By Shazan Siddiqi

What is the Megawatt Charging System (MCS)?

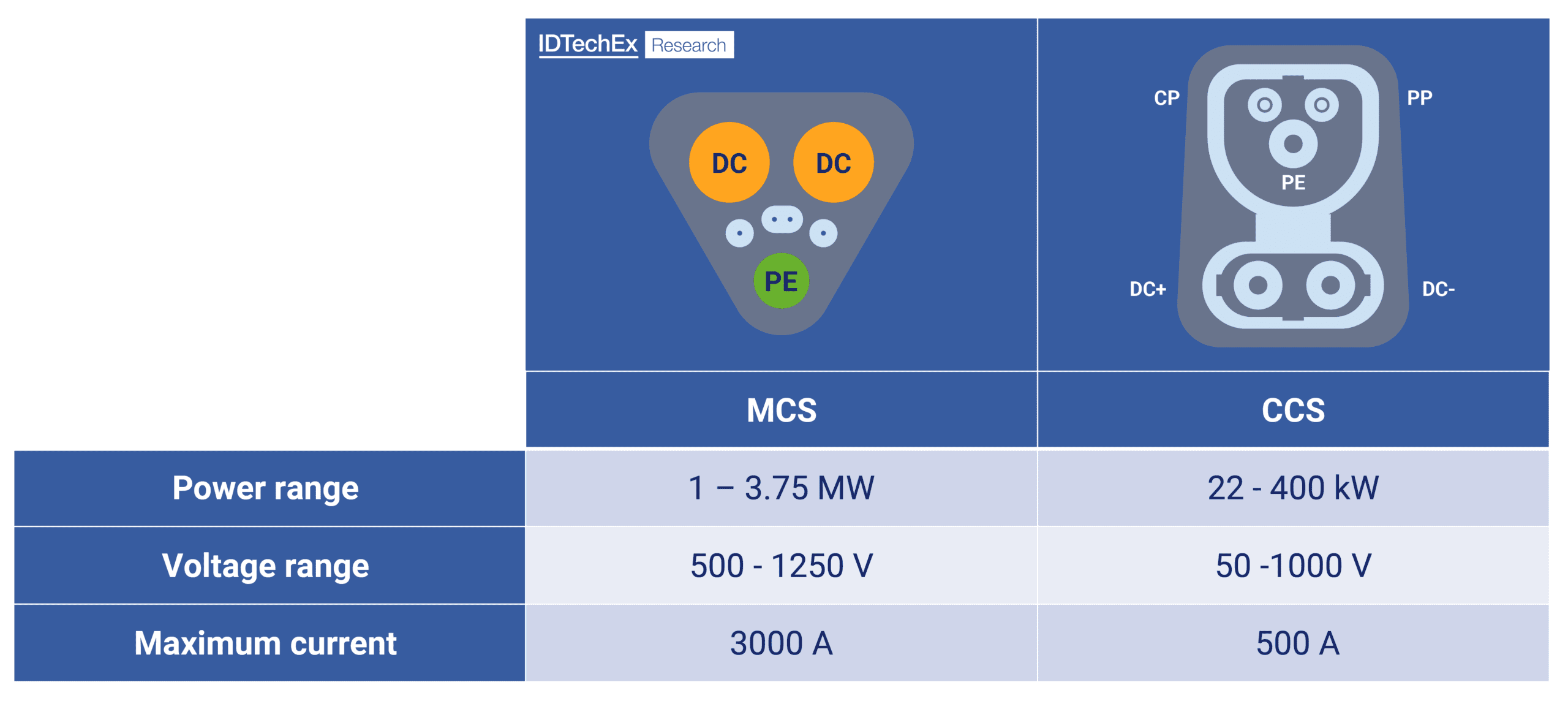

A new high-power charging solution is required to meet the market need of the truck and bus industry to charge electric heavy-duty vehicles in an acceptable amount of time. As a result, the Megawatt Charging System (MCS), a charging system for large battery electric vehicles, is now being developed. The MCS is capable of charging at a maximum rate of 3.75 megawatts (3,000 amps at 1,250 volts DC), which is the highest rate. MCS is expected to enable fast and efficient charging not only for trucks, but also for marine vessels, aeronautics, and mining. The final publication of the standard and commercial rollout is expected in 2024.

Significance and use case of MCS

The increased charge rate offered by MCS will allow customers to drive more distance per day by utilizing the mandated break time from the hours-of-service regulations. These regulations state that drivers must occasionally take a break during their drive cycle. For example, the European Union requires 45 minutes of break after every 4.5 hours of driving; the United States mandates 30 minutes after 8 hours. It is well understood that reducing charging times to fit into normal breaks in the duty cycle is an enabler for improved electrification for commercial vehicles and long-distance haulage. However, not every commercial fleet owner will require MCS as some may find that slower, overnight charging at depots fits their duty cycles best. Site design will optimize for the lowest power solution that meets use case requirements. The recent report from IDTechEx finds that Level 2 AC chargers provide sufficient power to recharge light and medium-duty vehicles overnight, but larger battery capacity long-haul trucks will require DC fast charging. MCS is best suited to enable rapid charging of batteries when they are operating out of range of their home base; in other words, a BEV version of a stop-and-fill forecourt.

Challenges in implementing MCS

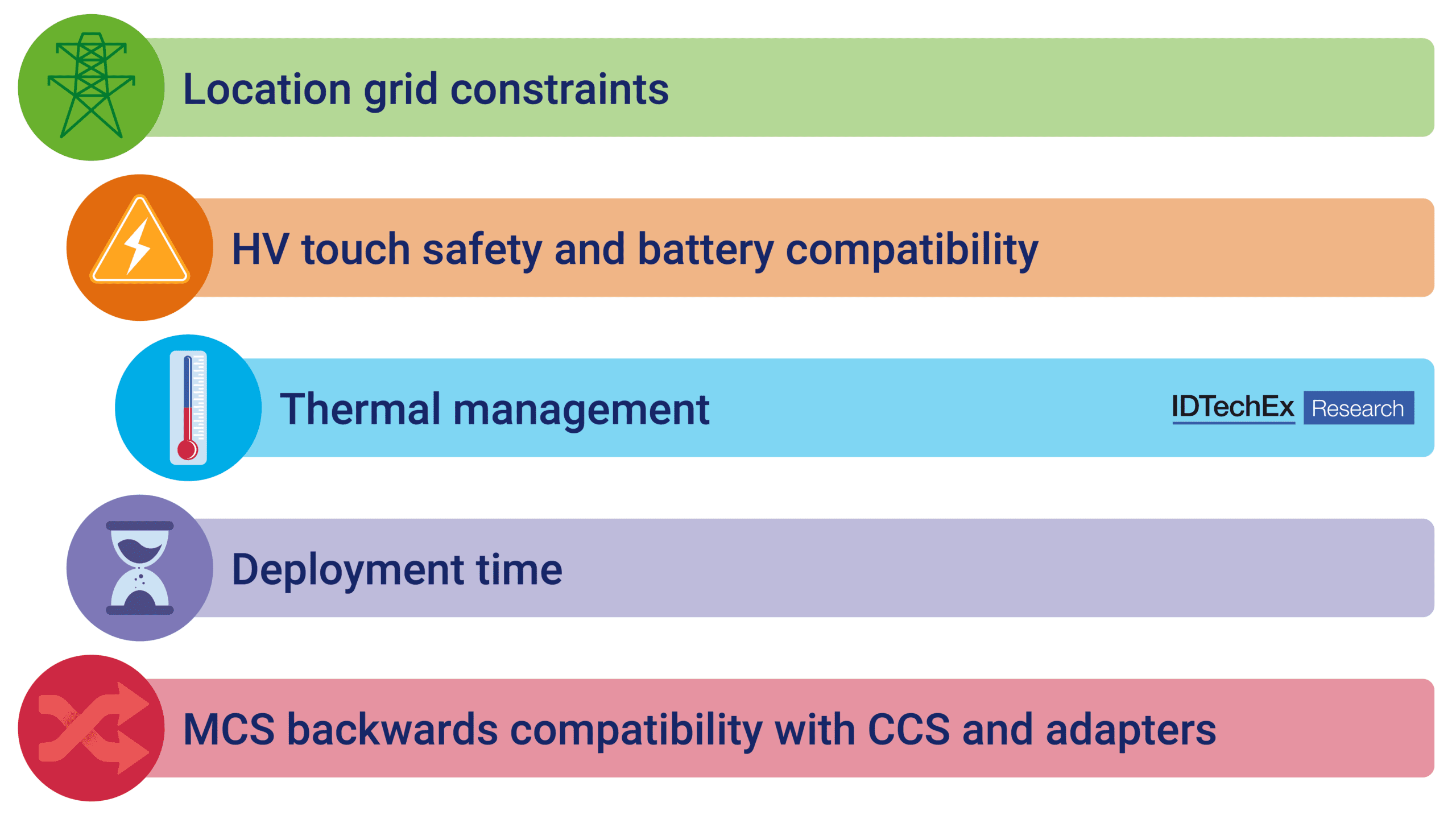

MCS is designed for a 6-fold higher current and up to 10-fold higher power compared to CCS. Commercializing chargers with rated power of 1 MW will require significant investment, as stations with such high-power needs will incur significant installation and grid upgrade costs. The need for on-site energy storage and solar-supplemented solutions is also emphasized to reduce demand charges.

Fleet operators and OEMs must work together with utility providers to ensure proper capacity for this new technology is in place. Furthermore, truck OEMs do not manufacture their own packs but buy them from third parties, so they need to make sure that the voltage requirements meet the specifications of MCS, as well as the battery density and the spacing between the cells. They must design for the cooling aspects, different connectors, and the battery management system. All of these changes contribute to the cost. Infrastructure deployment is also another limiting factor in MCS, as securing large grid connections can take up to 5 years. IDTechEx research finds that MCS infrastructure needs to be in place between 2025 and 2030 to support the long-haul electric trucks entering the market.

MCS player landscape

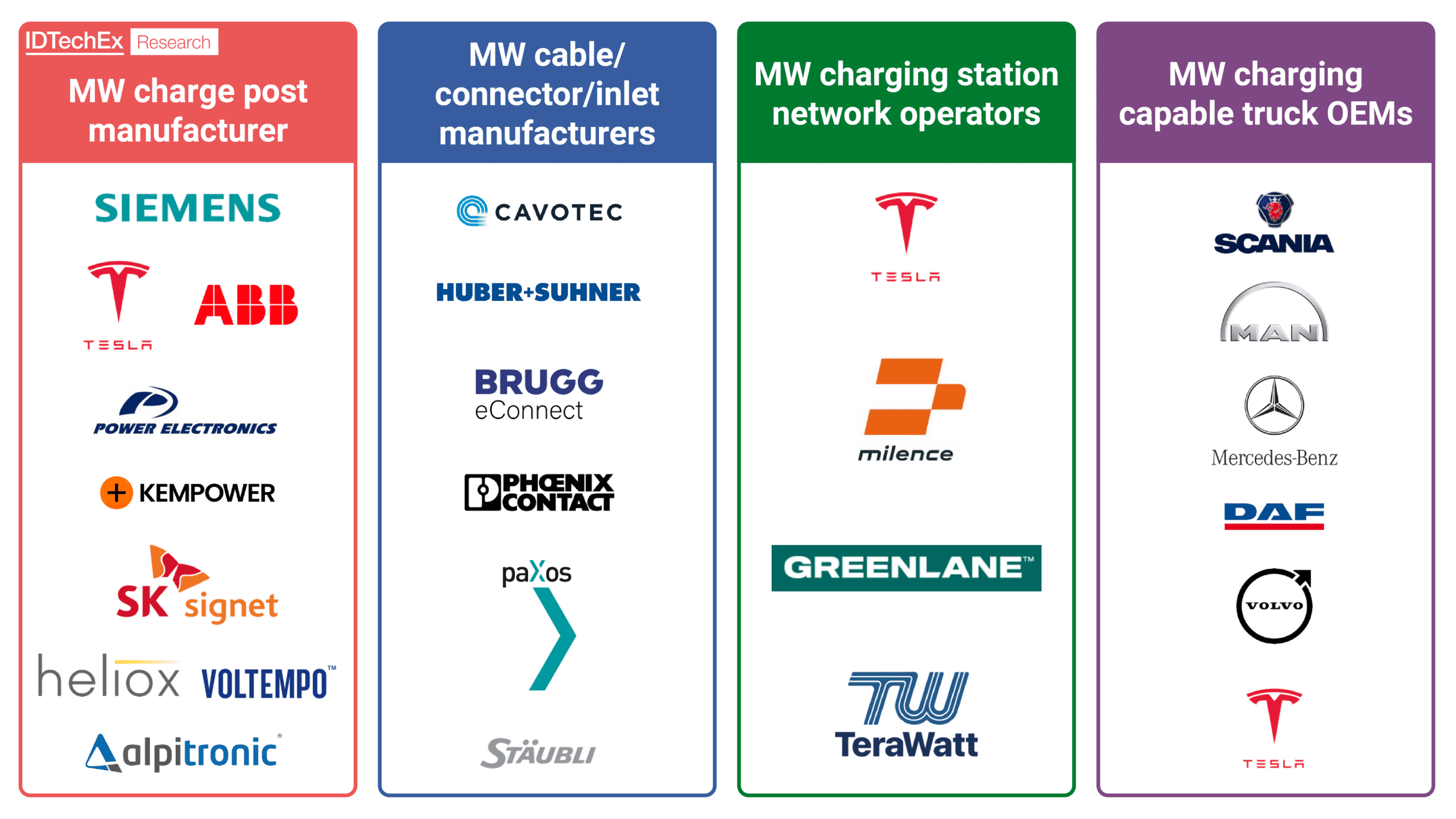

Bringing MCS to market is a cross-industry effort with various players along the value chain. IDTechEx research finds that leading EVSE hardware suppliers are now developing their own megawatt-capable charging stations. Component suppliers like cable and connector manufacturers are following suit and designing products that can support MCS specifications.

It was expected that the Tesla Semi would use the MCS connector. However, according to the Executive Director of CharIN, Tesla is not using the MCS connector. The first Tesla Semis in the US are instead using a dedicated, proprietary connector, which IDTechEx speculates is an earlier version of MCS. The Megacharger from Tesla uses an immersion-cooled thicker cable than their newly released V4 Superchargers to handle the high amperage required for multi-megawatt loads.

Non-Tesla electric trucks will likely utilize MCS exclusively or a combination of both MCS and CCS technology. In July 2022, a joint venture between Daimler Truck, TRATON GROUP, and the Volvo Group called Milence was formed, aiming to deploy 1,700 DC public charge points (including CCS and MCS) in Europe by 2027. IDTechEx forecasts that DC chargers capable of MW charging will exhibit a CAGR of 43% in the coming decade, with more granular power class split forecasts available in “Charging Infrastructure for Electric Vehicles and Fleets 2024-2034”.

Can MCS put the nail in the coffin for hydrogen?

The fact that businesses who have supported MCS, like Daimler Trucks, are now also investing in hydrogen fuelling is perplexing to many. A dual-track strategy is being pursued in the electrification of its portfolio, with both battery-electric and hydrogen-based drivetrains being developed. However, IDTechEx research finds that the adoption of MCS for electric trucks can potentially reduce the need for hydrogen fuel cell trucks for several reasons.

MCS can achieve a high charging efficiency, which means that a large portion of the electricity fed into the vehicle’s batteries is converted into usable energy, minimizing waste. In contrast, hydrogen production, transportation, and conversion in fuel cell trucks involve multiple energy conversion steps, leading to greater energy losses. Moreover, hydrogen fuelling infrastructure is complex and costly to establish, requiring dedicated hydrogen production, storage, and distribution facilities. MCS can also draw power from various sources, including renewable energy such as wind, solar, and hydropower. This flexibility allows for a cleaner and more sustainable energy mix as compared to hydrogen production, which often relies on fossil fuels.

Finally, IDTechEx research also finds that the current high price of hydrogen significantly impacts fuel cell trucks’ total cost of ownership (TCO) and fleets’ willingness to adopt this technology. MCS will be the factor that pushes electric to be the first choice for trucks. The IDTechEx report on the EV charging market includes a detailed coverage of megawatt charging that will support the deployment of electric trucks to markets globally.

For more information on this report, visit www.IDTechEx.com/EVCharge.