By Tom McBeth, Policy & Infrastructure Manager with plastics resource efficiency group RECOUP

New data reveals an increase in the amount of plastic exported for recycling in 2023, and significant quantities are now going to developing, non-OECD* countries.

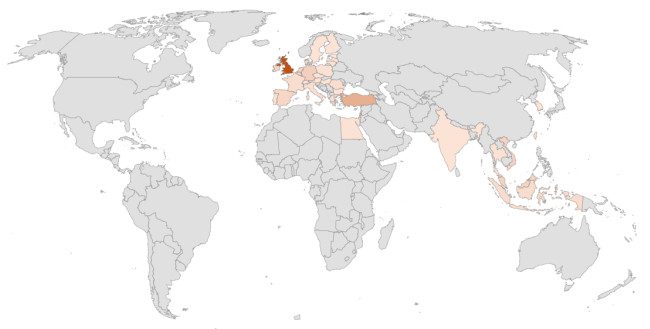

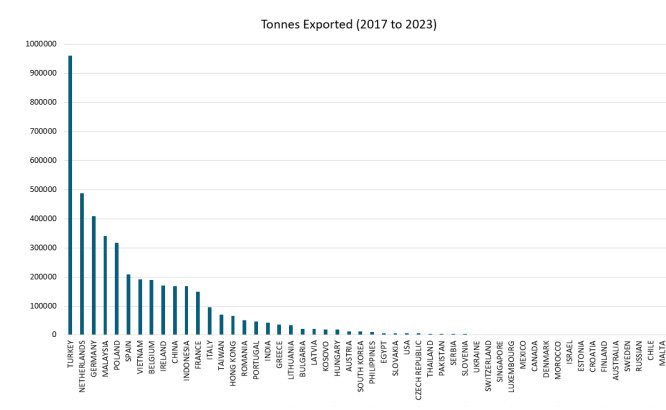

Year-on-year, despite increases in material being recycled in the UK, quantities of plastic waste exported for recycling from England have increased by more than 10% to just over 600,000 tonnes. Of this, more than 25% was sent to Turkey, 25,000 tonnes more than in 2022. This also means that just short of 1 million tonnes of plastic has been sent to Turkey for recycling since 2017.

The next largest destination, Germany, received just under 10%, whilst material sent to Asia, overall, increased from around 9% in 2022, to almost 20% in 2023. Malaysia and Vietnam, two non-OECD countries that had received decreasing volumes of UK waste in recent years, took around 8% each. Indonesia took a further 3.4%, and Taiwan 2.5%.

Material to non-OECD countries

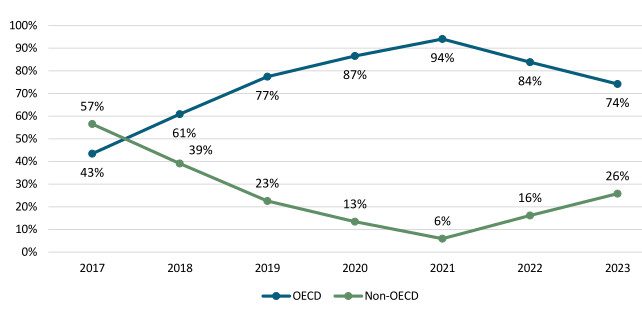

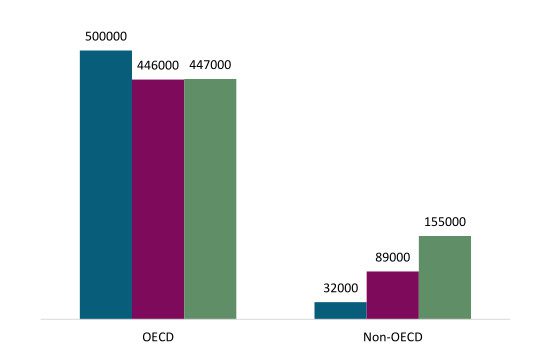

More than 26% was sent to non-OECD or developing countries. This is significantly more than the 16% in 2022, and 6% in 2021, when overall quantities were also lower, resulting in an increase of 500% in three years. This amounts to 155,000 tonnes sent to non-OECD countries, 15,000 of which was to European Union (EU) Member States Bulgaria and Romania, and the remaining sent to a combination of countries in non-EU Europe, Asia and Egypt.

Whilst discussions take place around a ban on export to non-OECD countries, these figures show the market’s resilience and flexibility at a time when recycled plastic demand was at a low across Europe, not least in part due to low virgin oil prices and high virgin plastic production, particularly outside of Europe. As such, this material exported for recycling would likely have otherwise gone to landfill or incineration.

A ban on export of waste from the UK to non-OECD countries is expected, being part of the Conservative party’s manifesto, but a consultation on this did not materialise as expected in 2023. Whilst the non-OECD EU Member States are not included in the proposed ban (Malta, Croatia, Bulgaria and Romania), this still leaves around 140,000 tonnes of plastic exported that would need new receiving destinations.

On top of this, the EU is in the midst of various changes to legislation. These include restrictions on import and export of waste into the bloc, its own ban on exports to non-OECD countries, and requirements for export to any country outside of the EU and European Free Trade Association (EFTA) being notifiable waste.

As background, the OECD is made up of 38 countries and is often used as a synonym for high-income or ‘developed’ countries. Membership has therefore been considered a suitable measure for if a country has the infrastructure and regulation in place to receive and process plastic waste for recycling. However, it should be noted that the OECD’s remit relates to a broad range of topics, including policy and trade. Furthermore, non-OECD countries China, Indonesia and India are all considered ‘key partners’ of the OECD, with Indonesia having expressed an interest in joining in late 2023. Bulgaria and Romania are also both applicants to join the OECD.

The metric for UK waste export policy

It is known that whilst countries seen in the news with poor quality waste management and incidences of illegal burning or burying of waste are more often non-OECD countries, there are high quality reprocessing facilities in a number of these countries. Equally, being an OECD country does not guarantee that all facilities and national waste and environmental policies are of a sufficient quality.

This follows on from RECOUP’s Plastic Waste Exports Position that material should only be exported as long as there is robust evidence that the infrastructure is in place to handle it, and to help that ensure illegal, unethical or unnecessary exports are stopped.

All of these factors bring into question the use of OECD membership as the sole metric for whether a country is suitable for accepting plastic waste for recycling.

To help address these issues, the UK requires development of its recycling infrastructure, as well as its policies, to limit the need for exporting of material in the first place, regardless of where to. An outright ban does not feel an appropriate course of action, at least not without sufficient time and planning to develop domestic infrastructure to compensate for the loss of available markets. A sudden ban would likely result in more material being sent to landfill, incinerated or exported to other markets. Worse still, this may increase the likelihood that these countries merely act as a transfer station for the material to move on to other markets.

The consultation on a ban to non-OECD countries will be welcome, though should not be a foregone conclusion. Further consideration is needed to ensure that this is not implemented at the expense of countries like Turkey merely taking more material instead, or material making its way to developing countries by unregulated and illegal means. Worse still, if existing countries that currently receive plastic waste for recycling can join the OECD without evidencing suitable infrastructure or practices in relation to imported plastic waste for recycling, then this calls into question the use of OECD as the sole criteria for being permitted as a destination.

Importance of digital waste tracking and reviewing the PRN system

Digital Waste Tracking will be a vital policy, albeit one that may not come to fruition until 2025. A system that should allow a live, accurate and, most importantly, transparent reporting of material transportation both in the UK and overseas, replacing the archaic paper-based system that is currently in place. This much needed update will help ensure confidence in exports and material end destinations. This is especially important for import and export out of England, where the lion’s share of UK material is exported from, and Wales. Historic legislation means that Annex VII and Green List export data is not necessarily provided to the EA and Natural Resources Wales (NRW), unlike for material going out of Scotland or Northern Ireland.

Furthermore, revisions should be made to the Packaging Recovery Note (PRN) systems first designed in the late 1990s, as they have financially incentivised the export of waste over processing domestically. A formal review of the system was called for following the 2021 packaging Extended Producer Responsibility (EPR) consultation in 2025. These notes act as the current packaging producer responsibility scheme, purchased based on the amount of packaging placed on the UK market, with the money then intended to be reinvested into the infrastructure to manage the waste at the end of life. However, PRN prices are volatile, fluctuating based on recycling rates and demand, making them unsuitable for business planning. At present, material recycled in the UK is measured at the point that the recycling has taken place once any contamination or non-target material has been removed and material yield losses in the recycling processes have taken place. Material that is exported using Packaging Export Recovery Notes (PERN) includes the weight of any contamination or non-target material that may be lost in the recycling steps that take place overseas, prior to reaching any end-of-waste status. Removing the economic variable between PRNs and PERNs based on the point the note is claimed would make UK recycling more economically attractive to recyclers and help balance the market.

Whilst data for overall recycling quantities for 2023 will not be available for a few months, the amount sent for export appears likely to have increased. Whatever the solution, the UK cannot continue on its current trajectory, and efforts must be made from the legislators to the exporters, and everyone in between, to help turn the tide in effectively, ethically and transparently managing our nation’s own waste.

* Organisation for Economic Co-operation and Development (OECD)