🌏 From FOAK to NOAK

FOAK IV: That’s all, FOAKs!

Part II: How grid tech is the rails of the energy transition

The grid serves as the underlying infrastructure for the climate transition — tethering us all via overhead and underground wire and fiber. For a 2050 net-zero future, we’ll need an electricity grid large enough that its untangled cables would be long enough to stretch all the way to the sun.

Last week, we got in tune with power markets to set the stage for a reliable, resilient, and decarbonized grid. To get there, the grid requires constant attention to balance the flow of electrons. Ensuring grid reliability, resilience, and security is a balancing act between assets, systems, and participants. As electricity demand rises to meet population growth and the electrification transition, so does the need to expand and strengthen the grid.

To quantify that growth requirement, the International Energy Agency (IEA) pegged the gap at 80 million kilometers of new power lines that will have to be built or upgraded globally by 2040. And power lines are just the rails — not to mention all of the accompanying hardware, software, and services that create a reliable, resilient, clean, and accessible grid.

If reaching net zero means electrifying everything, investment in grid tech will be crucial. Accordingly, this year we’ve seen an uptick in public and private interest. In the US, for example, the Department of Energy (DOE) announced $3.5B for grid upgrades as part of the Grid Resilience and Innovation Program (GRIP).

While the grid serves as the underlying infrastructure, the power markets keep the entire operation humming by performing two key functions. First, they use price signals to influence market behavior, just like other commodity markets. Second, they act as a matchmaker between electricity buyers and sellers in order to balance the flow of electrons in real time.

This balance is reflected as two layers:

Physical layer: The underlying infrastructure that allows electricity to flow from generation to end use. This is the equipment, systems, and structures including transmission lines, distribution lines, transformers, and substation equipment.

Digital layer: The data, analytics, and digital processes that allow for the pricing, management, and operation of the grid. In most cases, the electrons sold to you from a residential solar roof won’t be the same ones that you’ll receive. It’s a transaction in the digital layer that represents this movement.

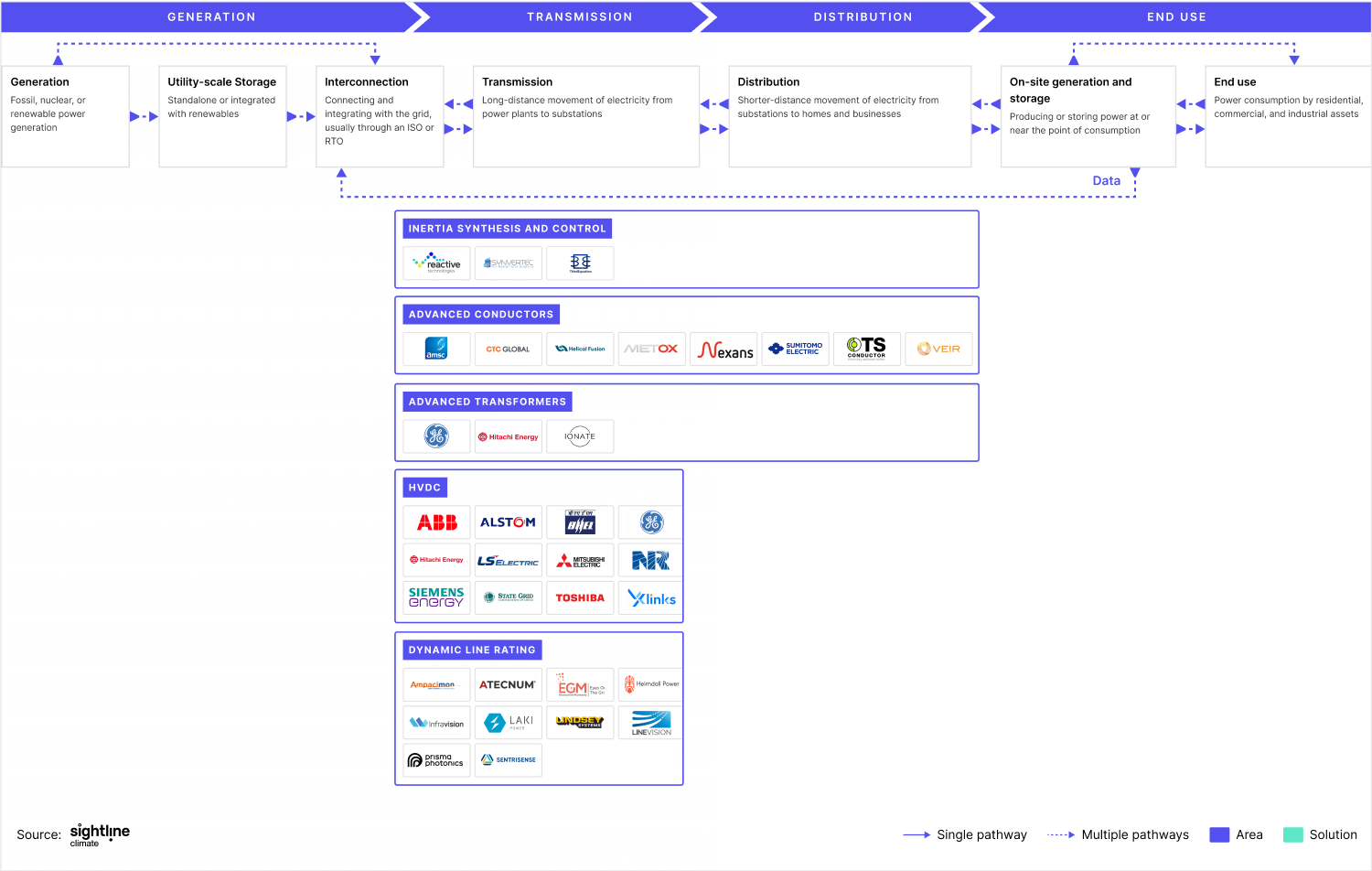

Here, we’ll focus on the physical layer — and more specifically, grid hardware. We’ll walk you through the Sector Compass, how the market works, the key technologies and players, and what to take away.A quick tour of the power value chain

The grid follows a four-step value chain. Whereas the power markets followed a fairly linear operation in the past, a more digital, distributed, and decarbonized grid creates a more complex and sometimes circular set of flows. As demonstrated by the bi-directional arrows, power doesn’t necessarily have to flow from generation straight to end use.

As residential, commercial, and industrial customers install distributed energy resources (DERs), or build virtual power plants (VPPs) or microgrids, they transition from being continuous power consumers to more flexible sources of power demand and, in some cases, even power generators themselves. But how do grid operators know how to work with this additional flexibility and generation and pull these capabilities into the grid? On the market framework diagram, this is highlighted by a Data arrow that feeds back into the Interconnection stage. This data exchange allows end-users with on-site flexible demand, generation, and storage capabilities to offer ancillary and grid flexibility services [read more about grid services in our power markets explainer].

Grids face challenges specific to each step in the value chain.

Generation: Utilities, independent power producers (IPPs), and others generate electrons from fossil, nuclear and renewable sources.

Transmission: Power is sent from power plants over long-distance, high-voltage lines to substations, where the voltage is stepped-down to go through the distribution network.

Distribution: Utilities move power from substations to end users across shorter distances at lower voltages.

End use: Residential, commercial, and industrial consumers use power for various applications.

Transmission and distribution are ripe for innovation, offering the largest opportunity to improve overall grid capacity, flexibility, and resilience. A robust physical grid layer characterized by optimized and modern transmission and distribution infrastructure, is a prerequisite for a more digital, distributed, and decarbonized grid.

Certain grid hardware technologies are leading this charge, seeking to solve the most immediate issues that are holding the grid back. They provide direct solutions for aging infrastructure or solve high-priority challenges such as congestion and seamless renewables integration.

Here, we’ll walk through some of these key technologies and who is pushing the state-of-the-art forward.

Many power lines are aging past their best before date. Designed and installed in the mid-20th century, this system of power lines is deteriorating fast and unable to cope with the pressures of increased demand. As power lines age, they become more inefficient due to prolonged usage, and natural, repeated wear and tear.

This materializes into two common problems: 1) Declining power capacity where power lines can no longer carry as much power for the same buck and 2) Increasing power losses where more energy is dissipated as heat, rather than being transferred down the line.

Advanced Conductors are next generation wires or technologies that replace these existing lines and can carry more capacity with greater efficiency. Adding them to the grid requires no major physical overhauls and when compared to installing new power lines, avoids lengthy permitting times. They serve to provide operators with an immediate solution to optimize existing transmission corridors. Thus, replacing old power lines is low-hanging fruit for operators who want to increase capacity, alleviate congestion, and reduce losses.

As more renewables connect to the grid, inertia levels decrease. The rotating fossil turbine generators provide stored energy through inertia which is particularly useful during grid outages and asset failures. However managing and knowing levels of inertia at a specific time to keep the grid stable has become increasingly difficult.

Inertia Synthesis and Control equipment is a collection of sensors and measurement devices that detect levels of inertia in the grid. Think of these as stethoscopes that listen in on the grid to detect changes in stored energy. They help operators detect drops in inertia levels, especially when faults and outages occur. Being able to accurately detect changes in inertia levels helps operators respond to faults and outages. If inertia level drops, operators can quickly respond by switching on generators.

Similar to other grid assets, existing transformers, that step up and down voltages for transmission and distribution respectively, are aging. They represent important interfaces as power moves across the network that ensure that each part of that system is set to the right voltage. Like aging joints, they have become increasingly rigid and cannot cope with variations in the loads that the modern grid requires. To add to these pressures, transformers are increasingly difficult to replace as they are often large power systems that are custom-made depending where they sit in the grid.

Advanced Transformers are next generation transformers, typically with interchangeable plug-and-play designs that reduce delivery and installation costs and times. Most of these new transformers are digitized, allowing operators to monitor their health in real-time and predict faults ahead of time. Compare this to existing transformers that are notoriously analogue and provide limited visibility for operators. Some Advanced Transformers also offer software-based dynamic scaling, stepping up or down to multiple voltage levels, to enhance power movement and cope with multiple loads.

Generating capacity is projected to increase by between 55% and 108% by 2050 to align with demand. Congestion and losses can be improved by replacing current power wires with Advanced Conductors, but even with enhancements, existing capacity will be well below what is needed. The grid also needs to be expanded with new power lines, especially in the form of High Voltage Direct Current (HVDC) lines.

Typically, operators have relied on High Voltage Alternating Current (HVAC) lines which have been cheaper and easier to install, as they don't require power conversion between Alternating Current (AC) and Direct Current (DC). However, with advancements in High Voltage Direct Current (HVDC) technologies, such as improved converters, long-distance power transmission has become more efficient. HVDC lines facilitate the integration of renewable energy projects located offshore, in other states, or even across national borders, expanding the potential beyond regional networks. Currently, the majority of operational HVDC projects are in China, with a smaller presence in Europe and the US. There are over 200 GW (58,000 km) of HVDC lines in operation and an additional 180 GW (45,000 km) planned.

Historically, power lines have been monitored via Static Line Rating (SLR) and Ambient-adjusted Rating (AAR), which determine the maximum current that a transmission line can safely carry under a set of environmental condition assumptions, based on static historical and hourly data respectively.

Because operators don’t have a sufficiently precise picture of what’s happening to individual lines, they struggle to know the true capacity that is available at a particular moment and make changes to power flows that reflect the underlying thermal line or other conditions that reflect this available capacity.

Dynamic Line Rating (DLR) technology forms the next era in real-time monitoring of power lines through sensors or drones that give operators direct visibility at the power line level. Analogous to blood pressure monitors, most DLR technologies can be retrofitted to wrap around existing power lines rather than being built into the power lines themselves. DLR technology gives insights on line conditions such as voltage, current, and frequency levels. This data can be used to determine power capacity and inform operators when lines are congested so that they can anticipate, react, and remediate issues.

FOAK IV: That’s all, FOAKs!

$82bn of new capital for climate tech in the past 6 months

A new interactive Climate Capital Stack Map