What’s driving the deployment of utility-scale energy storage assets? In a word, opportunity. These are the key ingredients for successful deployments:

- Market price volatility

- Ability to access the full spectrum of energy storage value streams

- Software to help manage the unique characteristics of energy storage devices

- Software to optimize for existing and future revenue opportunities

The proliferation of energy storage is growing rapidly across the market from residential deployments paired with solar installations, to corporate customers establishing their own microgrids, to large utility-scale storage deployments. We will focus on the opportunities for “utility-scale” or “grid-scale” energy storage in this blog.

“Utility-scale” or “grid-scale” energy storage system developers are moving quickly to meet market needs for grid stability, while pursuing lucrative new revenue streams. Unlike the distributed energy storage systems deployed behind-the-meter in consumers’ homes, these much bigger systems are designed to provide large amounts of energy and power services to the electrical grid itself. They typically are deployed in the range of several megawatts (MW) but increasingly larger systems can reach up to hundreds of MW hours. They can help to balance the supply and demand of electricity by storing excess energy and providing services that help complement new or existing renewable generation deployments.

Grid-Scale Batteries

Grid-scale energy storage systems include batteries, flywheels, pumped hydro, and compressed air energy storage. Nevertheless, grid-scale batteries currently dominate new energy storage capacity additions and typically feature some form of lithium ion technology.

Grid-scale batteries offer access to nearly every available revenue stream across the energy dispatch market, ranging from fast-responding frequency regulation (sub-second response times) to filling capacity requirement gaps in the day-ahead or real-time markets. Beyond taking advantage of power price volatility to enhance revenue opportunities, storage operators must carefully maintain battery health while ensuring market commitments and dispatch.

In a rapidly expanding energy market there are many competing priorities, from minimizing energy costs and maximizing asset performance to reducing carbon emissions. Achieving balance must take into account various factors such as the battery’s state-of-charge (SOC), real-time energy market conditions, as well as ensuring compliance with battery limitations and warranties. The optimal solution requires the incorporation of all of these variables to allow asset owners to maximize opportunities for grid-scale batteries.

Four Successful Battery Business Models

Installing grid-scale batteries opens up new business opportunities while bringing needed solutions to the grid. Identifying and implementing the right business models is a critical factor in financing these transactions. Here are four key models, which we will also explore on an upcoming webinar with TotalEnergies:

- Renewable Smoothing Model. Grid-scale storage can help smooth the intermittency of renewable energy sources such as wind and solar, thus making these resources a more reliable supply source. In this case, grid-scale storage effectively fills in the gaps in intermittent generation. With more reliable delivery, and the services related to the smoothing of short-term intermittency of either solar or wind, a higher power purchase agreement (PPA) value can be realized by renewable energy developers.

- Solar Shape Fixing Model. Electricity generation from solar resources is challenged by the familiar “duck curve.” The opportunity to fix the shape of solar generation delivery on a daily basis allows for battery storage to be charged during the day while the sun is shining (belly of the duck) and deliver that power in the evening after the sun sets (the duck’s long neck). Collocated solar PV farms and grid-scale batteries should also garner higher PPA values based on improved shape of solar resource delivery to power grids.

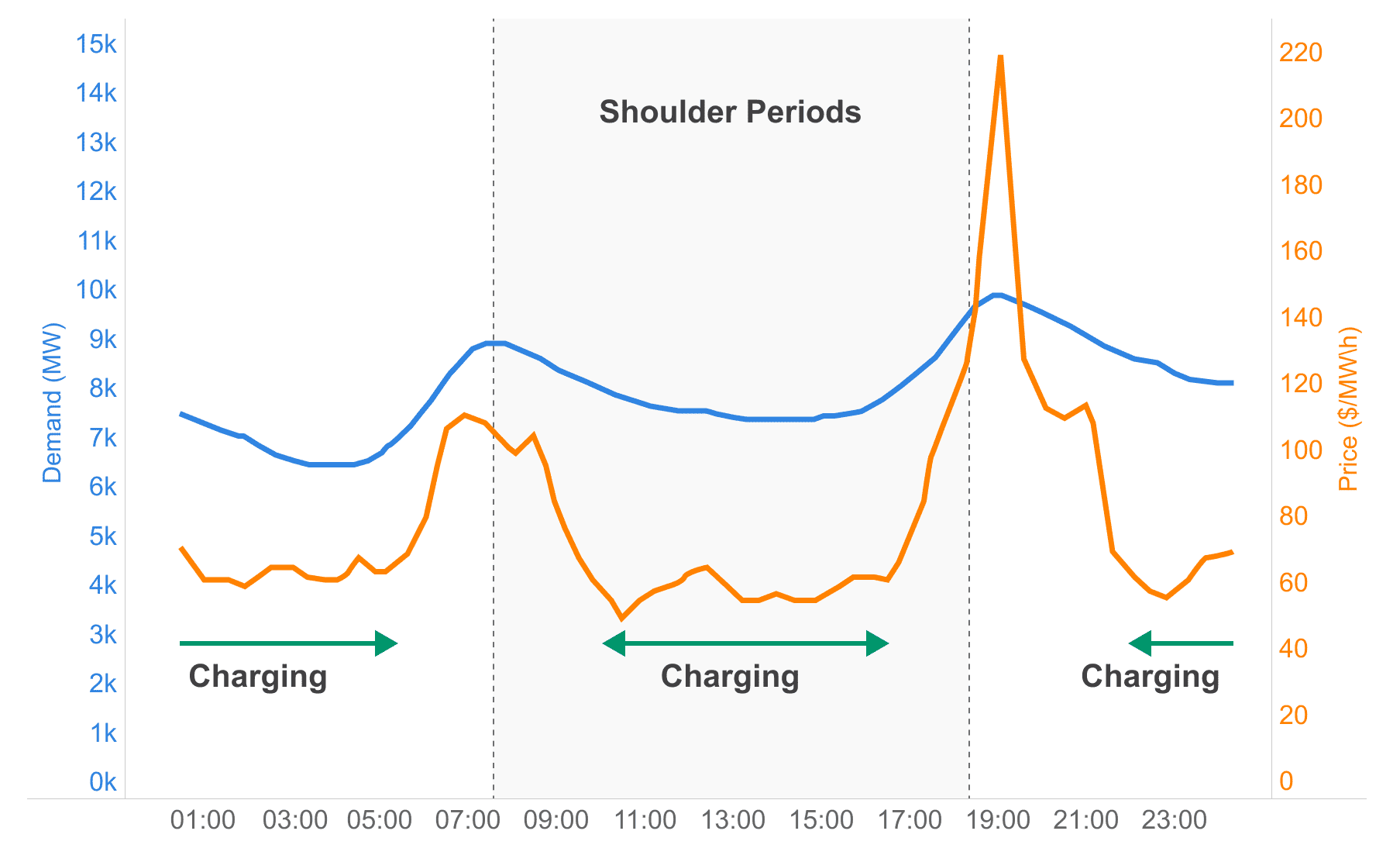

- Merchant Model. The most risky, but also possibly the most lucrative business approach is a merchant based model. The goal under this scenario is simple– to buy low and sell high. Buy power from the grid or connected renewables to charge up the batteries when prices are low, and then sell back into wholesale markets when prices are high. This model will be most profitable in more volatile price markets.

- Storage Tolling Model. Developers for whom the location of their assets represents a real merchant revenue opportunity can also enter into a tolling agreement with a trading organization for use of their battery storage assets in the market. The early stages of these agreements are emerging as some developers want to lock in more traditional fixed revenue streams where a traditional PPA for the storage assets is not as attractive.

Ultimately the right business model is the one that can be financed and built. The proof of the value of merchant revenue streams – and the complement of grid-scale batteries – to make solar and wind resources more reliable and manageable are clearly beginning to emerge. A rapid increase of entrants into the grid-scale storage arena is proving out the profitability of a still untapped market, and financing options are expanding.

Software Squeezes Value from Hardware

Software is key to helping asset owners realize the full potential of energy storage and the full spectrum of revenue opportunities. Battery storage introduces new challenges versus traditional grid balancing technologies like gas-fired peaker plants, namely the limited duration of time a battery can deliver energy. Software is ideal for managing the logic and ensuring management of the critical state-of-charge.

Enter artificial intelligence (AI) and machine learning (ML). AI is the simulation of human intelligence by computers that can perceive, synthesize, and infer information that improves performance over time. In the energy sector, AI is already producing dramatic results and outcomes impossible for a human to replicate. The scale of the electric grid alone can overwhelm traditional resources, with millions of discrete endpoints all interacting in real time to maintain narrow frequency tolerances. Perhaps the most advanced subset of A,I ML uses algorithms and statistical models to analyze and draw inferences from patterns of data in order to learn and adapt without following explicit instructions.

Applying AI and ML can help market participants, investors and regulators navigate the competing needs of the power grid, the environment, and the bottom line. AI and ML help manage grid assets by learning from and adapting operational strategies to market constraints and price volatility over time. Digital systems also enable energy asset owners to maximize ROI by ensuring optimal battery performance and assisting with ensuring market commitments and dispatch events are met.

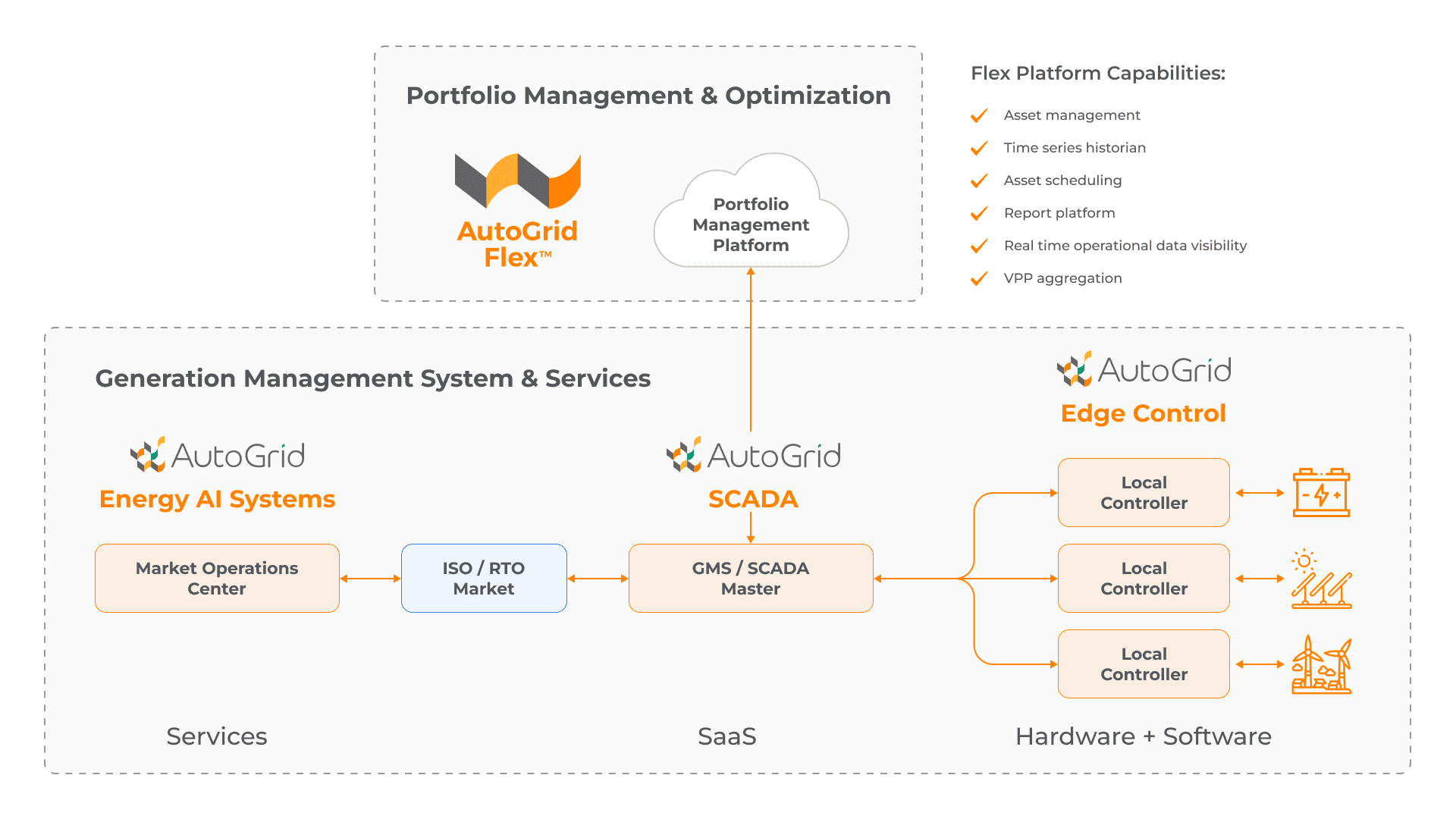

Energy asset optimization software can help solve the challenges that owners and operators of large renewable energy and storage assets are facing in several ways. For example, a robust digital platform can provide real-time monitoring and visualization of generation assets. Additionally, controls for dispatch of energy assets can capture the most possible revenue from both ancillary markets and wholesales energy market participation. This software can also help forecast both energy demand and supply, allowing asset owners to better plan and manage their energy assets accordingly. This can help increase the overall efficiency and sustainability of the energy system.

Asset owners can also incorporate their priorities into deployment strategies by leveraging AutoGrid Flex™ under a traditional software-as-a-service (SaaS) approach. Flex allows for asset optimization strategies based on API-driven inputs. Asset owners can tailor market participation to their specific on-site needs and priorities balanced against the needs of the power grid. Flex provides an efficient, reliable way to integrate diverse data sources – including real-time market prices, weather forecasts, and grid constraints – into a nimble, flexible resource allocation strategy.

What’s the key takeaway? Grid-scale batteries will play an increasing role in future energy markets, yet will only reach their full potential with the right software and the right business model. Entirely new categories of opportunity don’t emerge often, and early adopters are already staking claims in this promising new space.