested, and techniques can be tested, and the other half is to [provide a venue] for research and development by private companies, national labs, consultants, by the industry to build these tools. We’re also using techniques and tools that have never been used in the geothermal industry.” FORGE has been pivotal in developing and perfecting innovative drilling techniques, reservoir stimulation technologies, injection production, and well connectivity and flow testing efforts, including via subsurface imaging, Moore noted. In addition, the site includes a seismic monitoring system, which is essential for understanding the creation and growth of the reservoir fracture network.

|

An Accelerated Learning Curve

According to GTO, FORGE’s demonstrations have been monumental for EGS. FORGE demonstrated “average on-bottom drilling rates exceeding 71 feet per hour in 2022,” it noted. And now, at least one commercial firm—Fervo Energy—is leveraging learnings gleaned at FORGE alongside years of its own research and development to add to the remarkable progress, it noted.

|

|

2. Project Red, co-developed by Fervo Energy and Google through a partnership forged in 2021 under the “world’s first corporate agreement to develop an enhanced geothermal power project,” in November 2023 began supplying power to the local grid that serves Google’s data centers in Nevada. Courtesy: Fervo Energy |

In July 2023, Houston-based Fervo reported that Project Red—a nearfield EGS well pair drilled within a high-temperature, hard-rock geothermal formation in the Blue Mountain geothermal field in Nevada—achieved lateral lengths of 3,250 feet, reaching a temperature of 376F. It also proved controlled flow through rigorous tracer testing. The pioneering 3.5-MW EGS developed with Google reportedly began producing power in November 2023 (Figure 2).

Fervo also achieved several other milestones last year. In the summer of 2023, it broke ground on its first greenfield development in Milford, next to FORGE—a project that the DOE recently selected as a federal pilot demonstration. The project will aim to produce at least 8 MW of power from three wells at the greenfield development.

Drilling also began in June 2023 at Fervo’s next EGS project, the 400-MW Cape Station, in Beaver County, Utah, which is planned to be completed by 2028. By February, Fervo reported the project had already successfully drilled one vertical and six horizontal wells in the high-temperature deep granite rock. “Though Cape wells are hotter and over 2,100 feet deeper than Project Red wells, Fervo drilled its fastest Cape well in just 21 days, a 70% reduction in drilling time from Fervo’s first horizontal well drilled at Project Red in 2022,” the company noted.

Fervo said its results at Cape Station stem from an increased rate of penetration—of an average 70 feet/hour—and the life of its drill bits. The drill bits, made of polycrystalline diamond compact (PDC), are “typically deployed in shale basins to cut through hard, abrasive granite, while mud coolers counteracted high subsurface temperatures that have historically derailed geothermal exploration,” it noted. More crucially, drilling efficiency has resulted in significant cost reductions. Fervo has reported drilling costs across the first four horizontal wells at Cape fell from $9.4 million to $4.8 million per well.

|

|

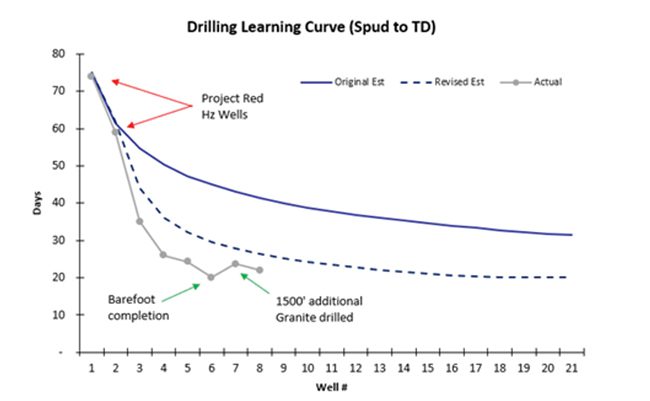

3. Fervo Energy’s enhanced geothermal system drilling learning curve, from project start (“spud”) to reaching the target depth (TD), suggests the company planned an 18% learning curve, but it has realized a 35% learning curve across all EGS projects. Courtesy: Fervo Energy |

The triumphs at FORGE and by Fervo signify “multifold increases in geothermal drilling rates of just a couple of years ago,” the GTO said. “Fervo Energy’s drilling rates already exceed DOE and National Renewable Energy Laboratory’s 2035 ‘most likely scenario’ (under the moderate Annual Technology Baseline scenario—50 feet/hour), with learning rates [Figure 3]—the speed at which they can bring down costs—ahead of DOE’s most aggressive estimates.”

The achievements have garnered Fervo a new slate of heavyweight backers, including shale oil and gas pioneer Devon Energy, Mitsubishi Heavy Industries, and several other investors. According to Fervo CEO and Co-Founder Tim Latimer, the company’s appeal lies in a unique combination of favorable factors. “Demand for around-the-clock clean energy has never been higher, and next-generation geothermal is uniquely positioned to meet this demand,” he said. “Our technology is fully de-risked, our pricing is already competitive, and our resource pipeline is vast.”

Challenges Remain for Wider Deployment

However, EGS’s wider deployment may still be challenged. Experts generally agree that, as with most other emerging power technologies, EGS power costs are currently not adequately characterized. The NREL in 2023 suggested average overnight capital costs for near-hydrothermal field EGS range widely, between $7,770/kW and $22,501/kW, and for deep EGS (3 km to 6 km), between $20,848/kW and $49,155/kW.

For the most part, cost uncertainty still appears rooted in unknowns related to well flow rates and the cost of deep geothermal drilling. “Drilling a single geothermal well can cost millions of dollars, and drilling can exceed 50% of a project’s total costs,” the GTO noted. “In addition, EGS depths are 4,000 to more than 10,000 feet in the subsurface, meaning longer and harsher drilling conditions. Improving drilling times, reducing drilling costs, and refining stimulation approaches are critical,” it said.

Other challenges include inherent risks in the time and cost involved in identifying resources and drilling to access them. The emergence of closed-loop systems may reduce this risk “because inherent geologic risks can be addressed through engineering improvements,” the GTO said. Protracted permitting timelines for EGS may also prolong project development, which poses hurdles for financing.

In addition, EGS projects depend on the time needed for development and the cost of associated materials. “EGS environments are hot, hard, corrosive, and abrasive, requiring improved or innovative materials and components that can withstand the subsurface environment,” the GTO noted. “Drilling improvements are showing a marked improvement in drilling times; however, material costs remain an important topic and can be addressed through improved materials or alternative development methods,” it said. Over the longer term, more and larger wells will play a significant role in reducing EGS costs, “so continuing to reduce casing and cement costs is vital.”

Cost considerations are especially paramount given that EGS’s future role in a decarbonized power system will likely be as baseload generation. EGS has been mostly viewed as baseload because “these plants tend to have high fixed costs and near-zero variable costs, and derive few if any benefits from curtailing output,” wrote researchers from Princeton University and Fervo in a January 2024 article published in the journal Nature. However, even with well-designed and successfully engineered reservoirs, EGS power plants could achieve capital costs on the order of $5,000/kW to $6,000/kW using current state-of-the-art drilling and power plant technology, they said. Major advances in deep drilling and high-temperature reservoir engineering could enable a better cost profile of as low as $3,000/kW, but even in that case, EGS deployment could still be limited to about 100 GW in “cost-optimized systems,” they added.

A more feasible pathway by which EGS could increase the average value of energy is through flexible operation, the researchers argued. While a flexible EGS plant will likely have a higher LCOE than an inflexible one, the “increased cost is more than made up for by an increase in system value, and by extension revenue,” they said. “The added value from flexibility can enable EGS deployment in scenarios where it would otherwise fail to find a market, including in partially decarbonized electricity systems where round-the-clock clean power is not yet fully valued. The ability to gain an early commercial foothold will be critical for an emerging technology like EGSs, which could see large cost reductions through learning by doing as adoption increases.”

Some EGS startups are already exploring a pronounced role for flexibility. In February, Houston-based Sage Geosystems outlined plans to build and begin operating its first 3-MW EarthStore facility by November. Sage’s EarthStore system is a Geopressured Geothermal System (GGS), which means it uses mechanical energy storage technology that harvests the pressure energy of the fluid and is also enhanced by the heat of an EGS well design, Sage CEO Cindy Taff explained to POWER.

The facility will be based on a full-scale commercial pilot that Sage demonstrated in Texas last year. The pilot produced 200 kW for more than 18 hours (long-duration) and 1 MW for 30 minutes (load-following) with Pelton turbines, with a round-trip efficiency of up to 75% and water losses of less than 2%.

“The depths of the energy storage are going to be between 7,000 and 12,000 feet (2.1 km to 3.7 km),” she said. “It’s applicable for depths around 16,000 feet to 20,000 feet, and we’re really looking for the temperature of the formation, 150C or greater,” she explained. “What differentiates the GGS is not only are we harvesting that heat from the system from the water that we pump into the ground, but we’re also harvesting the pressure. All other geothermal systems vent the pressure, but that pressure is an energy component. Our modeling says that if you don’t vent the pressure, you’re going to have a net output that’s 25% to 50% higher.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).