🌎 Climate brick by brick #194

A new framework for scaling climate tech companies, just in time for Earth Day

Last week, the world witnessed Hamas’s mass killing of Israeli civilians. This week, we’ve continued to be reminded of the horror of continued loss, and the import and cost of defending one’s home. Terrorism is wrong.

In this, we’re reminded that violence does not create knowledge, it destroys it. Hate slows human progress, and our world shrinks when we shirk from our responsibility to decry moral crimes.

This raw meditation from Isaac Saul on the tensions of navigating morality and identity rang true, and we mourn for everyone impacted by these tragedies.

Of course, the news marches on. The Biden administration announced $7B for 7 hydrogen fuel hubs to lay the track for the US’s hydrogen 2030 goal. Meanwhile, oil continues its price ascent while California interconnection gets speedier and UAW wins union protection for GM battery plant workers.

In deals this week, EV charging “passport” charges up with $200M, a supercapacitor attracts $113M, and yet more funding for nuclear fusion.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter at [email protected].

💼 Find or share roles on our job board here.

🔋 Skeleton Technologies, a Tallinn, Estonia-based graphene-based supercapacitor and battery energy storage developer, raised $113M in Corporate funding from Siemens Financial Services and Marubeni.

⚡ Shine, a Janesville, WI-based nuclear fusion developer, raised $70M in Growth funding from Baillie Gifford and Fidelity Management and Research Company.

⚡ Elcogen, a Tallinn, Estonia-based solid oxide fuel cells developer, raised $48M in Corporate funding from Korea Shipbuilding & Offshore Engineering.

🏠 myenergi, a Market Rasen, UK-based eco-smart home management platform, raised $37M in Growth funding from Energy Impact Partners.

🥩 BlueNalu, a San Diego, CA-based cellular aquaculture developer, raised $34M in Series B funding.

⚡ Perch Energy, a Boston, MA-based community and retail solar platform, raised $30M in Series B funding from Nuveen.

🌱 Scope3, a New City, NY-based collaborative sustainability platform for advertisers, raised $20M in Series B funding from GV, Room40 Ventures and Venrock.

🏠 JETCOOL, a Littleton Common, MA-based direct-to-chip liquid cooling manufacturer, raised $17M in Series A funding from Bosch Ventures, Schooner Ventures, Raptor Group, and In-Q-Tel.

⚡Bia, a Bogotá, Colombia-based smart meter data analysis platform, raised $17M in Series A funding from Kaszek, Nazca, Ewa Capital, and WildSur.

🥩 Bon Vivant, a Lyon, France-based animal-free dairy proteins developer, raised $16M in Seed funding from Sofinnova Partners, Sparkfood, Alliance for Impact, High Flyers Capital, Kima Ventures, and other investors.

⚡ Bedrock Energy, a Los Angeles, CA-based ground source heat pumps for buildings developer, raised $8M in Seed funding from Wireframe Ventures, Cantos, Climate Capital, First Star Ventures, Overture VC, and other investors.

🥩 Wanda Fish, a Tel Aviv, Israel-based cell-cultured seafood platform, raised $7M in Seed funding from Aqua Spark, CPT Capital, The Kitchen Hub, MOREVC, Peregrine Ventures, and other investors.

💸 Carbon Equity, an Amsterdam, Netherlands-based climate venture capital and private equity fund investing platform, raised $6M in Series A funding from BlackFin Capital Partners and 4impact.

☀️ raicoon, a Vienna, Austria-based provider of autonomous solar operations, raised $4M in Seed funding from PUSH Ventures and Voltares.

⚡ Elyos Energy, a London, UK-based energy flexibility and demand response platform, raised $3M in Seed funding from Rebel Fund, Zeno Partners, Endgame Capital, and Y Combinator.

💨 CNaught, a San Francisco, CA-based carbon credit marketplace, raised $2M in Pre-Seed funding from Greycroft, Carthona Capital and Long Run Capital.

🏠 Infrared City, a Vienna, Austria-based AI-based environmental simulation platform, raised $1M in Pre-Seed funding from xista science ventures, 2bX, and Antler.

🌾 HeavyFinance, a Vilnius, Lithuania-based marketplace providing green loans for agriculture, raised $1M in Seed funding.

☔ Frontline Wildfire Defense, a San Francisco, California-based wildfire risk platform, raised an undisclosed amount from Wyoming Venture Capital Fund.

🏠 VARM, a Berlin, Germany-based blow-in insulation marketplace, raised an undisclosed amount in Pre-Seed funding from A/O PropTech and Foundamental.

⚡ Syzygy Plasmonics, a Houston, TX-based photocatalytic reactor developer for industrial applications, raised an undisclosed amount from Mitsubishi Heavy Industries.

🔋 Battolyser Systems, a Schiedam, Netherlands-based integrated battery and electrolyzer manufacturer, raised $42M from the European Investment Bank.

⚡ Advanced Cooling Technologies, a Lancaster, CA-based thermal management and cooling technologies developer, raised $6M in Grant funding from the US Department of Energy.

⚡ EVPassport, a Venice, CA-based EV charging platform, had a controlling stake acquired by Northleaf Capital Partners for $200M.

⚡ Enfin, a Bloemfontein, South Africa-based solar financing platform, was acquired by Adenia Partners for an undisclosed amount.

🚗 Vacuumschmelze, a Hanau am Main, Germany-based advanced magnetic materials manufacturer, was acquired by Ara Partners for an undisclosed amount.

Share new deals and announcements with us at [email protected]

The Biden Administration awarded $7B to 7 hydrogen fuel hubs spanning 16 states. The plants are expected to produce 3M tons of hydrogen per year, reaching ⅓ of the DOE’s goal of 10M tons per year by 2030. Award winners took a broad swath of color approaches, from green hydrogen powering heavy-duty trucks and port operations, to pink nuclear-powered hydrogen, and blue hydrogen (natural gas with carbon capture) in the Appalachian Hub.

Oil prices are on the rise stemming from the Israeli-Palestinian conflict, climbing by $2.25 to $86.83 / barrel. The global energy market is still deeply tied to the Middle East, which accounts for a third of global oil supply with Iran itself controlling 3%.

Meanwhile, OPEC is diverging from the IEA’s prediction that the world will reach peak oil demand in 2030. OPEC projects production will grow 9% in the next two decades to 116M barrels per day, largely driven by demand from India, China, Africa and the Middle East.

In more oil news, ExxonMobil bought shale oil and gas giant Pioneer for $60B, its biggest acquisition since absorbing Mobil in 1998! The all-stock deal gives the oil major control over the Permian basin’s largest well operator, which accounts for 9% of the region’s production.

Interconnection is getting speedier in California. Governor Gavin Newsom signed a law to speed up distribution system interconnections, which in some regions of the state currently take as long as 6 months to a year. The bill requires the California Public Utilities Commission to set average and target time periods for grid connections and upgrades. And there’s more, the bill was part of a mountain of climate legislation that passed in California last weekend.

After weeks of strikes, the United Auto Workers (UAW) won union protection for GM battery plant workers. Battery manufacturing offers lower pay than other industry jobs and worries over workers’ rights in the EV transition have been a driving force for the union’s recent labor actions. The concession from GM came after UAW threatened to close a full-size SUV plant in Arlington, Texas, home to the company’s most profitable product segment.

Tesla tips the pricing scales (with the help of tax credits). Tesla slashed their prices to below the average price of gas-powered cars. A Model 3 now costs $31,490 after incentives, whereas the average price of a new car in the US is $45,000. EV buyers will also benefit from the Inflation Reduction Act mandate that starting in 2024 the $7,500 in available EV tax rebates will be awarded at time of purchase, not only during tax season.

Biden carbon pricing stays. The Supreme Court blocked an appeal to challenge Biden’s carbon pricing. Biden’s carbon price is critical in valuing the climate consequences of proposed projects and policies, ranging from oil and gas leases to power plants, construction and fuel-efficiency standards.

A very nice profile of a very nice owl.

The geoengineering cowboys taking climate science into their own hands.

Harvesting water from thin air. In Kenya, it’s less magic than necessity.

Ancient 14,300 year old tree rings tell the story of a different cosmos.

Some cool new climate results from Google: EV cost and range assessments, updated bike maps, and real-time flood and wildfire tracking. Plus new Map tools to identify optimal solar installation sites.

First climate change came for your coffee, tea, and grapes for wine. Now climate change is coming for your beer.

AI will soon require equivalent electricity demand to Argentina, the Netherlands, and Sweden’s annual use - or about 0.5% of global electricity.

Swedish EPA recommends seaweed cattle feed additives to kelp the planet.

Japanese banks press full send on clean energy crypto credit.

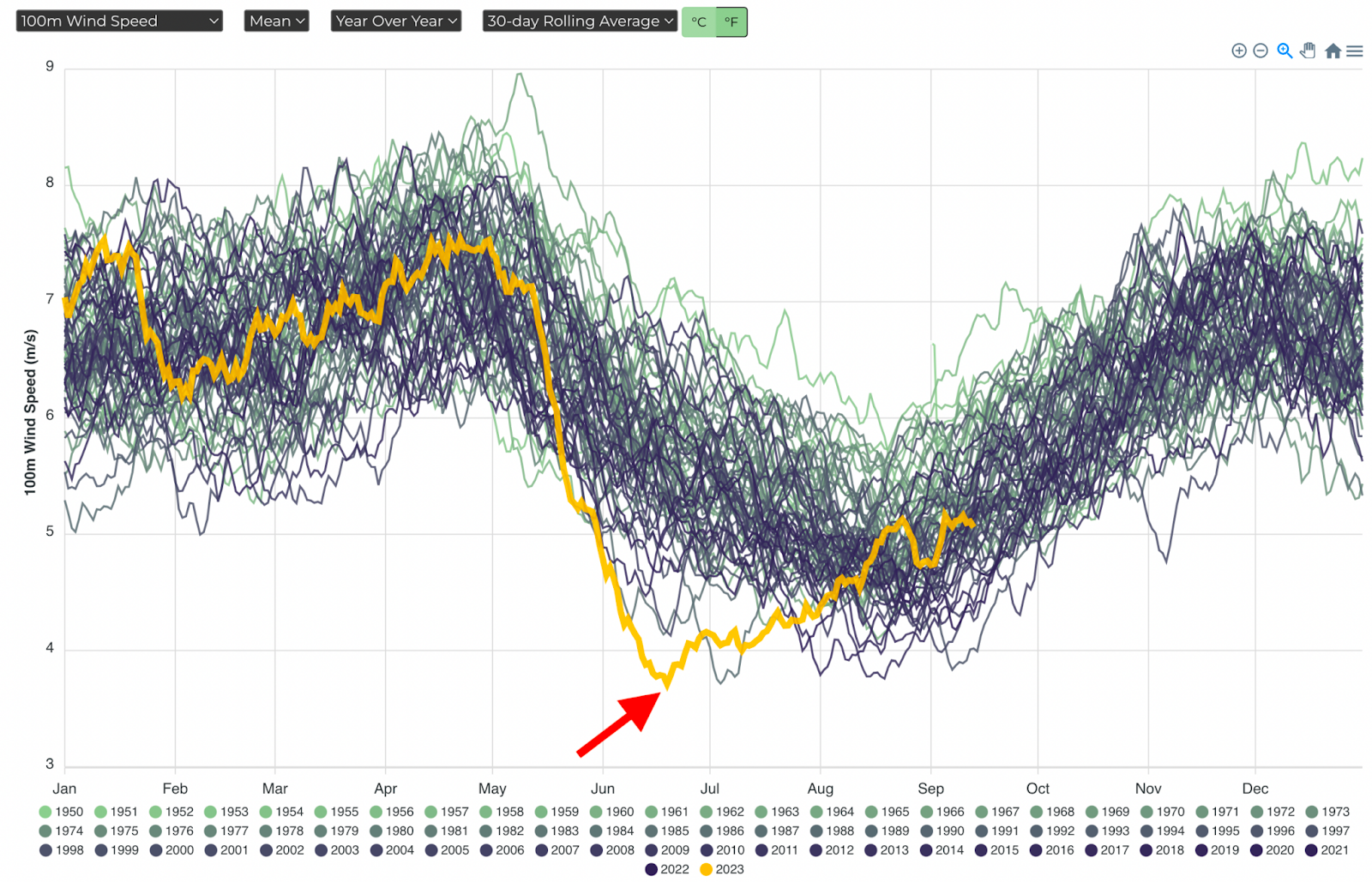

In the breezy business of North American industrial wind energy generation, the wind suddenly isn’t where it used to be.

Truly unexpected history lesson: an original solar energy entrepreneur was kidnapped in 1909, just as his company Sun Electric was taking off. Commercial activity went into a hiatus for 40 years thereafter, until Bell Labs. Sans kidnapping, according to Wright’s Law, solar would have become cheaper than coal in 1997!

🗓️ Global Direct Air Capture Conference: Register to join the Global DAC Conference, from Oct 16th-17th.

🗓️ FoodHack NYC Meetup: Meet enthusiasts, entrepreneurs, and investors from the NYC food tech scene at Newlab on Oct 26th.

🗓️ Verge Climate Tech: Join 5,000+ climate professionals at Verge’s climate tech event in San Jose on Oct 24-26th.

💡 Third Derivative: Apply to RMI’s global climate tech accelerator by Oct 27th to receive guidance and support for your startup’s go-to-market strategy.

🗓️ BERC Resources Symposium: Join Berkeley Energy & Resources Collaborative flagship fall event focusing on minerals essential for the clean energy transition on October 30-31st.

💡 Deep Tech Demo Day: Apply soon to join Frontier’s online Deep Tech Demo Day, taking place on Nov 29th, to showcase your early-stage startup to VC funds and angel investors.

💡 Empire Technology Prize: New York Governor Kathy Hochul and NYSERDA launched a $10M competition for innovators building technologies to advance low-carbon heating system retrofits in tall commercial and multifamily buildings across New York state. Apply by March 15th.

Investment Associate @Keyframe

Data Engineer @CTVC

Senior Full Stack Software Engineer @Bedrock Energy

Senior Director Business Development @Carbonfuture

Head of Product @Elephant Energy

Account Executive @Pulsora

Business Analyst Intern - Undergraduate @Bloom Energy

VP, Global Services Business Development & Strategies @Bloom Energy

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

A new framework for scaling climate tech companies, just in time for Earth Day

Tech companies and utilities cover their bases as data center electricity demand skyrockets

A new green bank to finance climate projects