MISO Warns ‘Immediate and Serious’ Challenges Are Threatening Reliability

The Midcontinent Independent System Operator (MISO) is warning reliability challenges have grown urgent as the nation’s power system grapples with a “hyper-complex risk environment.”

The grid operator that serves 15 U.S. states and the Canadian province of Manitoba, in its updated Reliability Imperative report released on Feb. 22, flagged several critical challenges that the region faces. The risks, ranging from fleet changes to new complexities related to regulatory incentives and fuel assurances, have been rendered more complex by extreme weather events, load additions, and incremental load growth, it said.

“We have to face some hard realities,” wrote MISO CEO John Bear in the report. “Studies conducted by MISO and other entities indicate it is possible to reliably operate an electric system that has far fewer conventional power plants and far more zero-carbon resources than we have today. However, the transition that is underway to get to a decarbonized end state is posing material, adverse challenges to electric reliability,” he stressed.

Several Immediate and Serious Challenges

The report serves as a stark call to the regional transmission organization (RTO’s) members and states to recognize and address headwinds facing the U.S. power system. While the North American Electric Reliability Corporation (NERC) suggests the bulk power system has generally remained highly reliable and resilient, in recent years, NERC has amplified its efforts to raise awareness of the evolving and often interdependent risks that threaten it.

Along with a series of dismal seasonal outlooks—including for both the summer and winter—that underscore vulnerabilities posed by extreme weather, the designated North American Electric Reliability Organization (ERO) has warned of rising forced outages at conventional generators given new operational demands, falling reserve margins, and surging peak demand. In August 2023, NERC, for the first time, added “energy policy” to its list of “significant evolving and interdependent risks” to grid reliability. The list already comprised the grid transformation, resilience to extreme events, security risks, and critical infrastructure interdependencies.

In its report, MISO describes these challenges as a “hyper-complex risk environment,” a term coined by NERC to describe evolving and interdependent risks. Their impact is widespread, MISO suggested. “There are urgent and complex challenges to electric system reliability in the MISO region and elsewhere. This is not just MISO’s view; it is a well-documented conclusion throughout the electric industry,” it notes.

A Shifting Power Profile

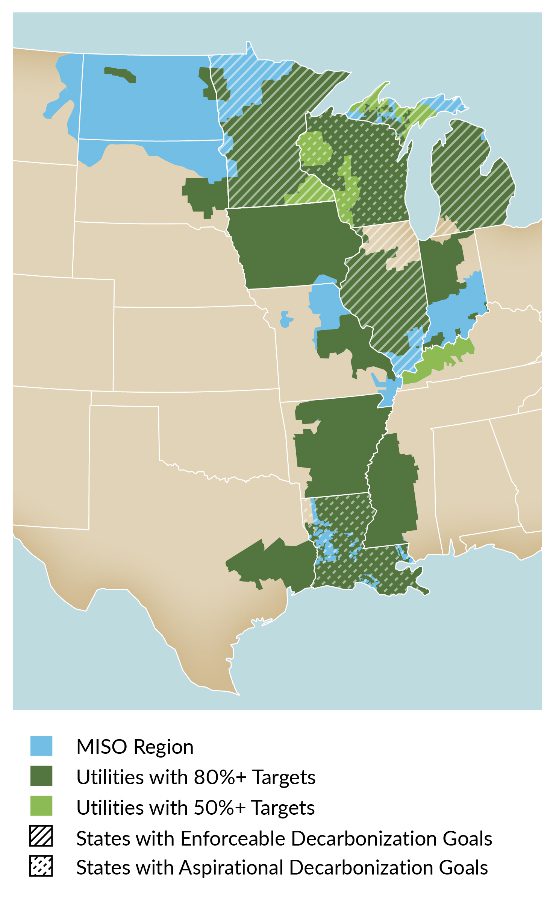

Echoing other grid operators, MISO notes about 75% of the region’s total load is now served by utilities that have unveiled ambitious decarbonization and renewable goals. “Without question, utilities and states are making remarkable progress toward their goals. Carbon emissions in MISO have already declined more than 30% since 2005, and far greater reductions are expected going forward,” the report notes.

Today, wind and solar make up about 20% of the region’s total energy. A MISO modeling scenario reflecting all the publicly announced utility and state clean-energy goals, however, suggests that wind and solar could serve 80% of the region’s annual load by 2042. “Fleet change of that magnitude would foster a 96% reduction in carbon emissions compared to 2005 levels—which would be an extraordinary accomplishment for a region that was predominately reliant on fossil fuels not that long ago,” the report says.

In its December 2023-issued Long-Term Reliability Assessment (LTRA), NERC meanwhile suggests over the past year, MISO saw coal and nuclear capacity retirements of 300 MW and 140 MW, respectively. New wind and wind accreditation increased by 725 MW, while solar PV and solar PV accreditation increased by 920 MW. New gas-fired capacity and increased output from existing units made up the largest capacity additions—of more than 4 GW.

Last year, MISO transitioned to its first year of seasonal capacity auctions (summer, fall, winter, spring), providing a better understanding of non-summer risks. However, while NERC expects that MISO will maintain reserve margins for the next three years, it projects MISO could face a 4.7 GW shortfall beginning in 2028 if expected generator retirements occur—despite the addition of new resources that total over 12 GW.

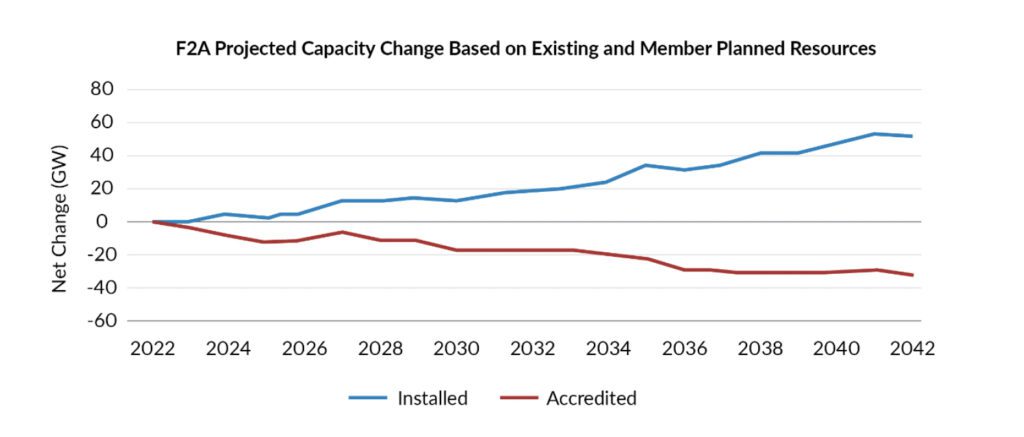

Accredited Capacity Forecast to Decline by a Net 32 GW by 2042

MISO points out that the mismatch is “because the new resources that are being built have significantly lower accreditation values than the older resources that are retiring.” One scenario that reflects utility and state publicly announced decarbonization plans suggests the region’s installed capacity is forecast to increase by nearly 60 GW from 2022 to 2042, mainly due to new wind and solar. At the same time, owing to lower accreditation values, the region’s level of accredited capacity is forecast to decline by a net 32 GW by 2042.

Meanwhile, a 2023 MISO survey suggests that the region’s level of “committed” resources will decline going forward, with a “potential shortfall of 2.1 GW occurring as soon as 2025 and growing larger over time,” the report says.

These factors paint a dire picture. “MISO modeling indicates that a reduction of that magnitude could result in load interruptions of three to four hours in length for 13-26 days per year when energy output from wind and solar resources is reduced or unavailable,” the report notes. “Such interruptions would most likely occur after sunset on hot summer days with low wind output and on cold winter days before sunrise and after sunset.”

Supply Chain, Permitting Delays Compounding Additions

The dynamics compound MISO’s efforts to overcome tight supply. Over the last 10 years, “surplus reserve margins in MISO have been exhausted through load growth and unit retirements,” the report says. Since 2022, MISO has been operating near minimum reserve margin requirements.

“While MISO has implemented several reforms to help avert near-term risk, more work is urgently needed to mitigate reliability concerns in the coming years. In fact, the region only averted a capacity shortfall in 2023 because some planned generation retirements were postponed and some additional capacity was made available to MISO,” it said.

At the same time, MISO, like other grid operators, is grappling with project delays. “As of late 2023, about 25 GW of fully approved generation projects in MISO’s Generator Interconnection Queue had missed their in-service deadlines by an average of 650 days, with developers citing supply chain and permitting issues as the two biggest reasons for the delays,” it said. “An additional 25 GW of fully approved queue projects had not yet missed their in-service deadlines as of late 2023, but MISO expects many of them will also be delayed by external factors.”

Mass Replacement of Dispatchable Resources

However, the lack of supply diversity is also a point of concern, MISO says. It notes that “urgent action” is needed to avoid a looming shortage of broader system reliability attributes, including system adequacy, flexibility, and system stability.

“No single type of resource provides every needed system attribute; the needs of the system have always been met by a fleet of diverse resources. However, in many instances, the new weather-dependent resources that are being built today do not have the same characteristics as the dispatchable resources they are replacing,” it says.

While studies show “it is possible to reliably operate the system with substantially lower levels of dispatchable resources, the transformational changes require MISO and its members to study, measure, incentivize and implement changes to ensure that new resources provide adequate levels of the needed system attributes,” it added.

However, the grid operator also pointed to transition-related risks that affect its existing fleet. Most concern fuel assurances. “Coal supplies have tightened in recent years due to a confluence of factors, including contraction of the mining and transportation sectors and supply chain issues. These factors increase the risk that coal plants will be unable to perform due to a lack of fuel availability,” it noted.

Gas-fired resources, meanwhile, are also subject to fuel-assurance risks because “they rely on pipelines to deliver gas to them,” it said. “However, because the pipeline system was largely built for home-heating and manufacturing purposes, gas power plants sometimes face very challenging economic conditions to procure the fuel they need to operate.”

Some renewables, too, also face “fuel availability challenges.” The energy output of wind “can fluctuate significantly on a day-to-day and even an hour-by-hour basis—including multi-day periods when output drops far below average,” the report notes. Over 60 consecutive days in January-February 2020, for example, hourly wind output in MISO averaged more than 8,000 MW. “For 40 consecutive hours in the middle of that 60-day block, average hourly wind output dropped to less than 47 MW, and only once exceeded 200 MW in any single hour,” MISO noted.

The grid experienced an even longer and broader “wind drought” during Winter Storm Uri in 2021 when the MISO, Southwest Power Pool, Electric Reliability Council of Texas and PJM regions “all experienced 12 consecutive days of low wind output,” it noted.

In the future, some emerging technologies—including long-duration battery storage, carbon capture, small modular nuclear reactors, and renewable hydrogen—show promise to mitigate challenges. For now, however, these technologies are not yet commercially viable to be deployed at scale, it said. The grid operator notes: “MISO is actively engaged in tracking the progress of these technologies and is preparing to incorporate them into the system if/when the opportunity arises.”

Surging Load Growth on the Horizon

Looking ahead, several other factors may prompt a tighter supply picture, it says. These include proposed carbon rules from the Environmental Protection Agency that could prompt existing coal and gas retirements earlier. “Wall Street investment criteria” also makes it “more challenging to build new dispatchable generation, even if it is critically needed for reliability purposes,” it noted.

Finally, the approximately $370 billion in financial incentives for clean-energy resources in the federal Inflation Reduction Act could further reshape the grid’s resource profile, it said. However, the grid operator is not optimistic that federal incentives will accelerate the commercial viability timelines of emerging technologies, it said.

Adding more complexity to the tight supply projections is that MISO expects load additions to surge. “Some parts of the MISO region are enjoying a resurgence in manufacturing and/or other economic growth, with companies planning and building new factories, data centers, and other energy-intensive facilities,” it notes.

“For example, in the MISO South subregion that spans most of Arkansas, Louisiana, Mississippi, and a small part of Texas, there are discussions and plans to build a variety of new manufacturing plants for steel, hydrogen, liquified natural gas, and other heavy industry that could add more than 1,000 MW of new load. The tax credits for clean-energy manufacturing in the Inflation Reduction Act are helping to drive some of these additions.”

Electrification trends in other sectors of the economy also pose new significant growth prospects. “Electric vehicles are growing in popularity, and the residential and commercial building sectors are increasingly using electricity for heating and cooling purposes—with a desire to source this new electric load from renewables. These trends will likely accelerate even more due to the substantial financial incentives in the Inflation Reduction Act for electric vehicles, rooftop solar systems, and electric appliances,” it said.

“In MISO’s 2021 Electrification Insights report, MISO found that electrification could transform the region’s grid from a summer-peaking to a winter-peaking system and that uncontrolled vehicle charging and daily heating and cooling load could result in two daily power peaks in nearly all months of the year,” it added.

Risk Mitigation a Priority

The report notes the grid operator and its stakeholders have made significant strides through the Reliability Imperative, which MISO describes as a “shared responsibility that MISO, its members, and states have to address the urgent and complex challenges facing the MISO grid.”

Notable achievements include the transition to a Seasonal Resource Adequacy Construct approved by FERC in August 2022. In addition, the MISO Board of Directors in July 2022 approved the first $10.3 billion tranche of Long Range Transmission Planning (LRTP) projects, marking a historic investment in the U.S. transmission system to support grid reliability and the integration of new generation resources.

MISO’s introduction of a Reliability-Based Demand Curve also aims to improve price signals in the Planning Resource Auction (PRA) for better investment and retirement decisions, with full implementation expected by the 2025 PRA. The grid operator noted it has also implemented major upgrades to its Energy Management System and the development of new market clearing engines.

Over the coming year, MISO says its priorities will include implementing a suite of solutions to ensure system adequacy, flexibility, and stability. This will involve modernizing resource adequacy constructs, refining market signals for flexibility needs, and enhancing inverter-based resource capabilities. MISO also plans to revise resource accreditation values to reflect expected performance during high-risk periods, proposing a three-year transition to a new methodology for non-thermal resources. Approval of the second tranche of LRTP projects is also underway.

Still, MISO suggests more work will be required, and it has issued a call to action to utilities and states in the region: “We must work together and move faster,” it said.

“The challenges we face are not way down the road; they are here right in front of us,” said MISO CEO Bear in a statement. “We need to execute on the solutions that we’ve already developed with our stakeholders, and we need to collaborate more closely to collectively address these pressing issues.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).