Joseph Doherty, Managing Director of Re-Gen Waste, and member of Defra’s Advisory Committee on Packaging, reflects on whether businesses should be accounting now for EPR

A recent Defra Business Ready Forum webinar attended by over 700 stakeholders on EPR data collection and costs, left many deeply frustrated by the lack of information available to predict their likely costs.

Aside from the complications of the new system and the uncertainty over reporting requirements, much of the concern was focused on the lack of information on likely costs, especially after the huge increases in PRN prices that obligated producers faced in 2022.

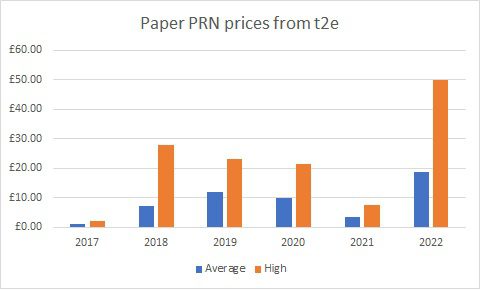

The graph below illustrates the change in paper PRN prices over the last 6 years which shows that the weighted average price of paper PRNs in 2022 was over five times higher than in 2021 and double the average in 2019.The previous most expensive year since the regulations began. The graph also highlights the volatility and unpredictability of PRN prices, making budgeting almost impossible.

For some businesses, the cost of the current PRN system is already having a major impact on viability. But from 1 January 2024, many businesses caught by the new EPR system will see the cost of compliance rising sharply.

The new system moves away from shared to single point responsibility. Under the current system, costs are shared between the raw material manufacturers, the convertors, the pack fillers and those that sell packaged product to consumers. The pack fillers, for instance, take 37% responsibility for the weight of the packaging they fill. Under EPR, pack fillers will take 100% responsibility unless the product is sold under the brand of another business – a supermarket, for instance – that will then take on the 100% responsibility.

The Defra Impact Assessment assumes that a similar number of producers will be obligated to pay the costs under EPR. However, the distribution of those costs will vary hugely related to the amount of packaging a producer is responsible for, that is classed as household packaging. It is only those producers making goods that end up in households, who will be paying towards the costs that local authorities incur from the management of packaging waste.

These costs are estimated at around £1.2 billion per year and include the collection, treatment and recycling of packaging waste as well as the cost of disposal of packaging left in the residual waste bin AND contributions to the cost of communications to householders and litter management.

Producers, regardless of whether their packaging goes to households or non-households will also have to meet recycling targets on all the packaging they handle and like the current system, will need to pay for PRNs to do this, estimated by Defra as being in the region of £335 million in 2024.

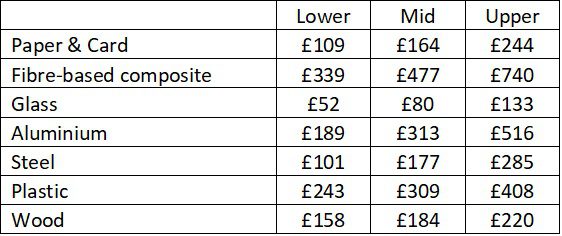

Defra has given a provisional indication of the scale of FNCR charges they expect to apply in 2024, shown in the table below, to those that have responsibility for packaging that ends up in households.

Consider a simple case of a sweet manufacturer that might, in a year, use 200 tonnes of plastic to package the sweets under their own brand which they place in 100 tonnes of cardboard transport packaging. Under the current system, they will have 37% responsibility for the plastic as a pack filler and 85% responsibility for the cardboard as a pack filler and seller. Applying the recycling targets and assuming a £40/tonne PRN cost for cardboard and £350/tonne for plastic, the cost to the business for PRNs in the current system would be around £19k.

Under EPR, if we assume the same targets and PRN costs but that the business will have 100% responsibility for the packaging as a pack filler, the PRN bill rises to around £46k. However, on top of that, for the plastic primary packaging of the sweets and using the mid-range FNCR fee of £309/tonne in the table above, the business will have to pay an additional £62k to the Scheme Administrator to pass on to local authorities plus an extra £13/tonne – £2.6k – as a contribution to administration and communication charges.

These will be in addition to a doubling of the Environment Agency registration fee and increased compliance scheme membership fees to take account of a new annual subsistence fee that schemes will have to pay. Overall, the sweet business would face a 6-fold increase in cost from 2023 to 2024.

Companies are ill prepared for these additional costs, partly because there is so little information available at present on which to base calculations, but mainly, I suspect, because there is so much confusion as to how the new system will work.

Central to the management of the new system and the distribution of funds to local authorities will be the Scheme Administrator, but Defra has indicated that this will not be appointed until the end of 2023.

The provisional fees proposed by Defra in the table above will only be for 2024. From 2025 onwards, the fees will be calculated by the Scheme Administrator on a modulated basis that will vary according to the recyclability of the packaging, so it is unlikely these will be known until late 2024.

The fees will also have to take into account the impact of the Deposit Return Scheme that will be introduced into Scotland in August this year and across the rest of the UK in October 2025. The materials covered by DRS will be excluded from EPR from the date that DRS commences.

Information continues to trickle out of Defra to help businesses understand how the new system will affect them, but it seems unlikely we will see the full picture for several months yet.

However, for those companies providing products that end up in households, there will be a huge increase in their producer responsibility costs from 2024 onwards.

Whilst it is impossible for these companies to make any accurate predictions at this stage, consideration should be given to the potential impact on their business using the prices in the table above, current PRN prices and whether they will end up with 100% responsibility for their packaging as a manufacturer or importer of branded products or a seller of own brand.

For some, it seems likely that unless they start to account for some of those costs this year, 2024 EPR could have a severe impact on their viability.