How Companies are Growing Profits and Making Climate Progress: Case Studies

Introduction

The transition to net zero is the greatest economic threat and multi-trillion dollar opportunity of this generation. Many leading companies are already advancing on climate goals by turning pledges into progress. A new report from EDF and Sustainable Public Affairs showcases case studies on how companies are acting on climate goals, while growing profits. This progress demonstrates that it is possible to reconcile emissions reduction with successful enterprises that offer quality jobs, profits, and the desired goods and services for consumers.

The European Union and its Member States have been frontrunners in establishing ambitious climate policy. By 2022, the EU had reduced greenhouse gas emissions by 34% compared to 1990 levels, with an increase in GDP of 54%. This collection of case studies highlights concrete examples of European businesses already putting decarbonization strategies into action.

Cement industry decarbonization

The cement sector represents around 8% of global CO2 emissions and since three-quarters of the infrastructure that will exist in 2050 has yet to be built, these emissions are expected to continue to rise due to increased urbanization and population growth.

Founded in 2000, Ecocem has four manufacturing facilities across Western Europe, selling into several major international markets including France, Ireland, the Netherlands, Belgium, Germany, Scandinavia, the UK, etc. It produces over two million tons of low carbon cement annually and is responsible for around 10-15% of the cement supply in the markets in which it operates. Ecocem’s revenues have tripled since 2015 and it expected revenues of around €230m in 2023.

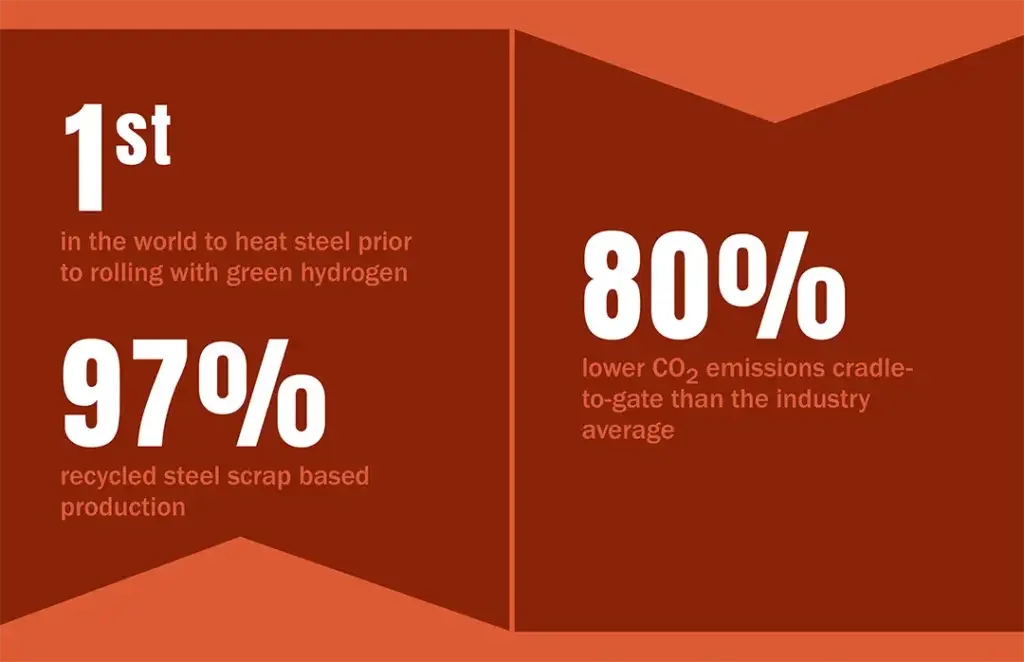

Steel industry decarbonization

The steel sector’s direct and indirect emissions represent 7% of CO2 emissions globally. Including upstream Scope 3 emissions, the steel industry represents around 11% of global CO2 emissions. Therefore, according to the European Commission’s Joint Research Centre, the steel industry needs to develop and commercialize new low carbon technologies in the next decade to remain aligned with the European Union’s climate objectives.

Ovako has become the largest recycler of Nordic steel scraps and is engaged in responsible business practices across the entire supply chain. Ovako’s business model is based on circularity and recycling, remelting scraps to make steel. As steel is totally and infinitely recyclable, scrap-based steel has the same quality as primary steel production. Ovako products consist of an average of 97.2% recycled steel scrap, corresponding to over 800,000 tons of scrap per year, coming from Ovako’s own mills, as well as scrap from downstream manufacturing industries and end-of-life products.

Residual heat from Ovako’s main production sites in Sweden is used in local communities via district heating networks. A large portion of the heat previously wasted can be utilized to produce district heating. The residual heat is enough to cover about 40% of the district heating needs in the whole town of Hofors (around 10,000 inhabitants).

Decarbonizing packaging

Since the 1950s, the world has produced over 9 billion tons (bt) of plastics. In 2019, the global production of this material amounted to 460 million tons (mt) which contributed to 3.4% of the world’s greenhouse gas emissions. Of these plastics, around 36% are used in packaging. Currently, the majority of plastics used for packaging applications are made from fossil-based raw materials, therefore consuming non-renewable resources and releasing fossil carbon in the atmosphere.

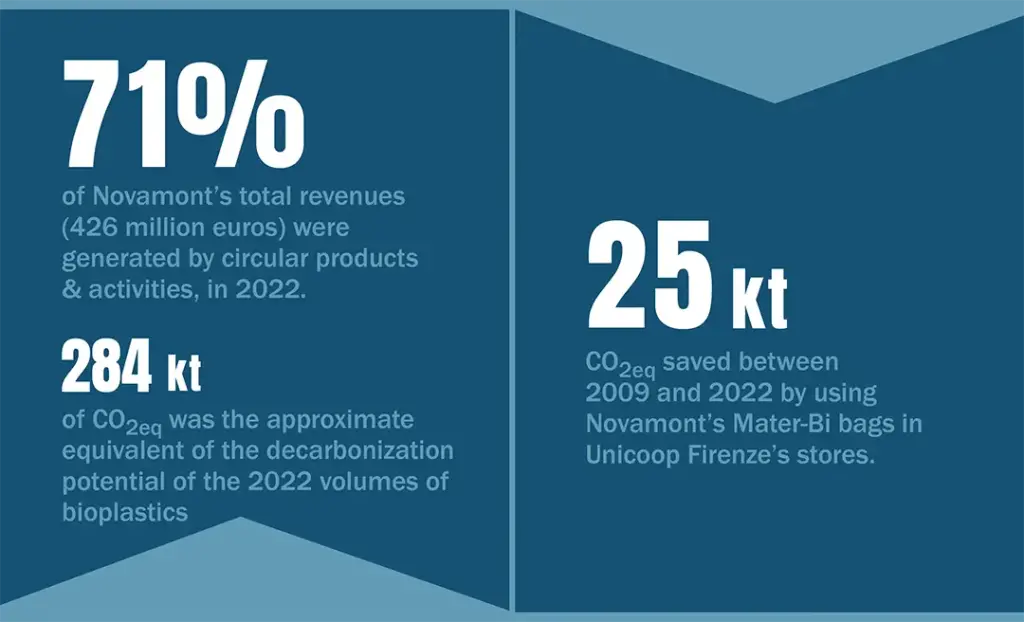

Novamont is an Italian company B Corp certified leader in the production of biodegradable and compostable bioplastics from renewable resources. Its bioplastics optimize the management of organic waste by avoiding microplastics, reducing environmental impacts and increasing the circularity of economic systems. Novamont’s bio-based plastics are used in applications designed to be in contact with organic content such as, among others, food packaging. In 2020, Novamont committed to a minimum threshold for revenues generated by circular products and activities (‘regenerative revenues’) of above 50%. In 2022 that grew to €426 million.

Decarbonization of the aluminum packaging sector

In 2018, the carbon emissions generated by the entire EU packaging sector accounted for 59 million US tons (mt) of CO2 per year and are expected to rise to 66 mt by 2030. Aluminum represents approximately 2% of all European packaging by weight.

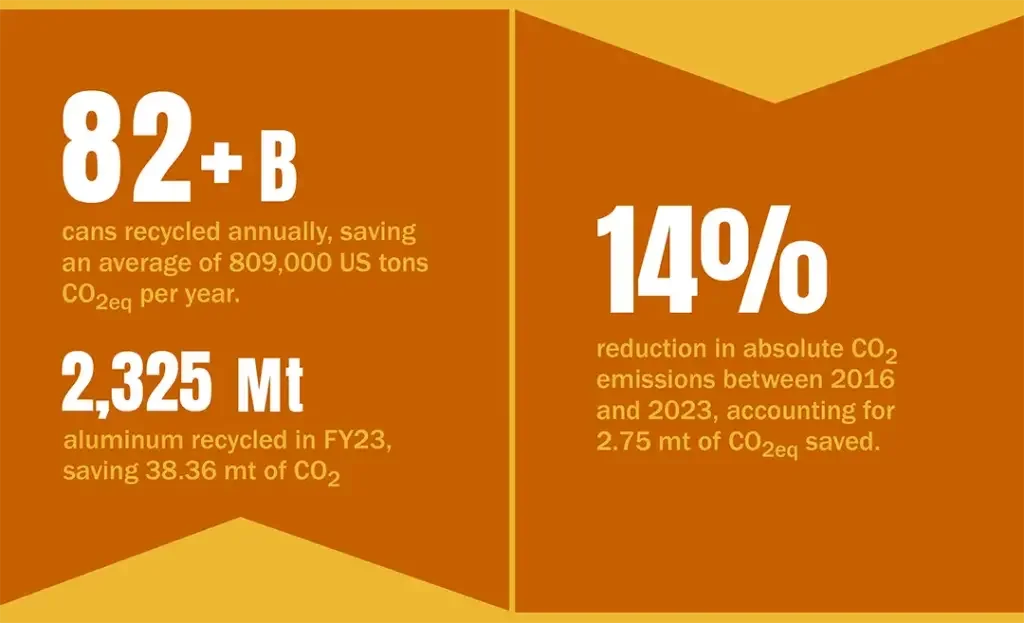

Aiming to become carbon neutral by 2050 or sooner, Novelis focuses its decarbonization strategy on reducing the larger Scope 3 emissions as they account for 87% of its total CO2

emissions, among which are emissions coming from primary aluminum production processes. Novelis is the largest producer of aluminum beverage packaging sheet and the world’s largest recycler of used beverage cans. In an ambition to deliver the most sustainable product to the beverage packaging industry, Novelis manufactures aluminum can sheet with an average recycled content of more than 80%, compared to the European average of 54%. Lowering the amount of prime aluminum used in its can sheet allows Novelis to radically reduce the carbon footprint of its products while also minimizing waste. Novelis has demonstrated economic success with sales of €18,486 million in 2023.

Retail industry decarbonization

The retail sector currently accounts for approximately 25% of global CO2 emissions and is expected to grow in the next decades. Reducing the carbon footprint of commercial retailers and their value chains will play a vital role in reaching global climate targets.

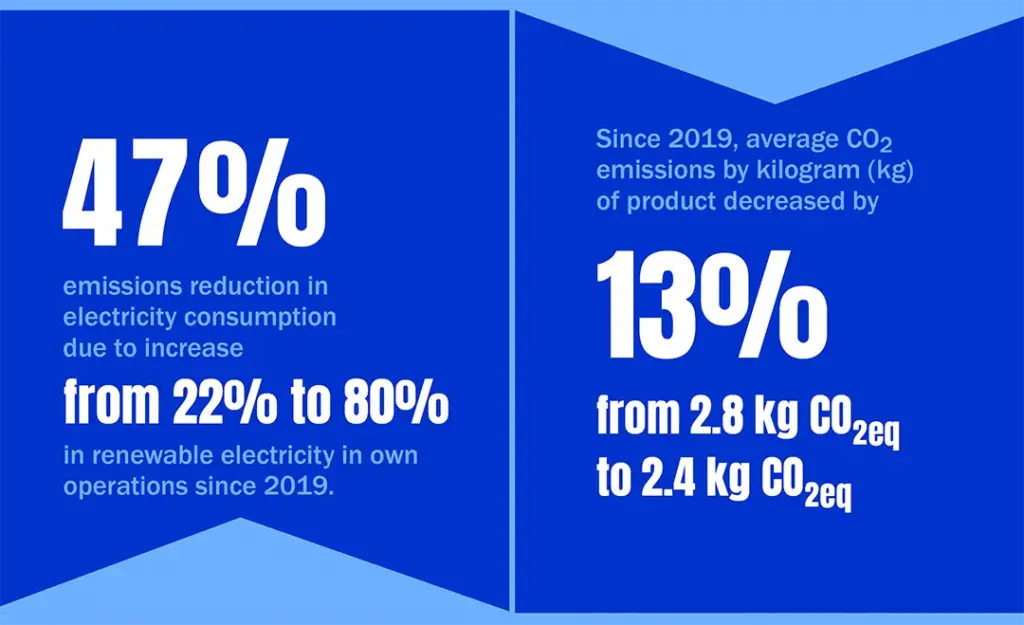

Flying Tiger Copenhagen is a Danish retail company founded in 1995. It operates over 900 stores worldwide. In 2019, following an internal decision to become more sustainable, Flying Tiger Copenhagen partnered with Normative, a carbon accounting engine, to calculate the carbon footprint of its supply chain. Flying Tiger has since increased the share of renewable electricity in its own operations from 22% to 80%, well ahead of its initial SBTi target of 84% by 2026. Flying Tiger’s eco-conscious product definition served as an internal tool to support buying teams when choosing product materials, helping them select more circular and often lower emissions materials. Copenhagen’s internal tool to make their products more sustainable contributed to a 16% overall reduction in product plastic use between 2019 and 2022, from 28% in 2019 to 22% in 2022.

Shipping industry decarbonization

Globally, the shipping industry accounted for 2.89% of greenhouse gas emissions in 2018. Emissions from the industry are expected to rise in the coming decades, possibly reaching 150% of 2008 emissions by 2050.

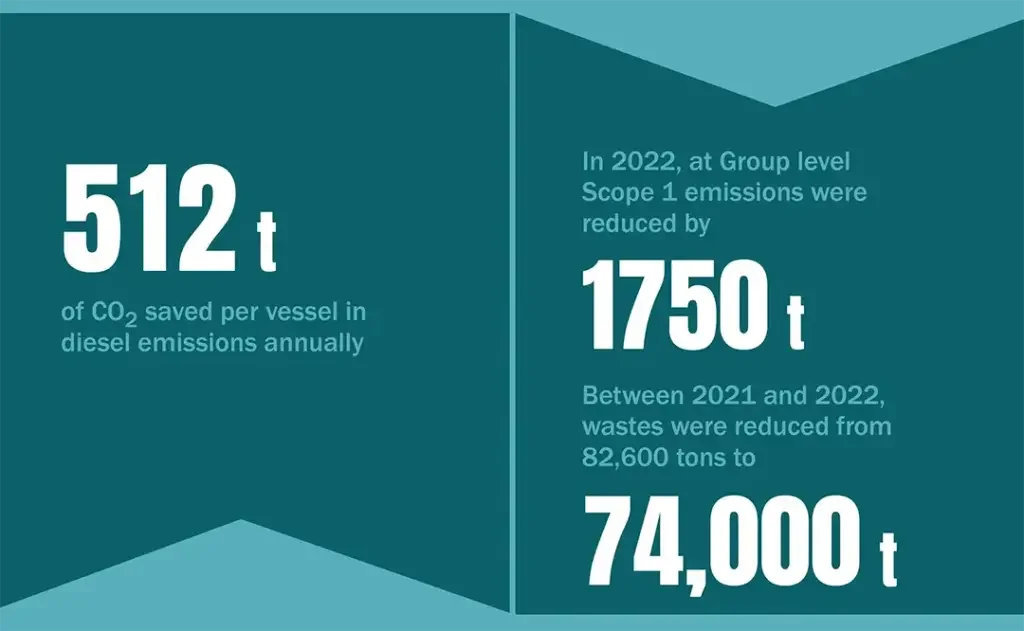

Damen Shipyards Group offers maritime solutions such as ship building and ship repair worldwide, operating a total of 35 shipyards in 13 countries. In 2022, the Group employed a total of over 12,000 people and reached a production value of €2.5 billion. Damen’s Workboats division produced and delivered its first full electric tug, Sparky, which will save approximately 465 tons of CO2 in diesel emissions annually per tug. In addition, the operating cost of an electric tug is less than a third of the cost of a diesel equivalent. Damen is planning to electrify

other vessels and develop hybrid vessels for the offshore wind market.

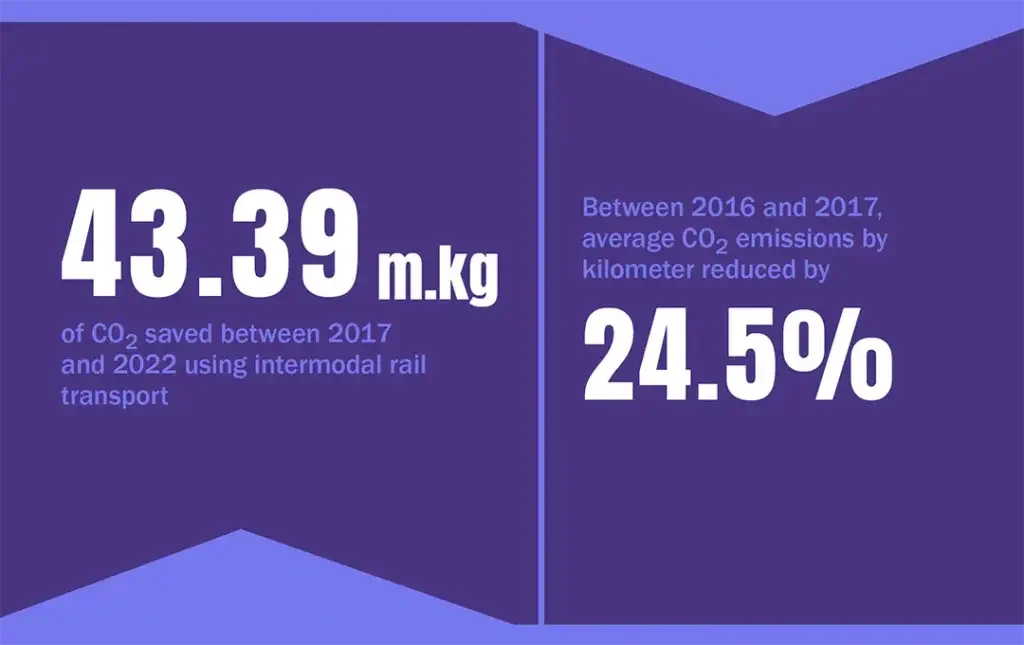

Transportation logistics decarbonization

Girteka Group, the largest asset-based transport company in Europe, started its history in 1996 with a single truck. Twenty-seven years later, Girteka now stands as one of the leaders in the decarbonization of Europe’s road freight transport, driving sustainability initiatives forward. Girteka found that carrying goods by intermodal rail systems with electric propulsion can save as much as 90% of CO2 emissions compared to road transport. Girteka’s in-house Drivers’ Academy provides a compulsory course on eco-driving, focused on developing the company’s drivers’ skills in a more environmentally friendly way of driving. The skills gained in this course are incentivized through an initiative known as the Eco League.