The UK government has launched its consultation on its proposals for kickstarting investment into long-duration energy storage (LDES), which includes a cap-and-floor mechanism and excluding lithium-ion from being eligible.

LDES will be pivotal in delivering a smart and flexible energy system integrating low-carbon power, heat and transport, and 20GW of LDES deployments between 2030 and 2050 could result in system savings of £24 billion (US$30.5 billion), the consultation outline said.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

LCP Delta and Regen provided the analysis for the Department for Energy Security and Net Zero’s (DESNZ) ‘Long duration electricity storage consultation’, which was was published yesterday (9 January) and is open for comment until 5 March, 2024.

A separate, longer report was produced by the research firms looking in detail at different deployment scenarios and their impact on the energy system: ‘Scenario Deployment Analysis for Long-Duration Electricity Storage’.

Cap-and-floor mechanism proposed

DESNZ is proposing a cap-and-floor mechanism for LDES technologies to overcome the barriers to LDES deployment which exist today, the main one being a lack of available revenue streams for LDES applications that can cover the high investment needed. An existing scheme called Contracts for Difference [CfD] has been largely successful in supporting the deployment of offshore wind and solar since its introduction in in October 2014.

Many LDES technologies are new and untried at scale, and no new large-scale LDES projects have been built in 40 years, even for tried and tested technologies like pumped hydro energy storage (PHES).

This would provided revenue certainty for investors by guaranteeing revenues above an agreed floor and offer protection to consumers by limiting revenues to an agreed cap.

The design and implementation is being carried out in conjunction with a separate wider reform of the UK’s energy markets, the Review of Electricity Market Arrangements (REMA), covered in depth by our sister cite Current.

Long-duration energy storage defined as 6-hour duration or more, but lithium-ion excluded

DESNZ is proposing two Streams through which projects can apply for the scheme. Stream 1 would cover established technologies with a Technology Readiness Level (TRL) of 9 for projects at least 100MW/600MWh. Stream 2 would cover novel technologies with a TRL of 8, with a minimum size of 50MW/300MWh.

However, in a separate release LCP Delta said that as renewable energy grows, primarily wind, increasingly long and intense shortfalls and excess periods of generation would require technologies that can “…flex their demand and supply over extended periods, often in excess of 12 hours…”.

DESNZ said that it considered it appropriate to exclude technologies that can already be funded under existing market arrangements, including lithium-ion which is the technology of choice for the vast majority of battery energy storage system (BESS) projects being deployed, with more than 3.5GW online already in the UK.

It also suggested that projects should not be eligible for the new LDES scheme alongside other government support schemes, which it said would primarily affect hydrogen. However, the government is already funding more novel LDES technologies through a separate funding programme with £69 million in grants provided to projects in late 2022 and early 2023, and it’s not clear if that would mean those technologies are excluded too.

The six-hour duration has been suggested after the vast majority of industry respondents said 4-hours was too low as a starting point, but beyond that there was no agreed stakeholder view for the most appropriate duration. Lithium-ion has been chosen for several projects of 6-hour and 8-hour duration in the US and in Australia.

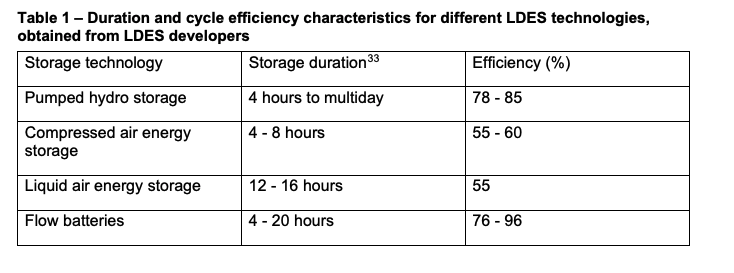

DESNZ’s consultation outlined highlighted PHES, compressed-air energy storage (CAES), liquid air energy storage and flow batteries as notable LDES technologies and assessed their duration and round-trip efficiency (RTE), while LCP Delta and Regen’s longer analysis included lithium-ion, gravity energy storage, zinc batteries, sodium sulphur batteries and iron-air batteries.

Industry reaction

The industry’s public reaction to the consultation proposals so far has been mostly positive, but still mixed.

Drax, which operates PHES projects and is hoping to build new capacity including extending an existing facility in Cruachan, Scotland, welcomed the proposals with Scottish assets director Ian Kinnaird saying: “This is a big step towards making a new generation of pumped storage hydro plants a reality. These new plants would enhance UK national energy security and play a significant role in the fight against climate change.”

Frank Gordon, Director of Policy at trade body REA (Association for Renewable Energy and Clean Technology) said: “REA welcomes the publication of proposals to reward the considerable system benefits from longer duration energy storage systems with a new support mechanism.”

But some have criticised the exclusion of lithium-ion. Ed Porter, director of revenue at market analytics platform Modo, said: “Lithium is being excluded on account of it being commercially feasible at shorter durations. It’s not acknowledged that it wouldn’t be at 6 hours (currently) & there would be a massive missing money impact of subsidising 20GW of other storage tech.”

Porter was formerly head of business development at vanadium redox flow battery (VRFB) company Invinity Energy Systems. VRFBs are one of the more mature LDES technologies currently being deployed.

Read DESNZ’s consultation outline in full here and LCP Delta and Regen’s longer deployment analysis here.

Energy-Storage.news’ publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 20-21 February 2024. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.